Best consolidation software helps finance teams replace spreadsheet chaos with automation, accuracy, and real-time visibility. When closing the books still feels like a marathon of spreadsheets, emails, and late-night reconciliations, it’s time to rethink your tools.

Consolidation is one of finance’s most critical and most frustrating processes. When you deal with multiple entities, currencies, and systems, even small errors disrupt your reports completely and delay decision-making. Especially when done in Excel. The reason is quite simple: traditional Excel-based approaches can’t keep up with the pace and complexity of today’s finance.

Read more: Financial Consolidation: Definition, Challenges & Solutions

That’s where modern consolidation software makes the difference – it automates eliminations, centralizes data, and gives finance teams real-time visibility and control.

In this guide, we’ll explore what makes great consolidation software in 2025, how to evaluate vendors, and which platforms stand out for speed, accuracy, and scalability.

Why Consolidation Still Breaks in Excel

For all its flexibility, Excel was never designed for modern consolidation.

It’s fine when you’re merging two cost centers. But when you’re closing across five subsidiaries, three currencies, and multiple ERP systems, it becomes a liability.

Here’s why:

- Manual inputs multiply errors. One broken link or outdated reference can throw off the entire close.

- Version chaos. Everyone’s working in their own file, sending updates by email, and hoping no one overwrites the latest “final_final_v12.xlsx.”

- Slow, disconnected data. Finance teams spend days just gathering numbers instead of analyzing them.

- No audit trail. You can’t trace who changed what or why, without digging through endless tabs.

- Limited visibility. By the time consolidation is done, it’s already outdated.

The result? A process that’s reactive, slow, and risky.

Modern finance teams need something better. Not just faster spreadsheets, but a connected, automated environment where data flows seamlessly, updates instantly, and the close runs itself.

Key Features of the Best Consolidation Software

When evaluating consolidation tools, skip the buzzwords and focus on what truly impacts speed, accuracy, and control.

Here’s what the best platforms get right:

- Automation at the core. Data collection, eliminations, currency conversions, and adjustments are handled automatically, no manual uploads or formulas to debug.

- Seamless integrations. Connect ERP, CRM, BI, and data warehouses to ensure a single source of truth.

- Multi-entity, multi-currency support. Consolidate across subsidiaries, countries, and accounting standards with ease.

- Auditability and compliance. Built-in controls, clear approval flows, and traceable adjustments for IFRS and local GAAP.

- Real-time reporting. Instant insight into group performance without waiting for month-end.

- Collaboration. Finance, accounting, and management work in the same live model, not in silos.

- AI-assisted checks. Identify anomalies or misclassifications before they reach your reports.

- Finance-owned flexibility. The best systems are low-code or no-code, giving finance full control without IT bottlenecks.

Together, these features create a foundation for faster closes, fewer mistakes, and full transparency across entities.

Comparison: Top Consolidation Software in 2025

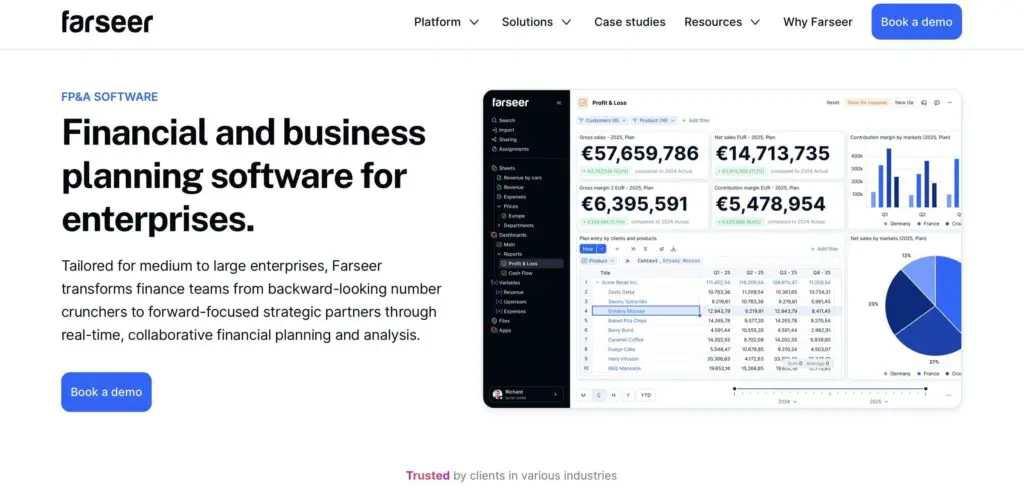

Farseer represents a new generation of consolidation software – built around the idea that finance should own the process, not just operate it. Unlike traditional CPM suites that require months of implementation and constant IT support, Farseer gives finance teams the flexibility to build, automate, and adapt models themselves, in real time.

