Companies that run Oracle Hyperion usually do it for three reasons: structure, governance, and confidence in the numbers. Hyperion has proven its value over decades, especially for organizations with multiple entities, strict reporting requirements, and established planning cycles.

However, Hyperion’s architecture has not kept pace with how finance works today. Reporting is continuous rather than monthly, plans are updated weekly, and operational inputs now come from a growing number of systems. The maintenance effort, upgrade pressure, and dependence on IT have pushed many teams to question whether Hyperion is still the right long-term fit.

This guide focuses on the tools finance teams actually evaluate when replacing Hyperion. The point is not to list features. The real question is whether a platform can take over Hyperion’s core responsibilities: structured planning, multi-entity consolidation, flexible modeling, and strong governance.

Read more: A Complete Guide to Financial Statement Analysis for Strategy Makers

What Companies Usually Want When Replacing Hyperion

When companies decide to move beyond Hyperion, they are rarely looking for “something similar in the cloud”. They are trying to match the speed and complexity of current finance operations.

They want planning and reporting that update continuously, not once a month. They want a real modeling layer, not rigid, template-driven workflows. Multi-entity groups expect consolidation that does not depend on parallel Excel files, plus direct integrations with ERP, CRM, HR, and billing systems, so data does not move through custom scripts and manual uploads.

There is also a clear expectation of lower maintenance than on-prem Hyperion, particularly around upgrades, infrastructure, and IT involvement. Finally, any replacement must provide robust governance and auditability that can support internal controls and external reporting without compromise.

Read more: What Great Financial Reporting and Analytics Actually Look Like

The 6 Best Oracle Hyperion Competitors in 2026

1) Farseer – Best for unified planning, modeling, and multi-entity reporting

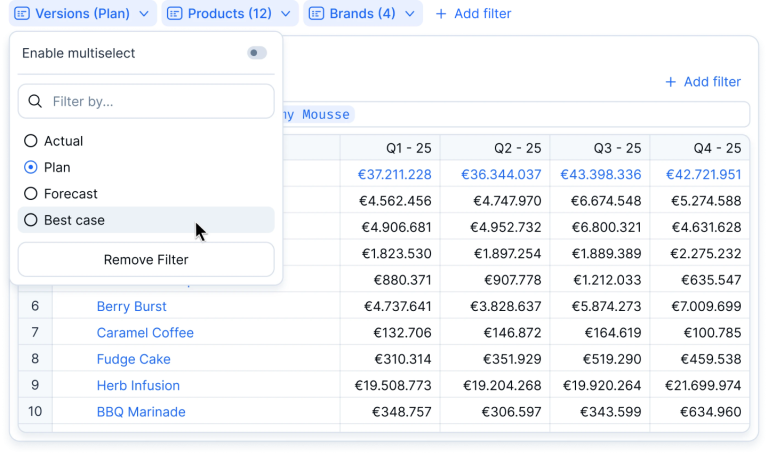

Farseer is built for finance teams that need Hyperion-level discipline without the cost, maintenance, and implementation burden of legacy enterprise systems. Instead of separating reporting, forecasting, and scenarios into different modules, Farseer runs everything on one underlying model. That architecture removes the usual gap between “reporting numbers” and “planning numbers” and allows teams to run reporting and forecasting continuously rather than waiting for month-end.

The platform is especially effective for multi-entity companies with fast-moving operations, distributed ownership of budgets, and the need for granular modeling that goes far deeper than classic finance templates. Adoption is quick because the interface is intuitive, and the system behaves the way finance teams actually think.

