You know how business budgeting software feels in a bigger company: it’s like you’re herding cats across cost centers, departments, and countries. It’s not just finance anymore. It’s chaos management.

And when you’re doing that with spreadsheets and scattered tools? It’s slow, stressful, and full of risk.

Read Strategic Financial Planning: How to Plan for Success

If you feel like that – you’re not alone. A recent multi-country survey looked at how companies are approaching digital budgeting: out of 37,600 companies, only 319 responded (yep, less than 1%). But the ones that did go digital? They reported better budget task performance and stronger financial results. So clearly, ditching spreadsheets isn’t just a time-saver – it pays off.

We’ve looked at the top budgeting software options out there, focusing on the ones that actually make life easier for complex teams like yours.

Who Needs Advanced Budgeting Tools

This comparison is for companies that:

- Have 10+ planners across departments or business units

- Plan more than once a year (often quarterly or monthly)

- Need to plan operational drivers (like units sold or produced), not just revenue lines

- Us business budgeting software intergrated with ERP systems like SAP, MS Dynamics, or Infor

- Are still managing planning processes in Excel or BI tools (e.g. Power BI)

Read more: Budget Management Software for Business: How to Finally Leave Excel Behind

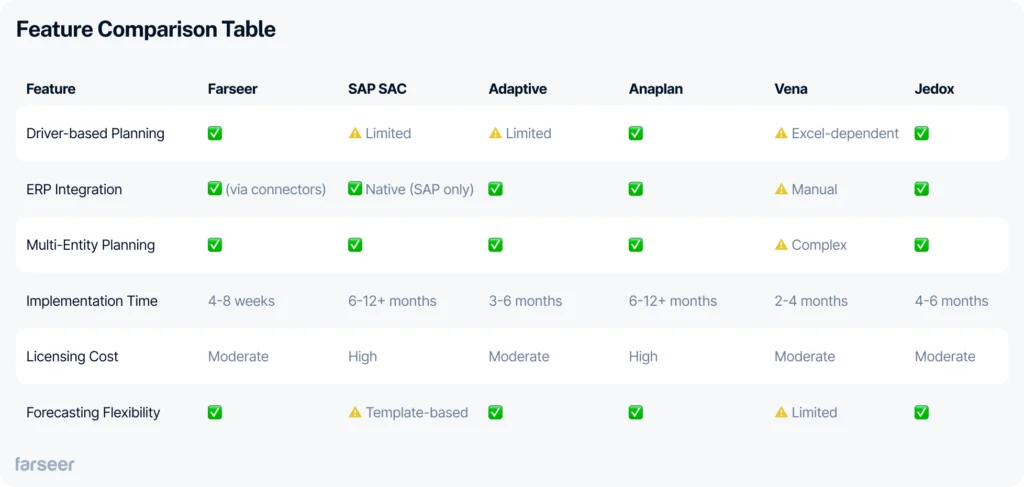

Farseer

Why Farseer?

Farseer is designed specifically for mid-sized and large companies that need to model their business from the ground up (units sold, regional pricing, discounts, inventory, headcount) and connect those drivers to revenue, cost, and cash flow in real-time.

It’s ideal for organizations that are outgrowing Excel, but don’t want a long or rigid enterprise software rollout. If your company operates across multiple entities, runs frequent forecasts, and needs finance and business users to collaborate in one place, Farseer is likely a strong fit.

Strengths

- Fast implementation: Companies typically go live within 4–8 weeks, with minimal IT involvement.

- Driver-based planning: Plan operational inputs like units, FTEs, or projects and link them to full P&L, BS, and cash flow outputs.

- Easy to use: Excel-like UX with collaboration features, audit trail, and centralized logic.

- Highly flexible: Finance teams can change formulas and logic without developers or consultants.

- Localized support: Experienced team based in Central and Eastern Europe; understands regional business structures and ERP landscapes.

- Cost-effective: Competitive pricing, transparent licenses, and low consulting overhead.

Weaknesses

- Smaller teams may find it too advanced

- The platform offers advanced capabilities that require some learning, but onboarding is well-supported and smooth thanks to responsive customer support.

SAP Analytics Cloud (SAC)

Why SAP Analytics Cloud?