Instead of static reports or after-the-fact reconciliations, Farseer creates one connected model where actuals, forecasts, and consolidations all flow together. Intercompany eliminations run automatically, adjustments are logged and auditable, and leadership can view updated results instantly, without waiting for the month-end close.

It’s especially powerful for multi-entity organizations that have outgrown Excel but aren’t ready for the complexity (or cost) of legacy enterprise software. From pharma manufacturers and logistics groups to multi-brand retailers, teams use Farseer to unify their planning and consolidation into a single, dynamic environment.

Best for: Mid-to-large enterprises (200–5000+ employees)

Key strengths:

- Real-time consolidation and automated eliminations

- Full finance ownership – no coding or external consultants

- Integrations with ERP, CRM, and BI tools

- Driver-based planning and forecasting built in

- Designed for complexity-heavy industries like pharma or manufacturing

Watch-outs: Not an ERP replacement; relies on existing source data integrations.

Fluence

Fluence appeals to finance teams that want to automate consolidation while staying close to Excel’s logic and layout. It offers a smooth transition from spreadsheets to automation, but remains more accounting-driven than planning-oriented.

Best for: Mid-market companies standardizing their close process

Key strengths:

- Excel-like interface with minimal learning curve

- Automated intercompany eliminations and journal postings

- Prebuilt workflows and audit trails

- Quick implementation and onboarding

Watch outs: Limited flexibility for advanced modeling and scenario analysis.

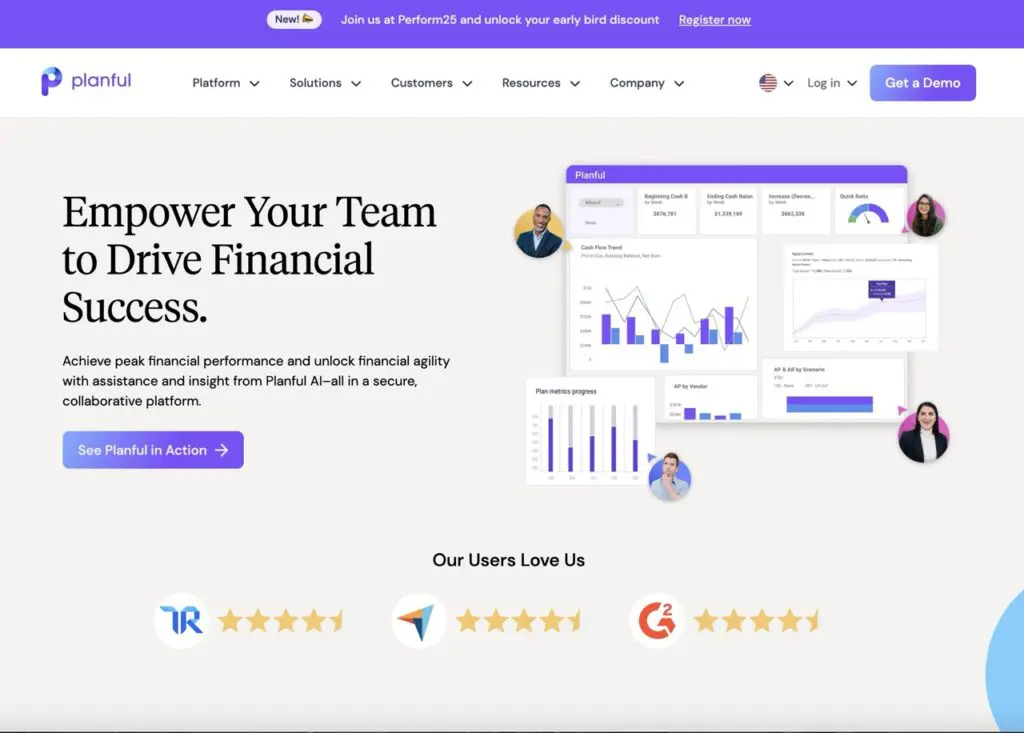

Planful

A well-established name in corporate performance management, Planful combines consolidation, planning, and reporting, particularly suited to large enterprises.

Best for: Global teams needing workflow control and integration depth

Key strengths:

- Strong approval flows and governance controls

- Tight integration with ERPs and data warehouses

- Solid reporting and dashboarding capabilities

- Scalable to multi-entity, multi-currency environments

Watch-outs:

- Complex setup

- may require implementation partners and IT support.

