$127 billion. That’s the cumulative penalty cost the pharmaceutical industry has paid for compliance violations since 2000. As staggering as that number is, it represents only a fraction of the actual financial cost incurred. Settlement costs typically represent only a fraction of the total financial impact on the business, accounting for 15-30%. FP&A professionals responsible for risk modelling and strategic planning must understand the full cost of compliance failure to safeguard the business’s long-term viability.

The remaining 70-85% of the costs lurk beneath the surface and include:

- Legal fees that potentially span a decade or more of litigation.

- Remediation programs cost tens of millions in extra operating expenses.

- Government investigations and executive turnover consume management bandwidth.

- Erosion of market confidence follows a compliance scandal.

All of these costs constitute the “compliance failure cost iceberg,” and most pharmaceutical finance teams aren’t modeling for it.

This article examines eight recent enforcement actions (2018–2025) across six compliance domains to demonstrate how failures in finance and compliance lead to cascading financial losses, quantify the “total cost of failure” beyond settlements, and provide an actionable framework for FP&A teams to incorporate compliance risk into their financial models.

The Playing Field

Unlike most industries, pharmaceutical companies face overlapping enforcement jurisdiction from multiple US federal agencies, each bringing its own statutory authority and penalty structure.

- The Department of Justice operates through both its Civil Division (handling False Claims Act matters) and Criminal Division (prosecuting willful violations).

- The SEC enforces the Foreign Corrupt Practices Act’s books-and-records provisions and pursues securities fraud when companies conceal compliance issues from investors.

- The FDA’s Office of Criminal Investigations prosecutes drug safety and clinical trial fraud.

- The Health and Human Services (HHS) – Office of Inspector General can impose the ultimate sanction: exclusion from federal healthcare programs, which for most pharmaceutical companies would effectively be a corporate death sentence.

What makes this particularly challenging for financial planning is the qui tam provision of the False Claims Act. According to the DOJ’s fiscal year 2024 statistics whistleblower-initiated lawsuits accounted for over 83% of all False Claims Act recoveries (of the $2.9 billion in settlements and judgments, $2.4 billion arose from qui tam lawsuits). More concerning is the fact that many of these suits can remain under seal for years while the government investigates. A company could be sitting on a material liability that doesn’t appear anywhere on its balance sheet.

Case Studies Where Finance and Compliance Broke Down

Biogen: The $900 Million Speaker Program Collapse

In September 2022, Biogen finalized a $900 million settlement to resolve allegations that the company paid kickbacks to physicians through sham speaker programs, consulting arrangements, and speaker training fees from 2009 through 2014. The alleged goal was to increase prescriptions of its multiple sclerosis drugs Avonex, Tysabri, and Tecfidera.

How it worked. According to court documents, Biogen allegedly identified physicians who wrote 60% of MS prescriptions and targeted them with speaking engagements. The whistleblower complaint alleged the company selected speakers “based on their prescribing ability, not their speaking ability.”

Key Financial Failure. Insufficient documentation regarding the Fair Market Value (FMV) of healthcare professional (HCP) compensation creates significant compliance risk. For instance, a $2,500 speaking fee for an audience of only three practitioners presents a disproportionate cost-to-engagement ratio. A robust FP&A function would identify such anomalies by flagging instances where aggregate spending is misaligned with measurable outcomes.

The whistleblower, Michael Bawduniak, received approximately $250 million (the most significant award in False Claims Act history) for a case where the government declined to intervene. That single fact underscores the financial risk: even without government participation, private whistleblowers can pursue these cases and win significant recoveries.

Teva Pharmaceuticals: Patient Assistance Masks Price Increases

In October 2024, Teva Pharmaceuticals agreed to pay $450 million to settle two separate federal probes into its drug copay assistance programs and generic drug pricing practices. This latest agreement brings the company’s total exposure to $675 million, including a $225 million criminal penalty previously assessed under a deferred prosecution agreement.

How it worked. From 2006 through 2017, Teva allegedly used two charitable foundations: The Assistance Fund and Chronic Disease Fund, as conduits to cover Medicare patients’ copays for Copaxone, its blockbuster MS drug. By eliminating patient cost-sharing, Teva raised prices without losing market share. The result: Copaxone’s annual price increased from approximately $17,000 to over $85,000. The copay scheme demonstrates how financial engineering can cross legal lines.

Key Financial Failure. The DOJ alleged that Teva coordinated with a specialty pharmacy to ensure its “charitable” donations flowed specifically to Copaxone patients. For FP&A teams, this case illustrates why patient assistance program expenditures should be analyzed as potential commercial investments, not merely philanthropic gestures.

