Long range planning often feels like wishful thinking when even annual budgets get outdated within a few months. Most companies spend weeks, sometimes months, fine-tuning their annual budget, just to see it get outdated within a few quarters – a common pitfall of the projection vs. forecast mindset. A sudden supply chain issue, a market shift, or an unexpected competitor move can throw everything off. So, if predicting one year ahead is tough, why even bother planning for the next five or ten?

Because the companies that do it, win in the long run.

Long-range financial planning is actually all about preparing for multiple possibilities – good, bad, and everything in between.

Read: Rolling Forecast – 101 Guide For Smarter Planning

Still, despite its importance, long-range planning is often overlooked or done poorly. Many companies rely on outdated spreadsheets, static forecasts, and gut feeling instead of real data-driven strategy.

The result? Missed growth opportunities, inefficient capital allocation, and surprises that could’ve been avoided.

So how do you do it right?

Let’s break it down. Starting with the challenges.

Challenges Companies Face in Long-Range Planning

Long-range planning sounds great in theory – until reality kicks in. You can’t foresee a market shift or a change in regulations, right? For sure – but that doesn’t mean you can afford to ignore the future.

Here are some of the most frequent challenges that companies face in long-range planning.

Rapid market changes make predictions harder

Inflation, interest rate increases, disruptions in supply chain – finance teams have had to rewrite their forecasts multiple times in the past few years. In other words, the only certainty is uncertainty (says a famous quote). All of this requires companies to be prepared to act fast and stay flexible while creating and implementing their strategies.

For example, a company investing in AI-driven automation today might see new regulations within a few years that completely change its cost-benefit analysis.

Spreadsheets can’t handle long-term complexity

Many finance teams still rely on Excel for long-range planning, even though it wasn’t built for that level of complexity. Think about a luxury hotel chain expanding into new countries (or any kind of business spreading abroad, as a matter of fact) – suddenly, they’re dealing with currency fluctuations, geopolitical risks, and shifting interest rates. One small formula mistake in a spreadsheet, and the whole financial model could get mixed up.

Finance and strategy teams work in silos

What is the gist of financial planning? It’s actually about making sure investments align with business goals. Still, finance and strategy teams often operate separately. Strategy teams think about expansion, new markets, and product lines, while finance teams focus on cash flow, cost control, and risk. Without a common planning platform, these teams work with different assumptions, leading to sometimes expensive misalignment.

Key Elements of an Effective Long-Range Plan

The most important goal of a long-range plan is to become ready for anything. The best companies don’t just set a single five-year target and hope for the best. They build plans that are flexible, data-driven, and aligned with their business strategy.

Here’s how that looks like in practice.