Read 6 Planful Competitors Finance Teams Should Consider in 2025

Workiva

If your close process revolves around audit readiness, Workiva is a standout. It’s favored by listed and regulated companies where compliance, documentation, and traceability take priority.

Best for: Public or highly regulated enterprises

Key strengths:

- Exceptional control, documentation, and audit trail

- Integrated reporting and SEC/IFRS compliance modules

- Real-time collaboration on reports and disclosures

- Secure cloud environment and workflow automation

Watch-outs: Limited flexibility for dynamic planning or forecasting.

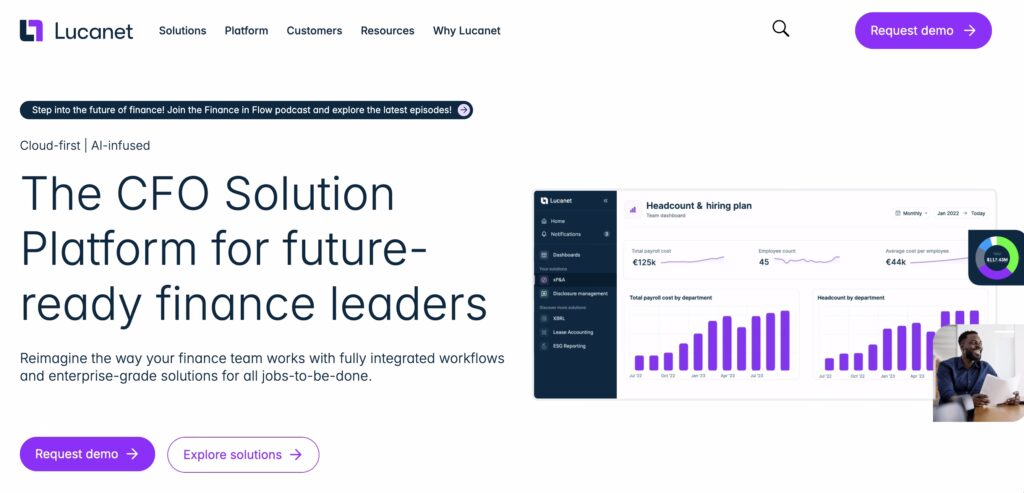

LucaNet

LucaNet focuses on financial accuracy and rule-based consolidation for mid-sized groups. It’s popular among accounting-driven organizations that want reliability and compliance above all.

Best for: Mid-sized organizations under IFRS or local GAAP

Key strengths:

- Strong built-in accounting logic and validations

- Multi-entity and multi-currency support

- Certified compliance for IFRS/GAAP reporting

- Consistent, structured setup across subsidiaries

Watch-outs Less adaptable for flexible planning or analytical use cases.

At the top end of the market, OneStream delivers an end-to-end CPM platform covering consolidation, planning, forecasting, and analytics. It’s designed for complex, multinational groups managing thousands of entities.

Best for: Large, globally distributed enterprises

Key strengths:

- Unified platform for consolidation, planning, and analytics

- Highly customizable logic for intricate ownership structures

- Extensive governance and audit capabilities

- Deep integration with multiple ERPs

Watch-outs:

- Long implementation time and significant cost of ownership

- best suited for organizations with dedicated IT resources.

Consolidation doesn’t have to be slow or painful.

Modern tools eliminate manual reconciliations, version chaos, and data silos, giving finance teams full control and visibility.

The best consolidation software goes beyond compliance. It creates a single source of truth for decision-making, connecting actuals, forecasts, and plans into one living model. When finance runs on real-time data instead of spreadsheet chaos, every close becomes a strategic moment, not just a reporting obligation.

Ready to see how it works in practice?

FAQ

Consolidation software automates the process of combining financial data from multiple entities into a single, accurate set of reports. It handles eliminations, adjustments, and currency conversions so finance teams can close faster and report confidently.

ERPs store transactional data; consolidation software sits on top, pulling, validating, and structuring it into consolidated statements. It also manages workflows, ownership, and compliance across entities.

Group accountants, controllers, and CFOs who manage multi-entity structures, especially those under IFRS or GAAP.

Depending on company size and complexity, pricing can range from €10K–€100K annually. Cloud-based tools like Farseer scale with your team and data volume.

Speed, accuracy, and visibility. Teams close faster, spend less time on manual reconciliation, and gain a single source of truth across all entities.

Automation didn’t just save time — it rebuilt confidence in the numbers and gave finance space to focus on analysis instead of reconciliation.