Zero-based budgeting is changing how finance leaders think about expenses – starting from zero, not last year’s baseline.

What goes into your budget – and why?

That is a question more and more CFOs are asking in 2025. With margins tight, AI changing processes, and boards demanding answers, traditional budgeting won’t cut it.

Assume that your logistics team approves €600K worth of contracts annually without hesitation. ZBB makes them re-justify each supplier, shop around, and question: do we still need this? That one change funded a pilot for a new AI routing system for one of our clients – and paid itself back in 3 months.

Read: Strategic Financial Planning – How to Plan for Success

What is Zero-Based Budgeting?

Zero-based budgeting (ZBB) is a process where budgets start from the beginning each time the planning cycle operates – from scratch, literally, or zero. Every expenditure has to be justified, rather than simply being adjusted.

So why is it trendy again?

Because business demands it. Economic volatility, increasing cost pressures, and higher expectations for strategic agility have compelled firms to rethink budgeting and allocating. ZBB is a break from “same as last year + 5%” thinking – and an impetus to reinvest funds in what actually drives results.

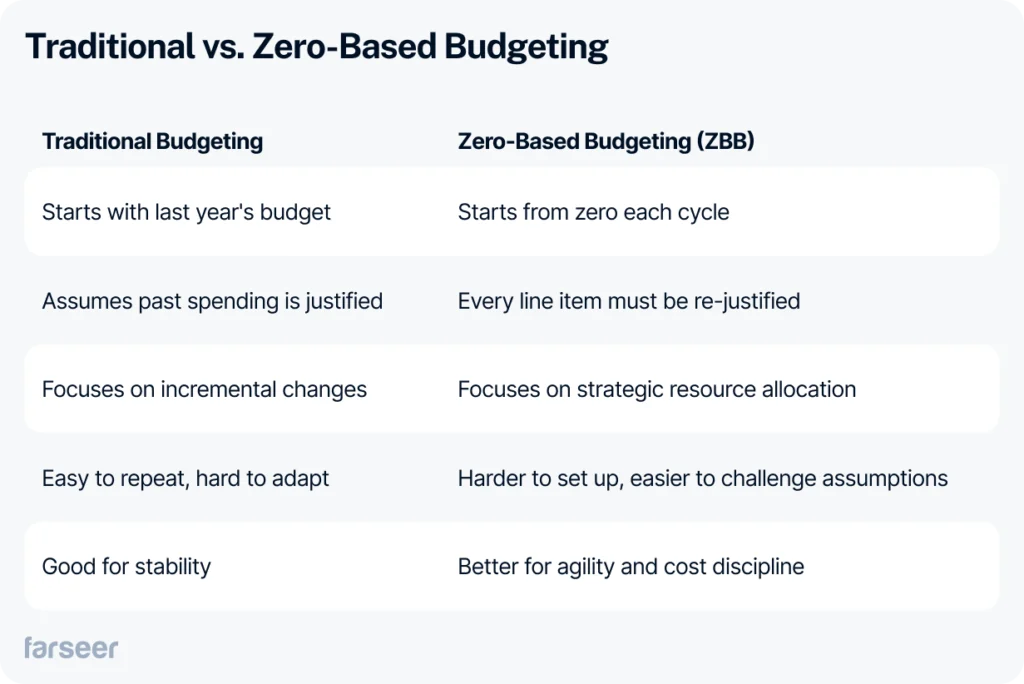

Zero-Based Budgeting and Traditional Budgeting

Most finance teams are still doing old-school budgeting: take last year’s numbers, massage some percentages, and you have a plan. That won’t cut it, though, when things move quickly – or when management insists on accountability for every dollar.

The majority of financial professionals are still practicing old-fashioned budgeting: last year’s figures, plus some percentage changes, and presto, a plan. That won’t do, though, when the game is happening rapid-fire – or when management needs to make every dollar responsible.

Zero Based Budgeting doesn’t just cut costs – it reshapes how decisions are made. It forces teams to connect budget expenditures to business drivers and strategic priorities, rather than legacy line items or outdated headcount assumptions.