Key features

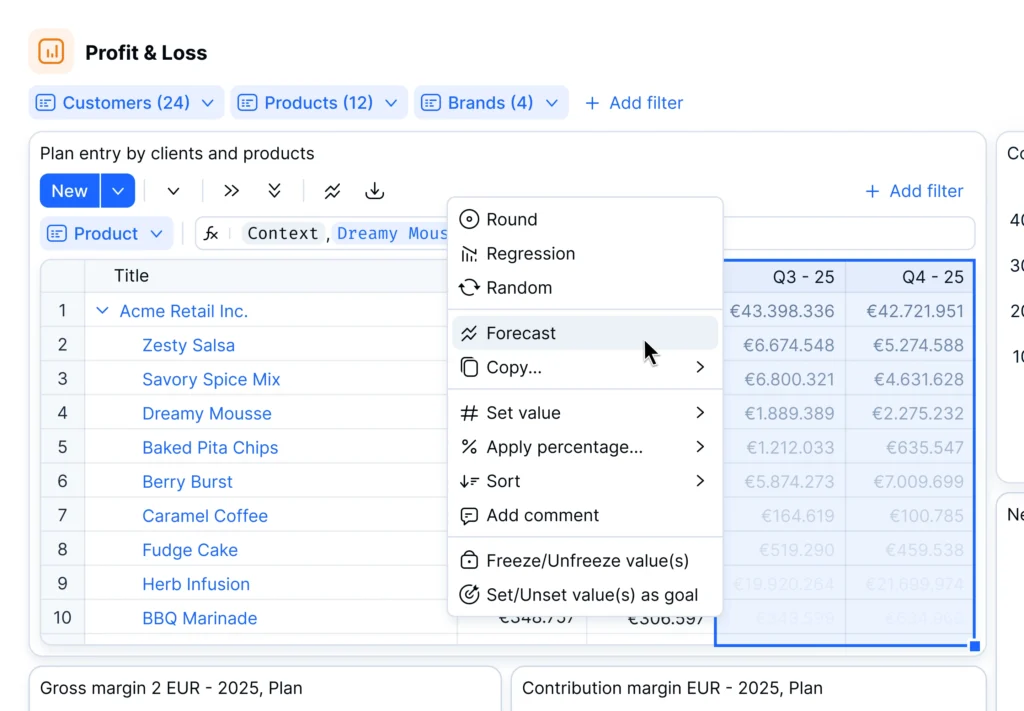

A real modeling environment that mirrors finance logic

Farseer lets teams build drivers, rules, allocations, eliminations, FX logic, and operational mechanics directly into the model. Revenue engines, workforce planning, production cycles, contract structures, and cost drivers all live in one structured environment. When a driver changes, reports, forecasts, and scenarios update instantly.

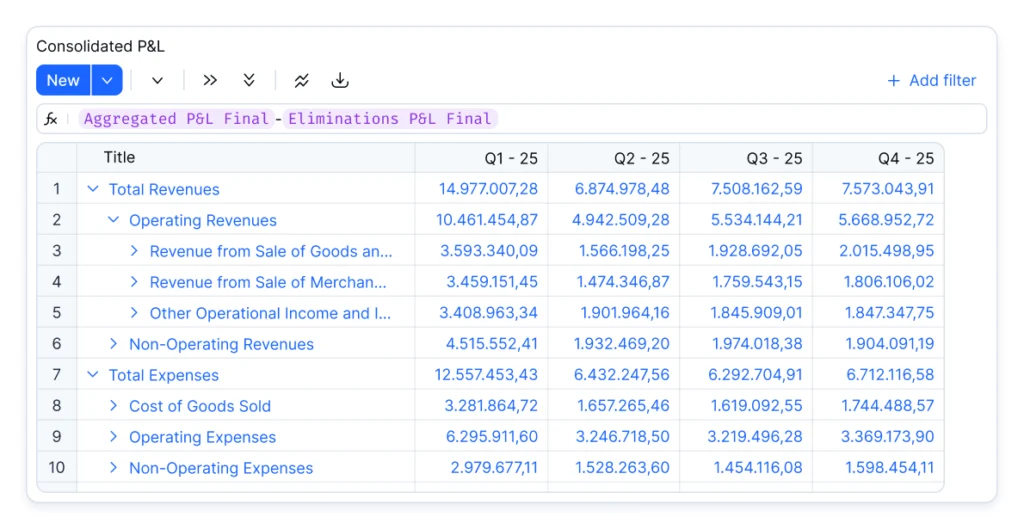

Multi-entity consolidation that finance controls

Intercompany rules, eliminations, FX conversion, ownership structures, and entity-specific adjustments are configured once and reused automatically. Consolidated P&L, balance sheet, and cash flow update immediately when actuals arrive or assumptions change.

