The Consumer Packaged Goods (CPG) industry has long been a battleground of velocity, quantity, and shifting demand. But these days, in an environment where a single viral TikTok trend can empty shelves overnight and raw material prices change weekly forecasting is not a nice-to-have but a mission-critical one.

Read more: Scenario Planning: How to Prepare Your Business for Uncertainty

CPG finance executives don’t just need better numbers. They need better reflexes.

Still, most have inflexible tools that don’t match market reality. That just isn’t working anymore. In a recent McKinsey survey, over 70% of CPG CEOs said their planning processes aren’t flexible enough to facilitate real-time decision-making. What’s the consequence? Promo opportunities lost, inventory in excess, and revenue sacrificed.

This blog breaks down what’s amiss with CPG planning and how to fix it with the right tools, processes, and mindset.

What is the CPG Industry?

The Consumer Packaged Goods (CPG) industry encompasses goods that are consumed daily, bought regularly, and usually have a limited lifespan: such as food, drinks, cosmetics, household cleaners, and over-the-counter medications. These are the products on every supermarket shelf, manufactured and replenished on gigantic scale.

What is particularly unique in the CPG market is its relentless pace. The competition is fierce, with brands competing for space on store shelves, price, and promotional visibility. Consumer preferences shift quickly, with small movements in demand. A storm, viral action, or promotion from a competitor can have instantaneous bottom-line effect.

In a high-volume, low-margin category such as this, every percent of planning precision, promo timing, and supply chain efficiency counts. So there’s always tension on CPG manufacturers to go faster, plan smarter, and optimize every detail of their commercial and operations processes.

The Planning Challenge in CPG

CPG planning has become an exercise in high-stakes balancing. Consumer behavior is changing fast – from product manias on social media platforms like TikTok to surprise spikes of demand via new digital platforms. At the same time, companies are under mounting pressure to meet ESG demands, navigate supply chain disruptions, and generate profit with volatile input costs.

And yet, the majority of planning teams are holding onto outdated tools.

Spreadsheets buckle under the weight of complexity. ERP systems are not geared for forward-looking decision-making. The market reality has changed by the time a quarterly forecast is determined. And, for good measure, marketing, sales, and finance usually work in silos – with their own reports, timelines, and assumptions.

The result? Inconsistent forecasts, late response, and lost opportunity. CPG firms need planning systems that match their market’s pace of speed.

Read more: Enterprise Software is Broken

What CPG Teams Really Need

Consumer goods are fast-moving. One promotion can blow up demand. One price hike can drown a category. One supply chain glitch can ruin a quarter.

That’s why CPG industry teams don’t merely require a budget – they require a living, breathing forecast.

Forecasts That React in Real Time

When events change a campaign performs better than you anticipated, or the price of inputs increases overnight your forecast will take care of itself. No more quarter-end surprise to find the devastation.

That new-fangled planning software lets you plug in the new data and instantly see the impact on margins, revenue, and production. That means faster decisions — and fewer surprises.

Learn more: What Is a Financial Forecast and Why It’s a Strategic Advantage

Promo and True Product Profitabilit

Every SKU doesn’t pull its weight. And every promo isn’t necessarily worth it. But basic reporting usually doesn’t capture that, especially if information is buried in stand-alone Excel spreadsheets.

With centralized planning, finance and category teams can finally track true product profitability by channel, promotion, or pack size and next time make better choices.