If your organization already uses SAP S/4HANA or other SAP products, SAC might be a logical extension for financial planning and analysis. It is a business budgeting software that enables deep integration with your SAP ERP data and can centralize reporting and planning in one environment.

Strengths

- Strong native integration with SAP ERP, BW, and S/4HANA.

- Centralized platform for analytics, planning, and predictive features.

- Preferred by large enterprises with dedicated SAP teams.

Weaknesses

- Rigid structure: Custom modeling is limited; often needs external consultants.

- Slow to implement: Projects often take 6–12 months or longer.

- Poor adoption by business users: Requires significant training; finance users often revert to Excel.

- High TCO: Between license costs and consulting, total cost of ownership is among the highest.

Read Looking for SAP Analytics Cloud Competitors? Here Are the 5 Best Options

Workday Adaptive Planning

Why Workday Adaptive?

Adaptive is widely used by companies that prioritize workforce planning and need a

business budgeting software solution that’s easy to roll out and maintain. It’s especially common in services-based industries with a strong HR-finance link.

Strengths

- Intuitive interface and solid user experience.

- Good fit for headcount and compensation planning.

- Quick to deploy compared to larger enterprise tools.

Weaknesses

- Limited modeling capability: Struggles with complex planning logic (e.g., driver trees, dynamic cost allocations).

- Not ideal for manufacturers or distributors: No true support for SKU-level or production-based planning.

- Relies heavily on templates: Limits flexibility in larger or more unique planning processes.

Read more: 4 Workday Adaptive Planning Competitors Worth Considering in 2025

Anaplan

Why Anaplan?

Anaplan is a powerful platform used by large multinationals with complex modeling requirements across finance, supply chain, and sales. It’s often selected by companies with internal capacity to build and maintain custom planning models.

Strengths

- Extremely flexible modeling engine (Hyperblock).

- Can handle enterprise-wide planning across multiple departments and use cases.

- Strong for scenario planning and “connected planning” concepts.

Weaknesses

- High resource requirement: Often needs a full-time model builder internally.

- Expensive: Licensing and implementation costs are high.

- Slow ROI: Full implementation can take 6–12+ months.

- Steep learning curve: Non-technical finance teams may struggle to maintain models.

Read Anaplan Competitors – The 6 Best Alternatives for Enterprise FP&A

Vena Solutions

Why Vena?

Vena is a good entry-level planning tool for teams that love Excel and want to add structure, workflows, and version control without abandoning spreadsheets.

Strengths

- Excel-native interface is familiar and easy for finance teams to adopt.

- Useful for simple budgeting and rolling forecasts.

- Fast deployment and easy to manage internally.

Weaknesses

- Still Excel-based: Core modeling remains in Excel; limitations of spreadsheets persist.

- Not scalable: Struggles with large data sets, cross-entity collaboration, or complex allocation logic.

- Poor auditability: Still prone to formula errors and versioning issues in larger organizations.

Read 7 Vena Alternatives and Competitors to Take a Look at in 2025

Jedox

Why Jedox?

Jedox combines budgeting, forecasting, and BI in one tool, and is especially common in Central Europe. It’s business budgeting software that is often chosen for its strong OLAP engine and flexibility with multidimensional data structures.

Strengths

- Built-in BI and dashboarding.

- Integrates with a wide range of ERP systems.

- Strong partner presence in the DACH region

Weaknesses

- Complex to use: UI feels dated and not intuitive for non-technical users.

- Requires training: Longer onboarding time compared to modern tools.

- Heavier IT dependency: Adjustments and model changes often need technical support

Read Looking for Jedox Competitors? Here Are the 7 Best Options

Final Thoughts

Choosing business budgeting software shouldn’t come down to who has the biggest brand. It should come down to what actually fits your process.

If you’re dealing with recurring forecasts, multiple regions, and complex cost structures, you need a tool that works the way your business works. Not the other way around.

Budgeting shouldn’t feel like a quarterly crisis. It should be quick, collaborative, and reliable.

If your current setup is slowing you down, and you’re ready to streamline planning, get more accurate forecasts, and and adopt better business budgeting software, Farseer could be worth a closer look.