FREE CALCULATOR

Net Present Value (NPV) Calculator

How to Use the Net Present Value Calculator

Use this net present value calculator to see if an investment is worth it in today’s money. Enter your expected cash flows, and the result updates right away.

What you need to fill in

- Initial Cost (C₀): What you spend upfront, like for equipment or a new system.

- Discount Rate (r): The return you want to earn. Most companies use their WACC or a risk-adjusted rate.

- Cash Flows (C₁ to C₅): What you expect to earn each year. You can leave some years empty.

What you get

- A live NPV result

- The full formula shown below the inputs

How to use the result

- If NPV is positive, the investment gives you more than your expected return.

- If it’s negative, the return doesn’t meet your expectations.

What Is Net Present Value?

Net present value (NPV) shows what your future cash flows are worth today. It helps you decide if an investment pays off once you factor in time and risk.

If you’re comparing options, NPV puts everything on the same timeline. You can see which project creates more value, based on your expected return. It’s one of the key tools used in strategic financial planning when you’re deciding where to invest and how to allocate capital.

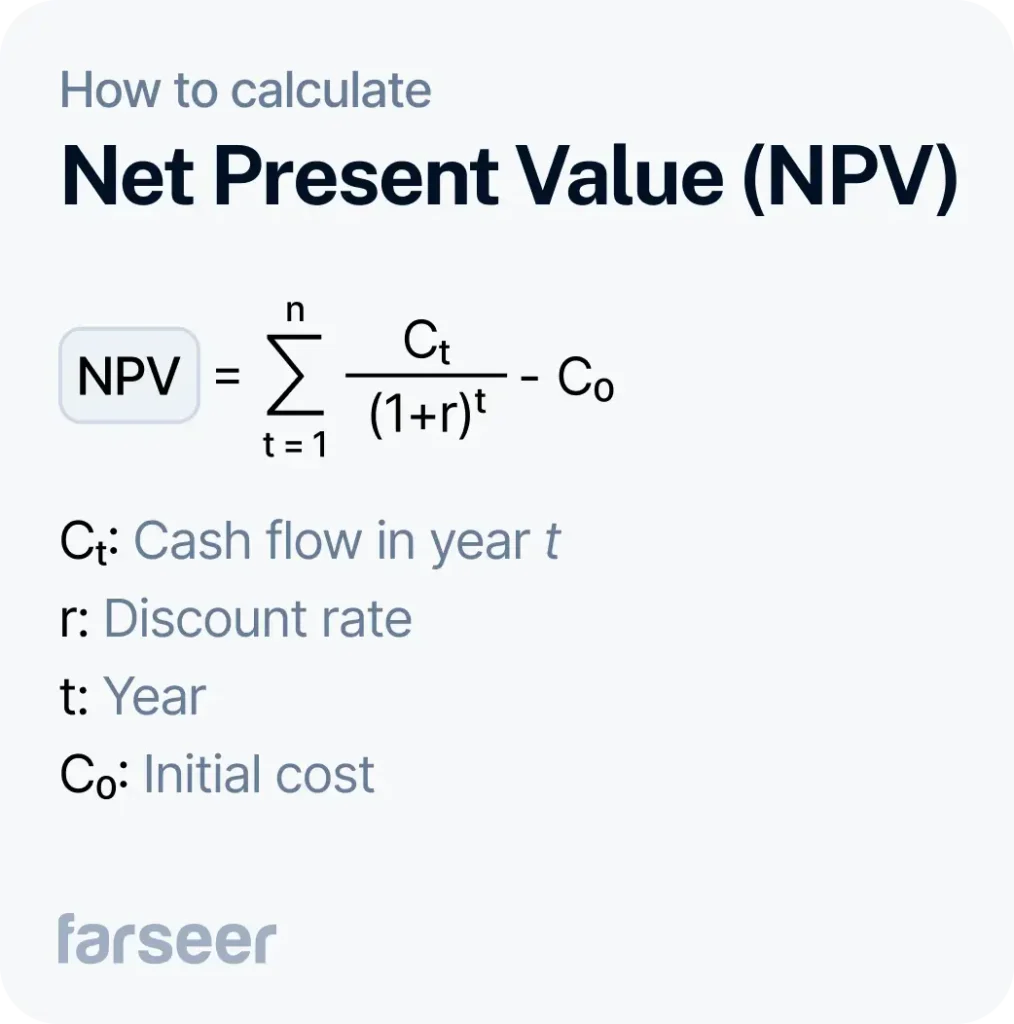

Formula

Choosing the Right Discount Rate

The discount rate is one of the most important inputs in your net present value calculator. It reflects the return you expect from the investment or your minimum acceptable outcome.

Most companies use their WACC if the project is funded through both debt and equity. If the investment carries more risk than usual, increase the rate to stay realistic. Don’t just use your loan rate; that’s too low. Use your cost of capital or opportunity cost.

Tips

- Use 6% to 10% for most stable projects

- Go higher if the investment is uncertain or experimental

- Never underestimate risk. It skews the NPV result

When to Use a Net Present Value Calculator

Use a net present value calculator when your company is spending money now to earn returns over time. It helps you figure out if the future payoff justifies the upfront cost.

Common use cases:

- Product development or expansion

- Buying equipment or upgrading facilities

- Acquisitions and other long-term investments

- Strategic capex projects

NPV gives you one number that blends cash flow, time, and return. It helps you compare options and back up decisions with numbers, especially for strategic capex decisions.

NPV vs IRR – Which One to Use?

Both NPV and IRR help you decide if an investment makes sense, but they work in different ways.

- Net present value (NPV) shows how much value an investment creates in today’s money. It tells you how far above or below your target return the project lands.

- Internal rate of return (IRR) is the return rate that would make the NPV exactly zero. It shows the point where the investment just breaks even.

IRR is a single percentage, which sounds simple. But in real-world planning, it can give the wrong signal. It assumes you reinvest at the same return, and it struggles with uneven cash flows.

That’s why most companies use NPV. The net present value calculator gives a clearer result. You can compare projects of different sizes, spot the actual value created, and make better decisions based on real numbers.

This calculator focuses on NPV because it’s more useful for long-term planning and capital investment decisions.

Take It Further with Farseer

If you’re running this kind of analysis often, you’ve already outgrown one-off tools like a net present value calculator.

Farseer helps you plan, model, and compare investment scenarios in real time. You can link everything in one place — from assumptions to outcomes — without dealing with broken spreadsheets.

With Farseer, you get:

- Real-time scenario comparison

- Drag-and-drop financial modeling

- Built-in collaboration with your team

- Clean reports that are ready for decision-makers

You can keep all your investment logic, forecasts, and reports in one place — and update them in seconds when something changes.

Book a demo and see how Farseer makes financial planning faster and easier.