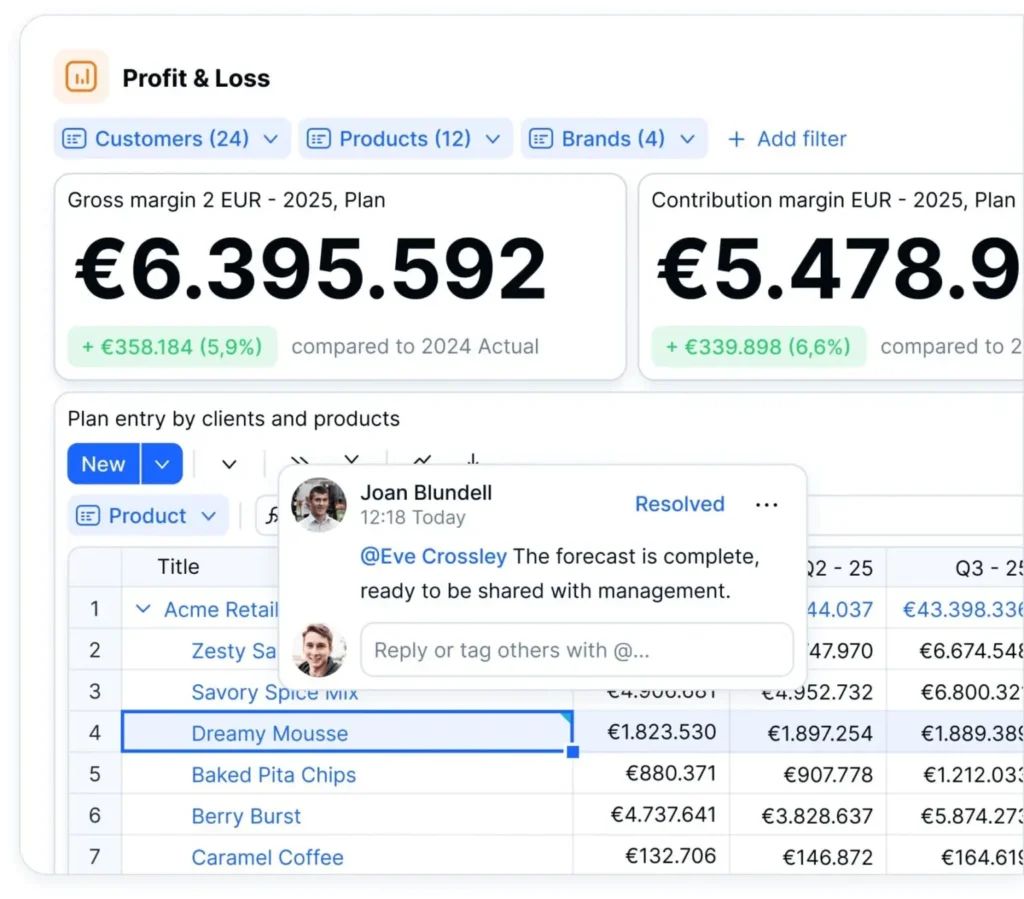

Not File Sharing, Real Collaboration

Finance, sales, marketing, supply chain, they’re all planning on different timelines and tools. That builds silos, duplicated effort, and misaligned targets.

What they actually need is a single source of truth: one model in which everyone sees the same numbers, updates in real time, and collaborates without passing around files.

Planning by SKU, Channel, and Region - Without the Spreadsheets

CPG industry is not about averages. You need granular plans by SKU, by region, by customer segment. To do that in spreadsheets is inconvenient and time-consuming.