Unified logic for reporting, planning, and scenarios

Farseer removes the “two systems” problem that plagues Hyperion users. Reporting, forecasting, and scenario modeling are all driven by the same formulas and the same data. No duplication, no parallel models, no version drift.

Real-time collaboration and communication

Comments, discussions, and cell-level explanations are stored directly in the model. Teams can attach reasoning, upload supporting files, and maintain context without leaving the environment. This dramatically reduces back-and-forth during close and forecast cycles.

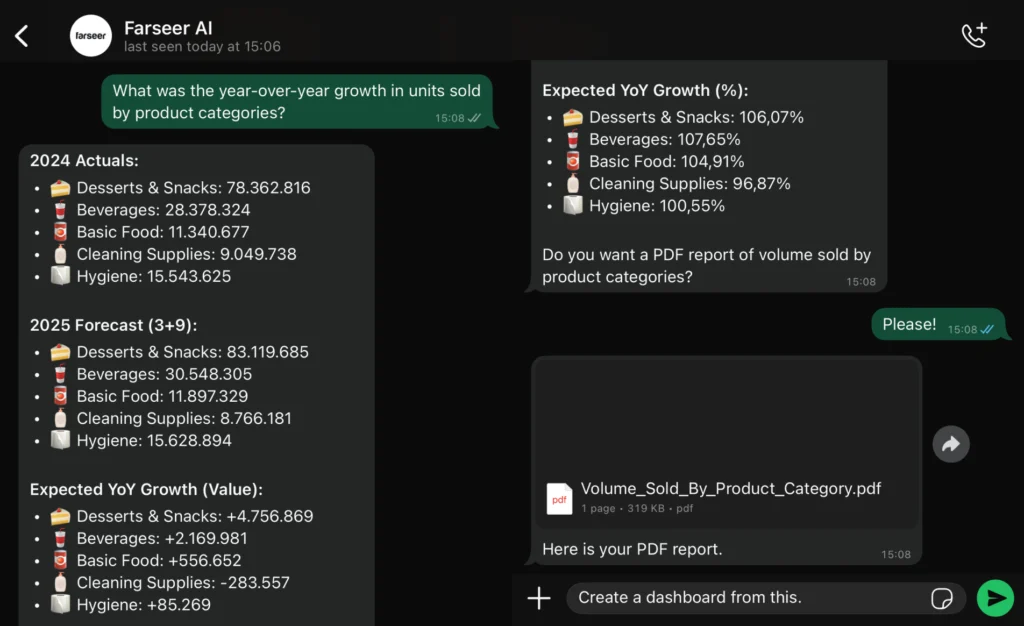

WhatsApp integration for instant updates

Farseer sends key alerts, approvals, and variance summaries directly through WhatsApp. Finance and business leaders receive updates instantly, without logging in, which accelerates reviews and shortens decision cycles.