Novartis: International Expansion Meets Bribery

In June 2020, Novartis AG and its former subsidiary Alcon agreed to pay over $346 million to resolve FCPA charges arising from bribery schemes in Greece and Vietnam. The Greek subsidiary made improper payments to state-owned hospitals and healthcare providers from 2009 to 2015; the Vietnamese operation routed bribes through third-party distributors from 2011 to 2014.

How it worked. According to the charging documents, the schemes included rewarding doctors for prescribing products with sponsorships to international medical conferences, disguising payments as “epidemiological studies,” and routing money through third-party distributors. The books-and-records violations were extensive, going beyond simple accounting errors, and were the result of the systematic mischaracterization of improper payments as legitimate business expenses.

Key Financial Failure. For companies with international operations, this case highlights the FCPA’s reach. Both Novartis Greece and Alcon Pte entered into three-year deferred prosecution agreements. The financial planning implications extend beyond the settlement itself to include enhanced compliance monitoring, third-party due diligence programs, and the reputational cost of being labeled a repeat FCPA offender.

Mallinckrodt: Ignoring the Warnings

Sometimes compliance failures come down to a company simply refusing to follow clear regulatory directives. Mallinckrodt ARD’s $260 million settlement in 2022 illustrates this pattern with devastating clarity.

How it worked. The scheme centered on Acthar Gel, a specialty drug approved by the FDA in 1952. When Mallinckrodt’s predecessor, Questcor, acquired the drug, they began reporting it to the Medicaid Drug Rebate Program as if it were a “new drug” first marketed in 2013. This classification allowed them to ignore all pre-2013 price increases when calculating inflationary rebates. This was a significant omission given that Acthar’s price had risen from $50 per vial in 2001 to over $28,000 by 2013, eventually reaching $40,000.

Key Financial Failure. The government estimated that Mallinckrodt avoided approximately $650 million in rebate payments through this misclassification. What makes this case particularly egregious from a governance standpoint is that the Centers for Medicare and Medicaid Services (CMS) explicitly warned Mallinckrodt about the improper reporting in 2016, 2017, 2018, and 2019. The company continued the practice until 2020.

The whistleblower was James Landolt, who served as Mallinckrodt’s Director of Internal Controls, Gross-to-Net Accounting, and Government Reporting. He was the person responsible for ensuring accurate reporting and identified the fraud, escalated internally, and when the company refused to act, filed a qui tam lawsuit. Finance teams should ensure that the internal control function is empowered to escalate concerns to the appropriate level and have those concerns addressed; otherwise, significant whistleblower liability could be hiding in plain sight.

Indivior and Reckitt: The $2 Billion Opioid Marketing Disaster

The opioid crisis has generated some of the largest pharmaceutical settlements in history. In 2019, Reckitt Benckiser Group paid $1.4 billion to resolve allegations related to its former subsidiary’s (Indivior ) marketing of Suboxone, an opioid addiction treatment drug. In 2020, Indivior agreed to pay an additional $589 million ($289 million in criminal fines and $300 million in civil payments) in relation to the case.

How it worked. According to DOJ’s enforcement materials, Indivior promoted Suboxone to physicians who were writing prescriptions without legitimate medical purpose, without required counseling or psychosocial support, and for uses that were “unsafe, ineffective, and medically unnecessary.” The company’s sales force allegedly targeted high-volume prescribers regardless of their prescribing patterns. This alone should have been identified as a red flag that should have triggered compliance intervention.

Key Financial Failure. For FP&A professionals, the lesson involves compensation structure. When sales targets incentivize volume without compliance guardrails, lawsuit risk is built into the system. Revenue targets that reward aggressive marketing to high-prescribing physicians, without monitoring whether those prescriptions are medically appropriate, can create false claims liability.

Endo Health Solutions: Marketing to Known Bad Actors

In February 2024, Endo Health Solutions (Endo) agreed to pay $475.6 million to resolve allegations that it marketed opioid drugs to providers it knew were prescribing for non-approved medical uses. The settlement payments were structured as claims in the company’s ongoing bankruptcy proceedings, illustrating how compliance failures can cascade into an existential financial crisis.

How it worked. Endo allegedly continued marketing investments to prescribers despite clear red flags about their prescribing patterns.

Key Financial Failure. This suggests a disconnect between compliance monitoring and commercial strategy. Siloed operation can create significant enforcement risk.

Rite Aid: When Volume Metrics Override Safety

n July 2024, Rite Aid agreed to pay $410 million to resolve allegations that it ignored red flags and knowingly dispensed controlled substances unlawfully. The case arose from the “corresponding responsibility” doctrine under the Controlled Substances Act, which requires pharmacists to verify the legitimacy of prescriptions before filling them.