Learn more: Why the Bottom-Up Approach Is Preferable for Budgeting (And How to Implement It)

The Benefits of Zero-Based Budgeting

In an era of margin squeeze, rising inflation, and perpetual disruption, ever more finance chiefs are asking the same thing: What are we actually paying for – and why?

Zero-Based Budgeting (ZBB) is back in vogue because traditional budgeting simply cannot keep up with the pace of change. Here’s what’s driving the shift:

- Margin squeeze isn’t hypothetical. Rising input prices, inflation, and supply chain volatility make across-the-board reductions moot. Zero Based Budgeting enables you to reduce where you need to reduce, retain what you are able to retain, and rebuy elsewhere.

- Artificial intelligence is revolutionizing how we do things. As automation reengineers workflow, org charts must also change. With ZBB, leaders actively remake structure, roles, and costs based on today’s real work.

Example – Kraft Heinz: With 3G Capital, the company utilized ZBB to revolutionize its cost base. They redirected over $1.7B of in-efficient activities into building brands and innovation – fueling margins and responsiveness.

- Accountability is not optional. Investors want transparency. ZBB leaves a trail for every expense – easy to justify, challenge, or re-direct spending.

- Digital transformation demands cost discipline. Everyone loves new tools but still uses Excel for planning. ZBB works best when applied with more sophisticated FP&A software that enables real-time review, collaboration, and scenario modeling.

Read more: 10 Ways Farseer Simplifies Enterprise Budgeting and Forecasting

Challenges and Limitations of Zero-Based Budgeting

Zero-based budgeting is not a silver bullet. Done well, it’s a transformation. Done poorly, it’s a time-waster that alienates teams and jams up decision-making. That’s where most companies are going wrong – and why.

High Complexity and Resource Needs

Zero-based budgeting requires teams to analyze and justify every expense from the ground up. Traditional budgeting moves faster because teams just roll forward costs with minor tweaks – ZBB takes more time but forces a deeper review.

Business Resistance

Some departments may feel like the ZBB method adds unnecessary complexity to their operations. Others may oppose it since re-evaluating expenses and justifying them takes extra time. Or they could feel like it takes their autonomy and create tension with the upper management.

Short term focus

Zero based budgeting’s emphasis on eliminating unnecessary spending can sometimes lead to short-term cost reductions at the expense of long-term investments, such as research, development or employee training.

Weak Tooling Slows Everything Down

Without a solid FP&A platform, ZBB becomes a spreadsheet nightmare. You need data granularity, version control, and collaboration features that Excel simply can’t provide.

Read more: How to Spot Financial Gaps With Variance Analysis

Who Should Use ZBB (and When It Fails)

Zero-base budgeting isn’t for everyone – and that’s the good news. It’s a high-discipline strategy best suited to tighter cost control, more strategic resource management, or a much-needed culture overhaul in a company. But when abused, it drains the life from teams and yields little.

ZBB works when:

- A company is facing margin squeeze, investor pushback, or rising input costs

- There is a need to reallocate funds from existing businesses to new growth prospects

- Management wants cost transparency and responsibility across silos

- The company already possesses or would adopt digital FP&A technology

There’s C-level sponsorship with a willingness to break sacred cows. One of the most well-documented examples is that of Unilever. Having made various acquisitions of new brands and grown in emerging economies, Unilever used ZBB to rationalize its cost base and fund growth.

The program helped the business redirect spend away from overheads into marketing and innovation, supporting a sustained increase in operating margin. McKinsey estimates that companies saved over €1 billion without losing top-line momentum.

ZBB falls apart when:

- It’s been implemented as a one-time cost-cutting initiative, rather than as a strategic shift

- Teams view it as punitive rather than a source of empowerment

- There isn’t a clearly defined ROI model to quantify spend

- It’s spreadsheet-heavy and overly labor-intensive

- Leadership does not realize the cultural change that is needed

Is Zero-Based Budgeting simply about reducing costs

Not at all. One of the great myths is one of them. While ZBB is most closely associated with cost cutting, its true strength lies in reallocation of resources. It gives finance managers a clear, fact-based portrait of what costs add value- and what don’t.