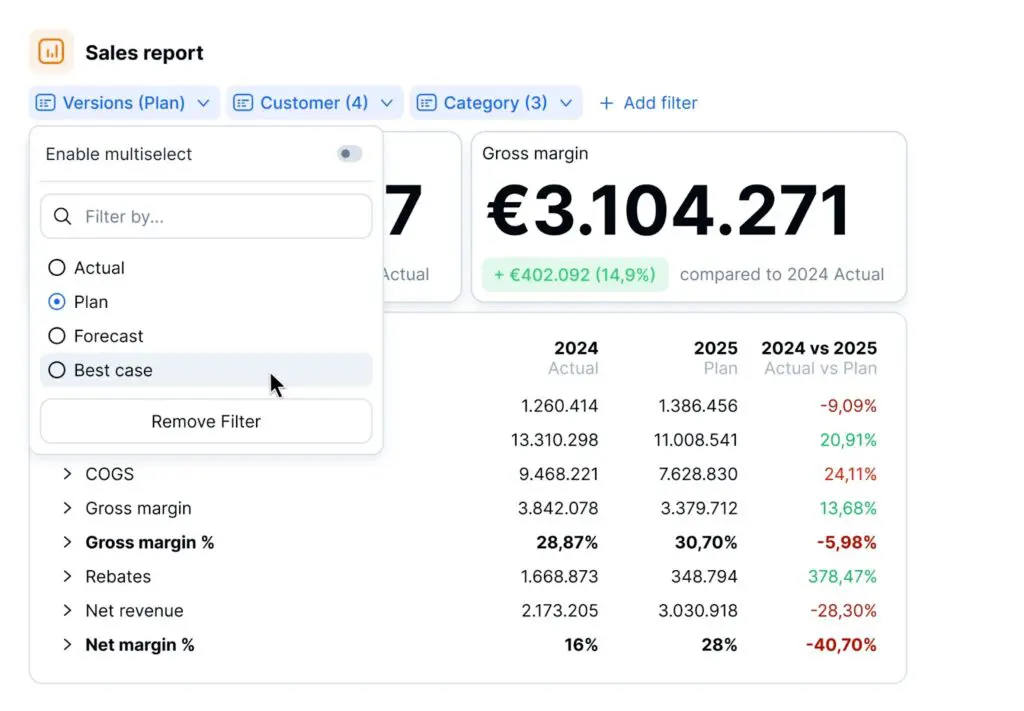

Scenario planning: be ready for the best, worst, and all that comes with it

No one can predict the future perfectly, but companies can prepare for different possibilities. Scenario planning means modeling best-case, worst-case, and most-likely outcomes based on key financial drivers. This is where what-if analysis plays a key role – helping you test how variables like inflation, sales drops, or FX changes could impact your long-term targets, and adjust in time. If you want to zoom in on one driver at a time and understand its individual impact, sensitivity analysis gives you that deeper level of control.

For example, an energy company might plan for:

- A best-case scenario where energy prices remain stable, leading to aggressive expansion.

- A worst-case scenario where costs increase, requiring cost-cutting and efficiency improvements.

- A base-case scenario where moderate price changes allow for steady growth.

With these models set in place, leadership teams can make decisions faster when market conditions change. Long-range planning supports any revenue forecasting model by ensuring leadership stays ahead, with future-focused visibility and financial assumptions that evolve with the market.

Capital allocation: investing in the right places at the right time

Every company has limited resources. The challenge is ensuring that long-term investments align with strategy and aren’t just based on short-term trends. This is where capital allocation planning is extremely important.

Take a retail chain for example. Before opening a new store, they don’t just look at current demand. They analyze long-term economic projections, population growth trends, and shifts in consumer behavior. If this data suggests that urbanization is slowing in a region, they may rethink expansion plans there and redirect their money to e-commerce or supply chain upgrades instead.

Workforce planning: balancing hiring with financial outlooks

Many companies hire based on their immediate needs, but this can cause problems down the road. For example, if a company hires too quickly for a short-term project, they might end up letting people go when the project ends. Also, if they only focus on short-term skills, they might find themselves lacking the right talent when future needs come along.

Long-range workforce planning ensures that hiring goes hand in hand with any growth projections, automation trends, and industry shifts a company may experience.

For example, a company planning international expansion needs to project:

- How many new employees will be needed in five years.

- Which skills will be in demand (like being confident with AI tools, for example).

- Whether to hire locally or relocate talent based on salary trends and regulations.

When companies include workforce planning in their financial strategy, it helps them avoid the need for sudden layoffs or last-minute hiring based on short-term changes.

Technology & digital transformation: planning for future investments

Many companies delay major IT investments because they’re expensive and complex. But without a long-term digital strategy, they risk falling behind their competitors.

A manufacturing company might need to plan for:

- Cloud migration costs and ROI over the next five years.

- The impact of automation and AI on workforce needs.

- Cybersecurity investments to meet new compliance requirements.

If you plan IT investments ahead of time, you can spread out the costs over time, which makes them more manageable. This way, you avoid rushing into expensive decisions later on, which could strain your budget or lead to poor choices.