How it worked. According to the government, Rite Aid’s performance metrics emphasized volume over compliance. Pharmacists who raised concerns about suspicious prescriptions allegedly weren’t supported, and, in some cases, the problems weren’t escalated to corporate risk functions at all.

Key Financial Failure. This is a governance failure with direct financial consequences. When field-level compliance concerns can’t reach the executive level, the early warning system that might prevent a business-ending settlement is effectively disabled.

AMB Research Center: Criminal Consequences of Data Fabrication

Not all compliance failures result in civil settlements; sometimes people go to prison. The AMB Research Center case resulted in prison sentences for the clinic owner and a pharmacist who fabricated clinical trial data for a drug being developed to treat Clostridium difficile-associated diarrhea.

How it worked. According to trial evidence, the defendants used names and personal information of individuals who never actually participated in the clinical trial (including family members and friends) and listed them as enrolled subjects. The per-patient payment structure created an incentive for enrollment fraud that apparently overwhelmed the site’s compliance controls.

Key Financial Failure. For pharmaceutical companies sponsoring clinical trials, this case underscores the importance of site-level audit protocols. If a clinical trial budget assumes a certain cost-per-patient, and a site is delivering enrollment at significantly lower cost, that variance warrants investigation.

Beyond Settlements: The True Cost of Failure

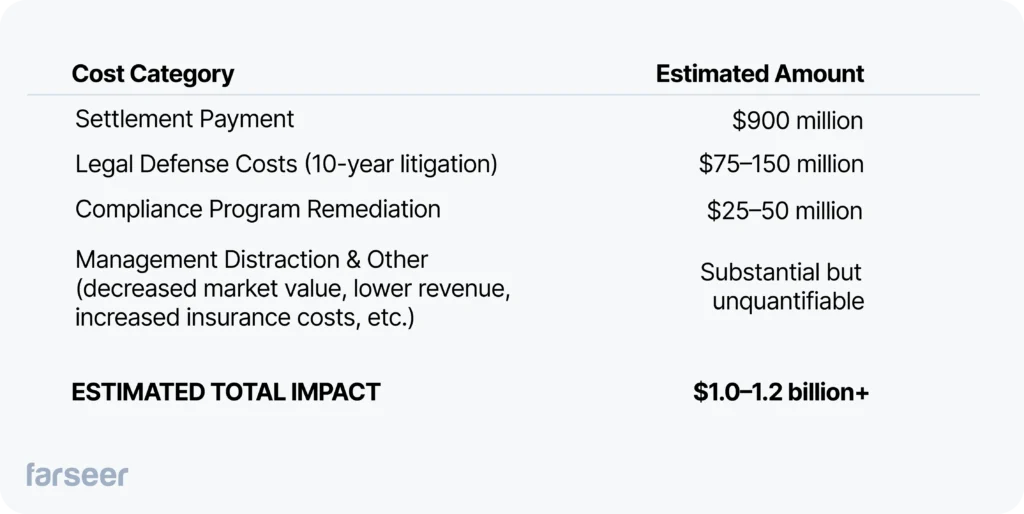

Settlement amounts make for compelling headlines, but they obscure the whole financial picture. A comprehensive analysis of enforcement actions reveals eight distinct cost categories that together comprise the total economic impact:

Direct Settlement Costs include criminal fines, civil penalties, disgorgement, state settlement payments, and whistleblower awards. These are the headline numbers stated above. They can be significant but are just the starting point.

Legal and Advisory Fees encompass outside defense counsel, forensic accountants, compliance consultants, and Independent Review Organizations required under Corporate Integrity Agreements (CIA). For a complex case spanning a decade of litigation, these costs can easily reach $75-150 million.

Remediation Costs cover compliance program enhancements, IT system upgrades, policy and procedure overhauls, and enhanced monitoring systems. Depending on the scope of violations, these investments can run $25-50 million.

Ongoing CIA Compliance Costs include five years of enhanced monitoring, annual IRO reviews, board compliance committee requirements, and enhanced reporting obligations. Budget $2-5 million annually for these requirements.

Market Value Destruction reflects declines in stock price following settlement announcements, sustained compression of P/E multiples, and analyst downgrades. This is often the largest single cost category but receives the least attention in settlement analyses.

Revenue Impact includes loss of government contracts, deferred product launches, damaged prescriber relationships, and reputational harm. These effects can persist for years after a settlement and are hard to quantify.

Executive and Talent Costs cover CEO and CCO turnover, severance packages, and management distraction. Major investigations consume 20-40% of executive bandwidth during active enforcement. This is time not spent on value-creating activities but on compliance and defense.