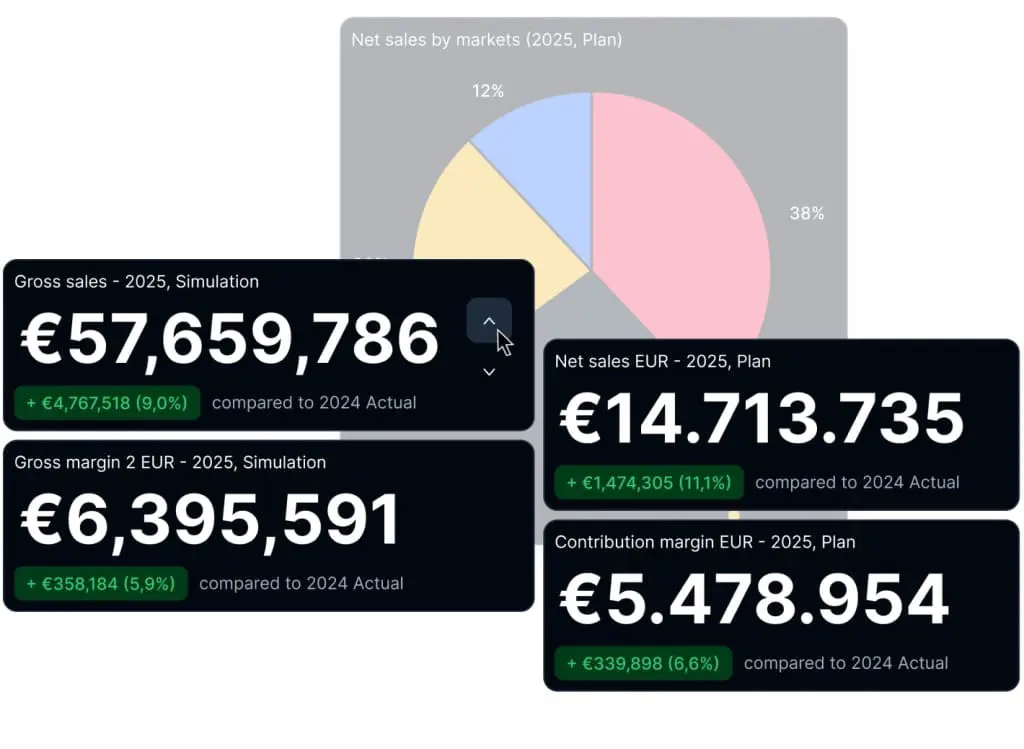

Real-time dashboards and rolling reporting

As data updates, dashboards and reports refresh automatically. CFOs and business leaders can monitor performance continuously instead of waiting for month-end or static exports.

What to look out for

Farseer delivers the most value for mid-market and upper-mid-market teams that want structure, governance, and unified modeling but do not need the deep custom modules or regulatory features of Oracle EPM Cloud.

2) Anaplan – Best for highly distributed modeling across global teams

Anaplan, one of oracle hyperion competitors, is a well-established alternative to Hyperion for companies with many contributors and decentralized planning. Its strength lies in the scale of its modeling engine and in the ability to build highly tailored planning structures.

Key features

- Large-scale connected planning engine

- Scenario modeling at business-unit and corporate level

- Strong workflow for distributed contributors

- Extensive ecosystem of prebuilt models

What to look out for

Anaplan’s flexibility also means its models can become complex very quickly. Most teams end up relying on specialized model builders to maintain logic, adjust structures, or fix performance issues. This limits how much the broader finance team can self-serve and raises the ongoing effort required to keep the environment running smoothly.

Costs can also escalate. Pricing grows with model size, data volume, and user roles, which often results in higher-than-expected annual spend for teams migrating from Hyperion. Integrations and data pipelines typically require additional tooling or IT support, so the total footprint is larger than it appears at first glance.

3) OneStream - tool for enterprise teams

OneStream is the closest direct successor to the full Oracle EPM stack. It unifies consolidation, planning, reporting, and analytics in a single platform, reducing the fragmentation that many Hyperion customers experience.

Key features

- Enterprise-grade consolidation with auditability

- Strong governance and controls for regulated industries

- Marketplace with additional modules (tax, capital, people planning)

- Unified data model for reporting and planning

What to look out for

OneStream is powerful, but implementation is rarely light. The platform assumes enterprise-scale processes, which means most projects require specialized consultants, defined governance structures, and a longer rollout than mid-market teams typically plan for. Smaller organizations often discover that the setup effort mirrors Hyperion more than they expected.

Ongoing ownership also tends to sit with technical administrators rather than finance. Customizations, workflow changes, and complex calculations usually need expert support, which adds cost and reduces day-to-day agility compared with more finance-owned platforms.

4) Workday Adaptive Planning – Best fit for companies already on Workday

Adaptive, one of oracle hyperion competitors, is a logical transition for organizations that rely heavily on Workday HR and financials. It provides consistent reporting structures and standard planning templates.

