Financial reporting automation isn’t about replacing people – it’s about ending the reporting chaos. Finance teams are still stuck in Excel purgatory: broken links, version mismatches, and late-night fire drills to get the numbers out. It’s not the people – it’s the process.

If you’re spending 10+ hours building reports and still don’t fully trust the output – this is for you.

Financial Reporting Automation won’t “disrupt” your role. But it will stop the madness of chasing numbers across 12 tabs, 4 systems, and a dozen emails.

Let’s break down what it actually fixes – and where teams still get it wrong.

Read: Finance Automation in 2026: Tools, Use Cases, and Real-World Strategy

What is financial reporting automation?

More and more finance teams are turning to automation to streamline reporting, reduce errors, and speed up monthly close. According to Farseer’s State of Finance 2026 report, 61% of finance leaders are already investing in automation and RPA to build smarter reporting systems.

As data flows from more systems and reporting requirements get stricter, automation is becoming not just a nice-to-have – but a must-have.

According to McKinsey, up to 25% of finance tasks will be automated by 2030 – with reporting, reconciliation, and month-end close among the first to go.

What financial reporting automation helps with

Financial reporting automation takes over the parts of your workflow that slow you down – without changing the way your team thinks. It connects directly to your ERP, CRM, and spreadsheets, pulls in the actuals, validates the data, and builds reports that follow the same logic every time.

The real win? You spend less time on repetitive manual tasks – and more on reviewing performance and making decisions. Closing runs faster. Errors drop. And when audit season hits, everything is tracked: clean, comparable, and traceable. This is especially important for statutory reporting workflows, where clean audit trails and consistent disclosures are non-negotiable.

AI handles the first pass. It flags anomalies, drafts variance commentary, and surfaces trends – so your team can focus on applying judgment, not prepping numbers.

The biggest advantage of Financial Reporting Automation isn’t just speed. It’s consistency – in data, in structure, and in the process itself.

For a deeper dive into financial reporting practices, check out: What Great Financial Reporting and Analytics Actually Look Like

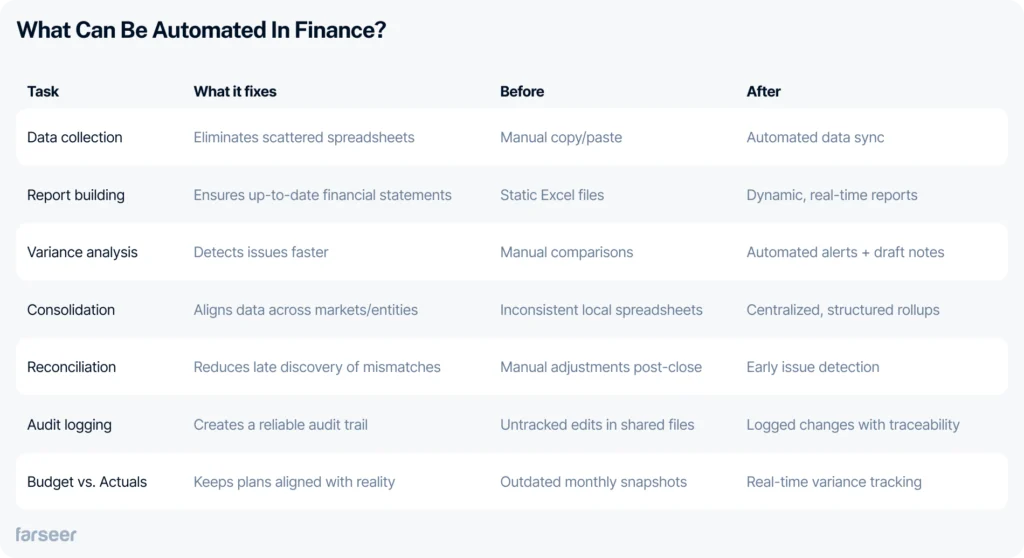

What can be automated in finance?