Insurance Costs include D&O premium increases, coverage exclusions, and deductible exhaustion. After a significant settlement, insurance costs increase significantly.

Example: Estimate of Biogen's True Cost of Compliance Failure

Applying this framework to the Biogen case illustrates how settlements represent only a fraction of total exposure:

Context matters. The $900 million settlement came as Biogen was already struggling with MS franchise decline following Tecfidera’s patent expiration in 2020 and the failed launch of Alzheimer’s drug Aduhelm. The compliance failure didn’t cause all of Biogen’s strategic challenges, but it consumed resources and management attention during a critical period when the company needed to execute a pivot.

The Patterns: Where Finance and Compliance Fail

Across these eight cases, recurring failures fall into two categories: structural and financial. Understanding these patterns should serve as a warning for those seeking to protect their organizations from similar outcomes.

Structural Failures

Siloed compliance functions represent the most common structural problem. When compliance operates separately from FP&A, risk-adjusted financial planning becomes impossible. The finance team builds forecasts that don’t account for compliance exposure; the compliance team identifies risks that never get incorporated into capital allocation decisions.

Inadequate escalation protocols allow field-level concerns to die in middle management. Mallinckrodt received four explicit warnings from CMS over four years, yet continued the practice anyway. Either the warnings never reached decision-makers, or decision-makers chose to ignore regulatory directives. Either scenario represents governance failure.

Revenue-first culture overrides compliance red flags when compensation structures incentivize volume without compliance guardrails. If sales force compensation is entirely based on prescription volume or increased revenue, people will be incentivized to find ways around compliance controls and failure will be built into the system.

Financial Control Failures

Inadequate fair market value documentation was the core failure in the Biogen case. When healthcare professional payments lack contemporaneous FMV assessments, it becomes impossible to demonstrate that they were for legitimate services rather than disguised kickbacks.

Third-party payment opacity enabled Teva’s patient assistance program scheme. Charitable foundation donations weren’t tracked as commercial expenditures, even though they were structured to benefit only Teva’s products.

Gross-to-net accounting gaps allowed Mallinckrodt to misreport rebate obligations for seven years. Rebate calculations weren’t reconciled with regulatory reporting requirements, creating a multi-million-dollar exposure.

Strategic Recommendations

Based on these cases, several strategic recommendations emerge for FP&A professionals in the pharmaceutical industry. Utilizing a robust planning and modelling tool such as Faseer will help to mitigate any organization’s hidden risks.

Integrate Compliance Risk into Financial Planning

Build compliance failure scenarios into stress-testing and capital-allocation models. Work with legal and compliance to quantify probable settlement exposure for SEC disclosure. Track leading indicators such as whistleblower hotline trends, audit findings, and regulator correspondence. These are early warning signals that will inform financial forecasts.

Strengthen Finance-Compliance Integration

Establish quarterly joint FP&A-compliance risk assessments that connect commercial strategy changes to compliance implications. Build dashboards tracking aggregate HCP spend against prescribing patterns and FMV benchmarks. Implement real-time reconciliation between commercial pricing decisions and government reporting obligations.

Enhance Governance Structures

Ensure the Audit Committee receives regular compliance metrics alongside financial results. Tie executive compensation to compliance performance indicators, not just revenue targets. According to the DOJ’s updated guidance on corporate compliance programs, integration of the compliance function into M&A due diligence is now an explicit expectation. FP&A teams should incorporate compliance risk into acquisition valuations accordingly.

Perform Enforcement Scenarios

Write the battle plan: identify outside counsel, forensic accountants, and potential IRO candidates before issues arise. Document compliance investments as the DOJ and SEC provide cooperation credit for proactive compliance enhancement. Maintaining an audit trail of improvements is critical to bolstering your case. Develop a framework to evaluate the benefits of voluntary disclosure against litigation risk.

The Bottom Line

The eight cases examined here represent over $5 billion in direct settlement costs, and likely $7-10 billion in total financial impact when the whole cost structure is considered. That’s shareholder value destruction on a massive scale.

For FP&A professionals, the imperative is clear: compliance risk is financial risk, and it belongs in the models. Companies that failed in these cases didn’t lack compliance programs; they lacked integration between compliance and finance. Operation-level concerns didn’t reach the CFO or other leaders. Commercial strategies were approved without compliance stress-testing. Regulatory warnings were received but not incorporated into financial planning.

By treating compliance not as a legal function operating in isolation but as a financial risk discipline that informs planning, forecasting, and capital allocation, FP&A professionals can help their organizations avoid becoming the next cautionary tale.

The cost of compliance is measured in millions. The cost of non-compliance is measured in billions. Do the math.