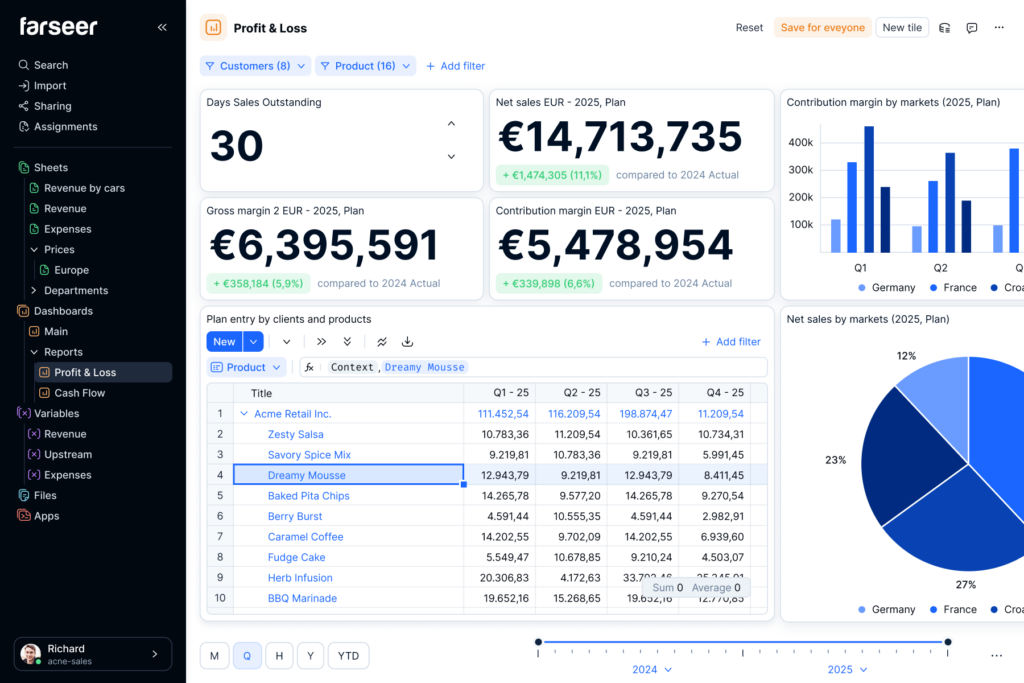

How Modern FP&A Tools Improve Long-Range Planning

Long-range planning is tough enough without having to fight with spreadsheets. Yet, as mentioned, many companies still rely on Excel for 5- to 10-year financial forecasts, even though it wasn’t built for that level of complexity. This leads to plans that are static, outdated, and don’t have much to do with reality.

Modern FP&A tools solve these issues with driver-based modeling – where forecasts are built on real business drivers like:

- Raw material costs (e.g., coffee, sugar, packaging materials for a consumer good company).

- Exchange rates and inflation (extremely important for multinational companies).

- Consumer demand trends (predicting market shifts).

With an automated FP&A platform, finance teams can:

- Run real-time scenario analysis to see how inflation impacts costs.

- Automatically update forecasts based on live market data.

- Simulate different pricing strategies to optimize profitability.

For example, the before-mentioned consumer company can use an FP&A system to:

- Model the impact of a 10% increase in coffee bean prices on total production costs.

- Adjust product pricing dynamically without hurting margins.

- Optimize capital allocation based on projected supply chain disruptions.

Key Takeaways

- Long-range planning prepares companies for various scenarios, ensuring readiness for market shifts and growth opportunities.

- Common challenges include market unpredictability, reliance on outdated spreadsheets, and siloed teams.

- Effective planning focuses on scenario planning, strategic capital allocation, workforce planning, and future-proofing technology investments.

- Modern FP&A tools use driver-based modeling and real-time updates for more accurate, flexible, and data-driven forecasts.

- Long-range planning is about preparation, not prediction, and modern FP&A tools offer a competitive edge in making smarter decisions.

The question isn’t whether your company should focus on long-range planning – the question is: Are you doing it right?