Companies like Kraft Heinz used ZBB to free up money for investment in innovation, and not just for reducing headcount. ZBB is, if done correctly, a growth enabler and not cost.

Can Zero-Based Budgeting be used in smaller companies or teams?

Yes, and even more so maybe in smaller companies. While ZBB began in the enterprise world, mid-sized companies, and even business units within large companies, have successfully used it.

The key is focus: apply Zero based budgeting in high-leverage areas like marketing, logistics, or indirect cost – where waste can go unnoticed. Small groups can move faster, align faster, and reduce results faster.

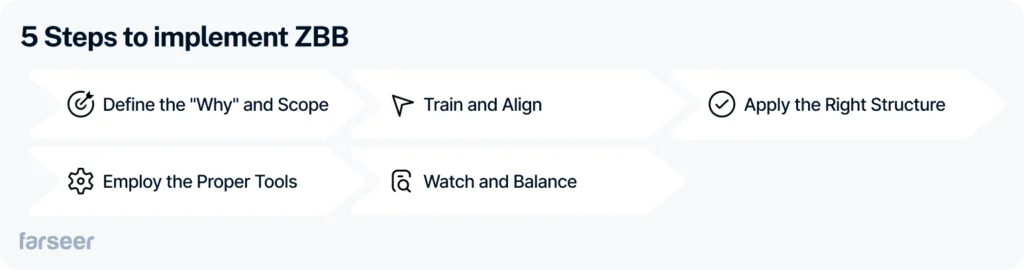

5 Steps to implement ZBB

Zero-based budgeting sounds tough-sounding – but doesn’t have to be so wild.

Here’s how leading companies use it without overwhelming employees:

- 1. Define the “Why” and Scope: Begin with a measurable goal: cost management, reprioritization to expand, or funding transformation? Determine if ZBB would be launched for the whole company or would be launched in specific functions such as marketing, G&A, or supply chain.

- 2. Train and Align: Educate department leaders why ZBB is best for them, not how it works. Engage them in discovery, not as targets for reduction. Buy-in, rather than autocratic fiat, is the path to success.

- 3. Apply the Right Structure: Divide the company into “decision units” — functions, product lines, or teams – that can justify their budgets at the ground-up level. Create a scross-functional ZBB team to review inputs, challenge assumptions, and oversee implementation.

- 4. Employ the Proper Tools: Spreadsheets will not do. Open, transparent, and formalized processes are what ZBB requires. With FP&A software you change the dialogue: from “where do we cut?” to “how do we optimize and grow?

- 5. Watch and Balance: ZBB is a continuous process, not a one-time exercise. Maintain continuous review cycles in motion, track actuals versus budget, and rebalance as needs evolve. Reinforce the behavior with recognition of sound decisions and tangible outcomes – not solely cost cutting.

How long does it take to implement ZBB?

The time to implement zero-based budgeting will vary based on scope, complexity of the tools to be introduced, and the organizational readiness to adopt the process. Phased installation – i.e., installing ZBB in a single cost center or business unit – can typically be accomplished in six to eight weeks.

Alternatively, an across-the-firm implementation will require three to six months if the company persists with outdated tools such as spreadsheets, which are sure to limit coordination and standardization.

Computer-mediated FP&A platforms accelerate adoption far faster by streamlining, standardizing inputs, and enhancing visibility. Companies typically begin modestly – then expand after process and mindset become ingrained.

Key takeaways

- ZBB ≠ reductions – It’s clarity, control, and re-allocations.

- It works best with fresh tooling and leadership investment.

- Excel won’t cut it – platform support required.

- Grow deliberately, show value, start small.

- If done well, ZBB pays for growth, not just saves cost.

Thinking of using ZBB?

Start small. Select a function. Pilot it.

And most of all – don’t do it in Excel.

Schedule a demo with Farseer and see how CFOs are using ZBB without running their teams into the ground.