FREE CALCULATOR

Working Capital Calculator

How to Use the Working Capital Calculator

Use this working capital calculator to see how efficiently your company can cover short-term obligations with short-term assets.

Just enter your current assets and current liabilities – the result updates instantly.

What you need to fill in

Current Assets (A):

Include cash, accounts receivable, inventory, and other assets that can be converted to cash within 12 months.Current Liabilities (L):

Include accounts payable, short-term debt, accrued expenses, and other obligations due within a year.

What you get

A live working capital result that updates as you type

The formula shown below for full transparency

Quick interpretation of whether your company has a liquidity surplus or shortfall

How to use the result

Positive working capital means your company can easily meet short-term obligations — a sign of healthy liquidity.

Negative working capital means short-term liabilities exceed assets, often signaling cash flow pressure or over-reliance on debt.

Zero working capital means the business is exactly balanced – no buffer for unexpected expenses.

What Is Working Capital?

Working capital measures how much cash and short-term assets you have left after paying your short-term liabilities.

It’s a key indicator of liquidity, operational efficiency, and short-term financial health.

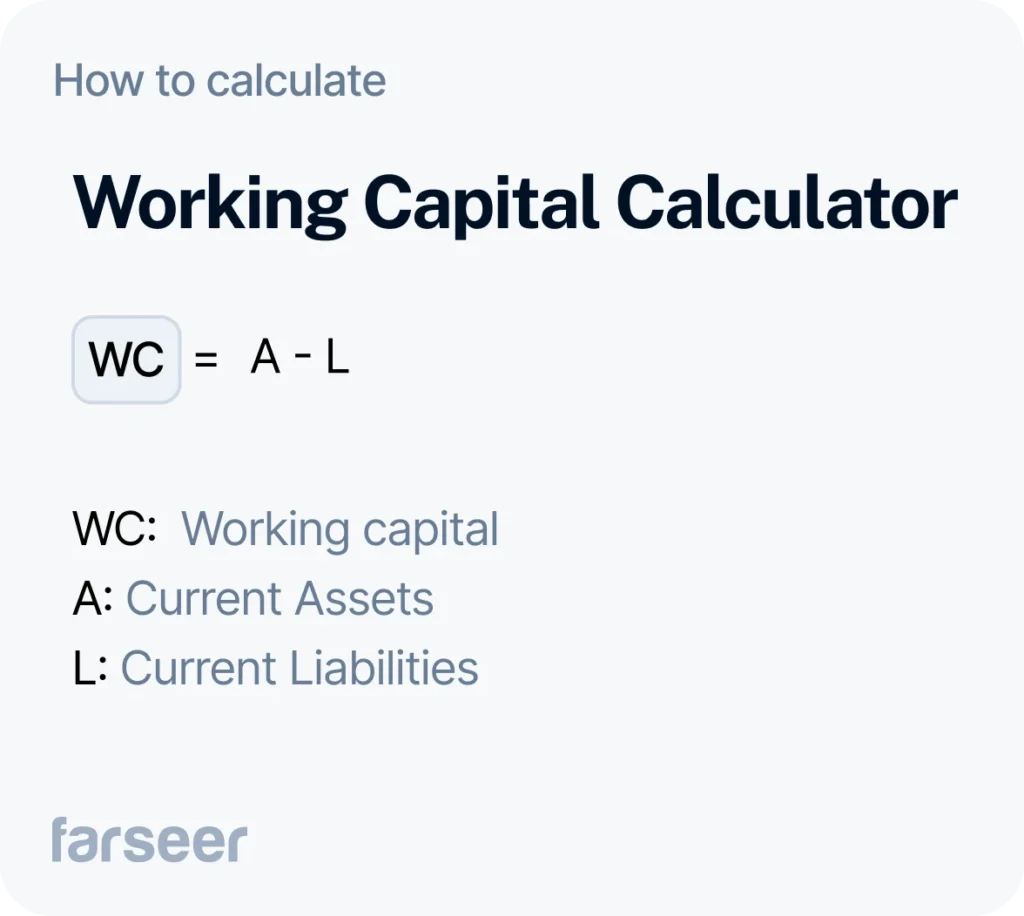

Working Capital=Current Assets−Current Liabilities

It answers a simple but crucial question: Can your business cover its daily operations with the resources it already has?

When companies expand, take on debt, or experience delays in receivables, working capital becomes one of the first warning lights for financial strain.

Formula

When to Use a Working Capital Calculator

Use this calculator when you need a quick snapshot of liquidity, especially during:

Monthly or quarterly closing

Capex and Opex planning

Debt covenant monitoring

Working capital is an essential signal for controllers, FP&A teams, and CFOs tracking operational efficiency and liquidity trends over time.

Take It Further with Farseer

If you’re analyzing working capital regularly, a one-off calculator won’t cut it.

You need a dynamic model that connects your cash flow, P&L, and balance sheet, and updates automatically as new data comes in.

That’s exactly what Farseer does.

With Farseer, you get:

- Real-time cash flow forecasting

- Automated working capital analysis

- Integration with your ERP and CRM data

- Collaboration across finance and operations

- Scenario modeling to simulate liquidity outcomes

Instead of juggling spreadsheets, you get a single source of truth for planning, forecasting, and reporting.

Book a demo and see how Farseer helps finance teams plan with confidence – no spreadsheets, no chaos, just clarity.