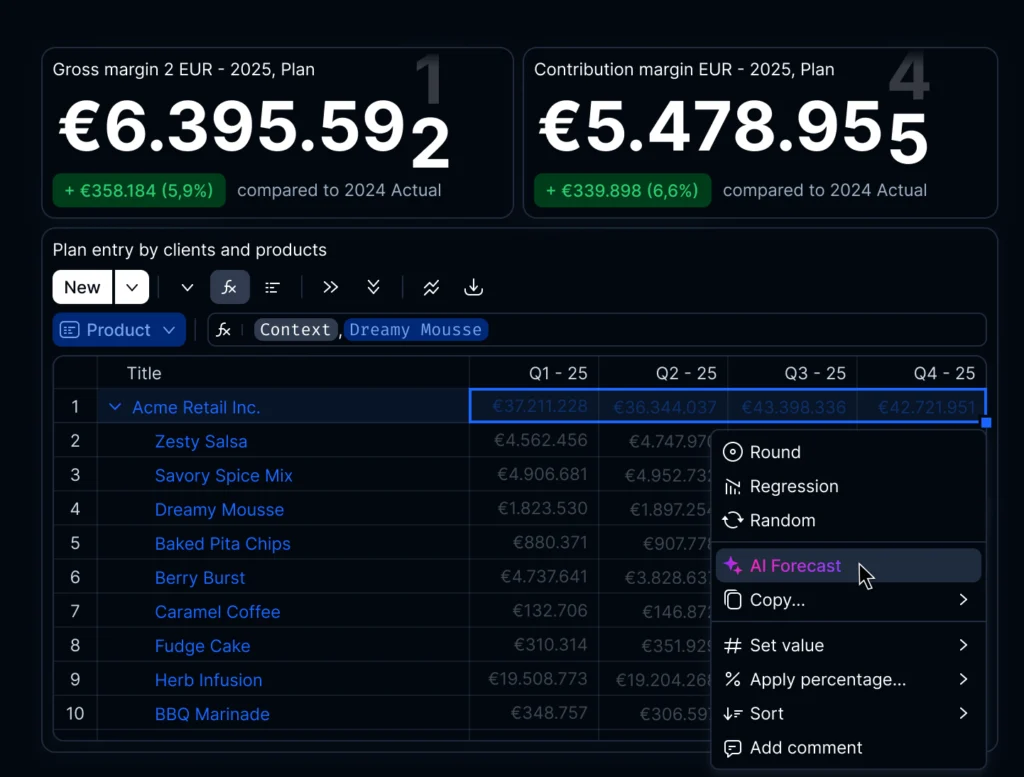

New tools allow you to model all that complexity without copy-paste madness. You can break down forecasts by distribution channel, compare regional lift, or model the effect of a price change – all in one place.

Where Planning Tools Make the Biggest Difference

In fast-moving verticals like CPG, the problem is never one of too little data – it’s what to do with it, and where to prioritize.

That’s where planning systems of today come in. Instead of stacking more and more reports on your desk, they help you connect the dots – between systems, across teams, and across timeframes.

Integrations with POS data, ERPs, and external sources like Nielsen or weather APIs let you enter forecasts with real-time signals. When a promotion starts to overperform targets, the system raises the alert and immediately surfaces the affected line items across SKUs and channels. When raw material prices skyrocket, your cost model reformats automatically.

You don’t need to remake the whole forecast. Just create a new run, shift some drivers, and watch your margins, volumes, or plans shift instantly.

It’s not a matter of having more data – it’s a matter of having the right data at the right time and framing it in a way your people can act upon.

What Does a CPG Planning Platform of the Future Look Like?

For CPG industry companies, planning solutions are useless if they’re going to keep pace with the speed, complexity, and ambiguity of their environment. It’s not about “eye candy” dashboards – it is about working capability.

The greatest planning platforms share some similarities:

- Flexible modeling by products and markets – You need to be able to plan by SKU, channel, or region without constructing enormous Excel files.

- Actuals in real time and forecast adjustments – Market changes (e.g., promo success or raw material cost) must appear immediately in your numbers.

- Scenario simulation and variance analysis – Your team needs to be able to understand not just what changed, but why it should care.

- Collaboration without silos – Finance, sales, and supply chain need to be in agreement regarding the version of the truth and not pass spreadsheets between each other.

- Auditability and governance – Most useful in multinational organizations with advanced cost structures and compliance needs.

Real-World Example: Violeta's Planning Transformation

An example that almost rings home in CPG is Violeta, the leading manufacturer of hygiene products with operations in Southeastern Europe. Running over 30 brands and hundreds of SKUs, the company was confronted by a familiar conundrum: taking rich, multi-dimensional sales data and turning it into a reliable, actionable plan.

Before Farseer, Violeta’s planning team was bogged down with inconsistent Excel spreadsheets, version-by-hand tracking, and time-consuming profitability calculations. Planning for large customers involved handling price, rebates, pack sizes, and volume targets – all while trying to meet annual revenue goals.

With Farseer, all of that changed.

Violeta:

- Automated sales objective distribution by brand, SKUs, and zones

- Integrated ERP and BI data for real-time planning environment

- Offered real-time P&L visibility by segment, product, or partner

- Spared weeks of planning time every year

Planners were finally able to model price fluctuations or input new targets and let the system dynamically update the rest. Even more importantly, they stopped firefighting in spreadsheets – and started working on growth and margin impact.

The CPG industry is moving too quickly, it’s too complex, and it’s too competitive for yesterday’s planning tools. Excel spreadsheets, isolated ERPs, and behind-the-scenes reports only slow you down – and in this business, speed matters.

Winning is all about flexibility, accuracy, and interfunctional coordination. Finance can’t budget in isolation. Sales can’t rely on instincts. And supply chain can’t afford blind spots.

CPG firms have a clear edge with contemporary tools such as Farseer:

- Faster response to shifting market conditions

- Better forecasts driven by real-time data

- Interconnected teams working off a single source of truth

If your team is still grappling with spreadsheets, maybe it’s time to stop scraping by and preparing better.

Want to see how it plays out in real-time? Request a demo.