- Data collection

Connect your ERP, Excel sheets, CRM, and other systems – data flows in without manual copy/paste. You stop chasing numbers and start working with them. - Report building

P&L, balance sheet, cash flow reports – automated and always up-to-date. You spend less time formatting slides and more time understanding what’s changing. - Variance analysis

Automatically flags when actuals drift from budget or forecast. No more manual comparisons or “where did that delta come from?” detective work – something profitability analysis software can highlight even further. - Budget vs actuals comparisons

Budget refreshes as actuals come in. No one needs to wait three days for “the updated file.” - Reconciliation

Matches entries across systems (bank vs GL, AP vs payments, etc.) and surfaces mismatches. You get cleaner books without the month-end crunch. - Audit logging

Every edit, every version, every approval – logged and traceable. Makes audit prep fast instead of painful. - Consolidation

Combine reports from multiple departments or subsidiaries into one structured view – consolidated financial statements make this easier and more accurate.

These group-level reports only work if you’re posting the right consolidation entries – eliminating intercompany revenue, aligning charts of accounts, and recognizing non-controlling interest so the group is presented as one economic unit, not 12 disconnected companies.

Read more: What Are Consolidation Entries (and Why They Matter in Group Reporting)

Why financial reporting automation efforts fail

Most automation projects in finance don’t fail because of the tools – they fail because of structure.

Here’s what kills automation projects before they scale:

- Buried logic

Key formulas and reporting logic are hidden in individual Excel files. No one else fully understands how they work. - Data silos

Actuals come from multiple systems that aren’t properly integrated. Each department works in isolation. - No ownership

When something breaks, there’s no clear process or person responsible for fixing it. - Inconsistent KPI definitions

Margin, revenue, and other metrics are calculated differently across teams, making reports unreliable. - Single point of failure

If one person built and manages the reporting model, the entire process depends on them. If they leave, continuity is lost.

You can’t automate chaos. Without clear structure and shared ownership, automation just scales the confusion.

In some teams, automation means “let’s build macros on top of broken sheets.” In others, it’s “let’s copy everything into a BI tool and hope for the best.” Both approaches collapse under pressure – especially at month-end, when timelines are tight and leadership wants answers.

And it’s not just the tools. People resist change. If the team doesn’t get the process or trust the data, they’ll revert to old habits.

According to KPMG, the biggest barriers aren’t budget or software – they’re unclear priorities and lack of direction. That’s why successful financial reporting automation depends more on structure and ownership than tech alone.

Read: Top 10 Finance Automation Software for Enterprise FP&A in 2026

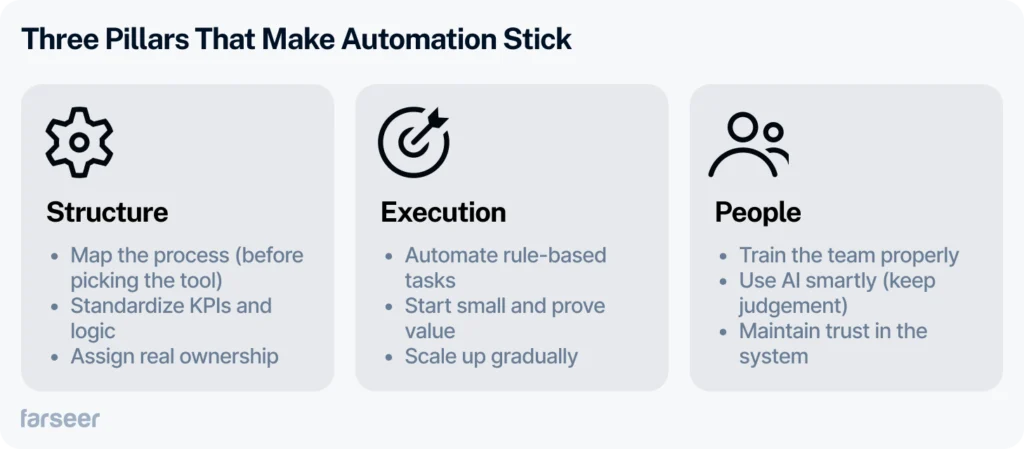

Best Practices That Make Automation Work

It’s not about buying better tools. It’s about fixing the structure, running a smart rollout, and getting your team on board. Here’s what separates projects that scale from those that quietly die after two cycles:

Structure: Fix the foundation first

Start with the process, not the tool: If you don’t know what’s broken, you’ll automate the wrong thing. Map out your reporting flow – where numbers come from, who touches them, and where delays happen.