Key features

- Seamless connection with Workday HR (headcount, comp, org structures)

- Stable budgeting workflows

- Predefined reporting templates for enterprise teams

- Reliable governance

What to look out for

Adaptive delivers its strongest value only inside the Workday ecosystem. Once you introduce non-Workday ERPs or operational systems, integrations become dependent on middleware or custom connectors, which increases effort and reduces reliability. The modeling layer is also more rigid than Hyperion, so companies with complex revenue engines, operational drivers, or multi-entity structures often run into limitations faster than expected.

5) Planful – Best for replacing Hyperion in mid-size finance functions

Planful provides structured budgeting, consolidation, and reporting for teams that need an organized process without the modeling complexity of enterprise platforms.

Key features

- Prebuilt financial consolidation

- Standard reporting templates

- Workflow-driven budgeting cycles

- Integrations with major ERPs

What to look out for

Planful performs well when planning cycles are structured and repeatable, but it is less comfortable with complex operational models or non-standard revenue logic. Teams coming from Hyperion often find that Planful’s modeling depth is limited, which makes it harder to recreate advanced allocation rules, granular driver models, or industry-specific structures.

6) Vena – Best for companies that want Excel familiarity with central governance

Vena appeals to organizations that want to keep Excel as the front end while centralizing data structures and workflows. For teams with a strong spreadsheet culture, the learning curve is minimal.

Key features

- Excel-native interface with controlled data backbone

- Workflow management for budgeting and reporting cycles

- Version control and audit trails

- Template library for financial statements

What to look out for

Vena carries over many of Excel’s structural constraints. Large or complex models can become slow, and scaling across entities or business units requires careful discipline to avoid formula drift. Integrations outside the Microsoft ecosystem also demand more setup and maintenance. For organizations seeking a full Hyperion replacement with dynamic modeling and multi-entity complexity, Vena may not provide enough depth or robustness.

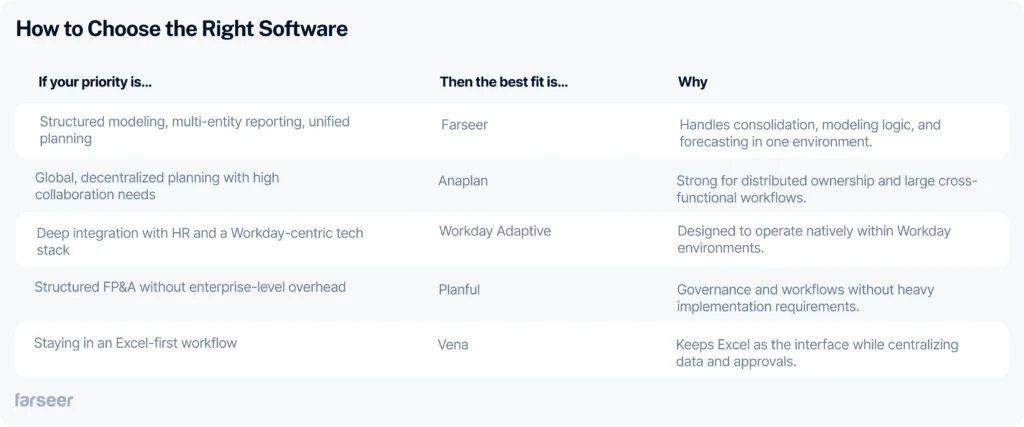

How to Choose the Right Hyperion Alternative

Selecting a Hyperion replacement is about operational fit and the realities of how your finance team works.

Conclusion

Replacing Hyperion is about choosing a platform that supports how finance operates now: faster cycles, more contributors, more complexity, and the expectation of continuous reporting.

Teams that transition successfully focus on the underlying data model, entity structure, and ownership before selecting a tool. Once that foundation is in place, the right platform becomes clear.

FP&A Tool Fit Quiz

Question 1

How complex is your organizational structure?

Question 2

How quickly do you need to implement an FP&A solution?

Question 3

What is your team’s technical profile?

Question 4

What is your primary planning priority?

Question 5

What is your expected FP&A budget?