Clean up your data structure: One product = one name. One margin formula = one version. If every department calculates KPIs differently, reports won’t align – automation or not. In the CPG industry, that means standardized SKU/pack naming and units (cases, packs, singles) across teams.

Assign real ownership: Who owns gross margin logic? Who updates mappings if they break? If your whole model depends on one Excel hero, it’s not automation – it’s a liability.

Execution: Start small, move smart

Automate what’s stable: Don’t start with your most volatile forecast. Begin with repetitive, rule-based stuff – actuals, reconciliations, simple P&Ls.

Keep it small at first: You don’t need a full-blown transformation right away. Prove value in one area first. Small wins build trust – and trust drives adoption.

People: Make sure your team is in

Train the team: People don’t trust systems they don’t understand. Show them how automation works, where the data comes from, and how to spot issues.

Use AI smartly: AI can flag odd variances or write a first draft of comments. But it can’t explain a sales drop or regulatory risk. Human judgment stays in charge.

Case study: How JGL cut market consolidation time in half

JGL, a major Croatian pharma company active in 60+ markets, used to rely on Excel for planning – leading to version conflicts, manual fixes, and long delays.

After switching to a centralized platform, they cut consolidation time by 50% and turned planning into a faster, collaborative process.

Here’s what changed:

- Reports refresh in real time – no more waiting for “final Excel files.”

- Market templates are standardized and version-proof.

- Scenario planning is instant, not an all-day task.

- Leadership gets clean, audit-ready numbers – fast.

Instead of troubleshooting broken spreadsheets, JGL now focuses on real planning. That’s what automation should look like.

Popular tools finance teams use for Financial Reporting Automation

Not all finance tools are built for automation – and not all automation tools are built for finance.

If you’re exploring financial reporting automation, cut down on manual work, and get a real planning workflow in place, these are the platforms FP&A teams use today:

Built for FP&A teams who’ve outgrown Excel, but don’t want to lose flexibility. Combines familiar spreadsheet logic with real automation: actuals flow in, reports update themselves, and teams collaborate across departments without copy/paste chaos.

Anaplan

Powerful modeling engine built for complex scenarios – but requires dedicated admins. Setup and maintenance aren’t for beginners, and flexibility comes with a steep price (both in time and budget).

Planful

Good fit for close management and budgeting. Strong ERP connections, but limited out-of-the-box reporting flexibility. You’ll need custom work to tailor it to FP&A needs.

If Planful is on your list, see how it stacks up in our guide to Planful competitors before you decide.

Familiar Excel-style interface makes onboarding easy. But under the hood, it still relies heavily on spreadsheets – which means scaling and version control can quickly become a problem.

For a deeper dive into what makes a great FP&A tool and how to choose the right one for your team, read: FP&A Software – A Practical Guide for Finance Teams

Key Takeaways

- Automation buys you time. No more copy/paste, broken formulas, or waiting for someone to send “the latest version.” Reports pull from source systems and build themselves.

- It doesn’t fix chaos. If your KPIs aren’t aligned and data lives in silos, automation just makes bad reporting faster.

- Start small. Automate what’s stable. Begin with P&Ls, reconciliations, or variance checks – not your most volatile forecast.

- AI is a co-pilot, not a decision-maker. It flags issues, suggests comments, and helps spot trends – you still own the judgment.

- Structure is the game-changer. JGL cut consolidation time by 50% by cleaning up their model and automating end-to-end – not just one report.