Finance is at the verge of monumental changes. And yes, it does sound as a cliche, but it’s also very much the truth. A slow, rigid and inflexible system just doesn’t work any more. The pressure of markets, speed of change and overall insecurity moved many financial teams to introduce much necessary changes to how they’ve been doing business.

To dig a bit deeper, we’ve talked to around 500 financial experts mainly from Europe to find out how they’ve been coping with modern day challenges, what kind of systems they use in their day to day work and what their thoughts are on the future.

Here’s what we’ve found out.

Download Report Here

About the Participants

Experienced finance leaders from across industries share how they’re navigating transformation.

- We interviewed 496 participants through our company survey and direct outreach

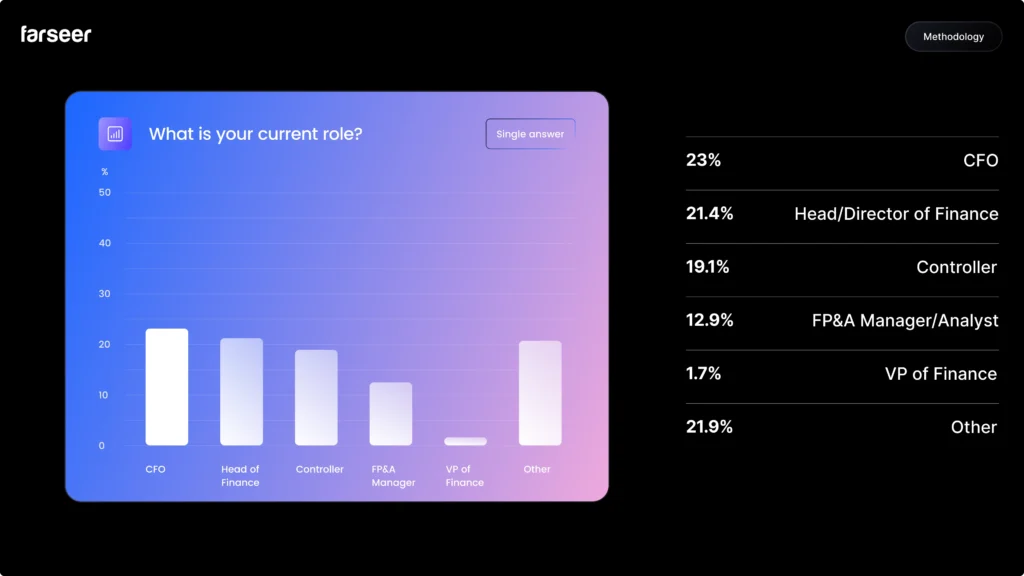

- Almost half of the participants are CFOs and Heads/Directors of Finance (44%), 19% are controllers and 13% are FP&A managers and analysts. Others include VP Finance, Consolidation Managers, and Finance Specialists.

These are the people who live in models every day, and who are demanding faster, more connected tools.

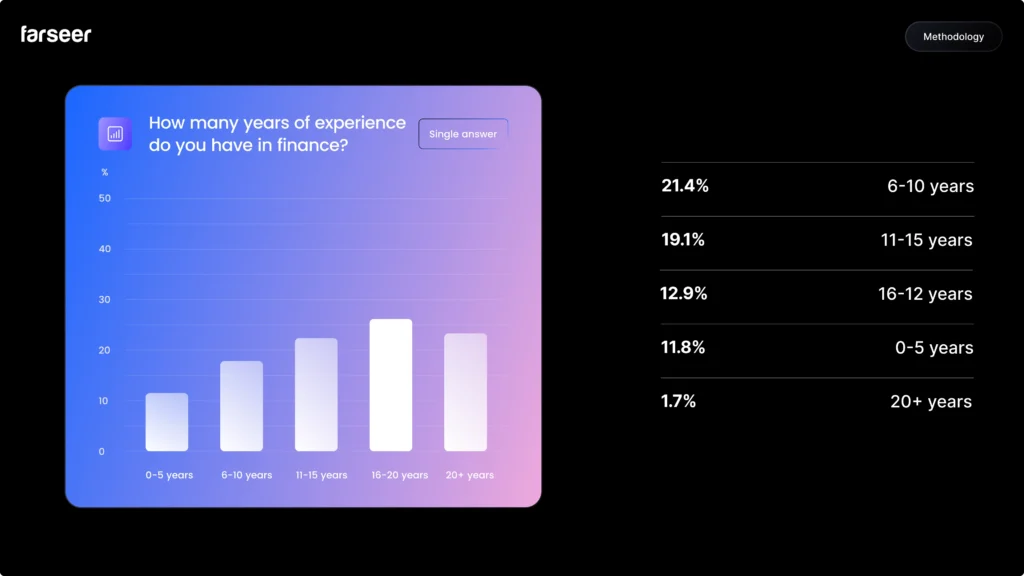

- 25% of participants have between 16-20 years of experience in finance, 23% have more than 20 years, 22% between 11 and 15, 18% between 6 and 10 and the remaining 12% have up to 5 years of experience in finance.

- Meaning – nearly 70% of respondents have over 10 years of experience in finance. These are not early adopters chasing trends. They’re veterans who’ve spent years in Excel, ERP silos, and manual consolidation cycles and are now leading the change toward smarter, automated planning.

“We’ve been doing this for decades. The tools are finally catching up.” – CFO, Manufacturing

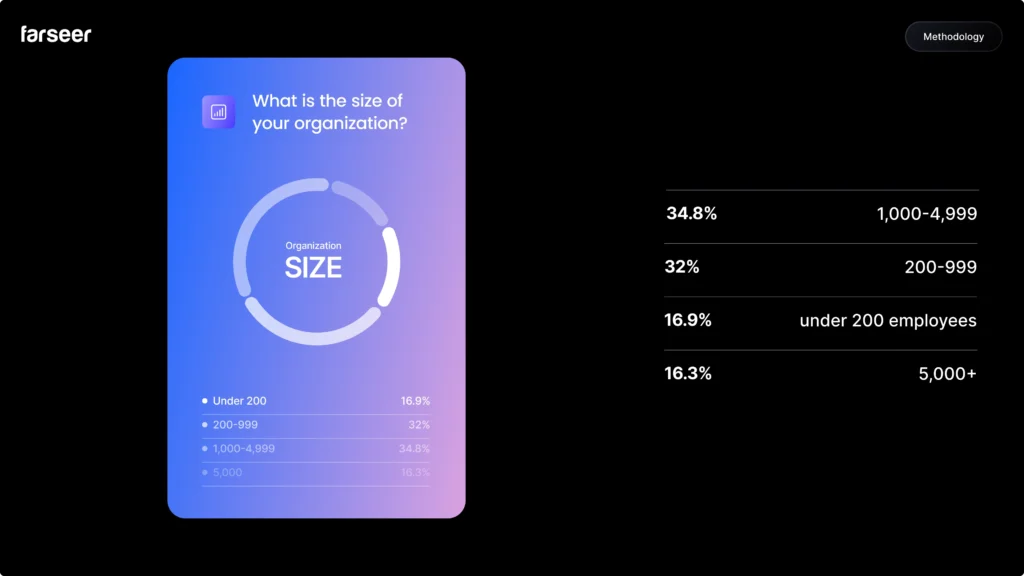

- The majority work in mid-sized to large enterprises (200-5000 employees) – exactly where complexity multiplies: multiple entities, currencies, markets, and reporting structures. That’s also where spreadsheet-based planning reaches its breaking point.

The State of Finance 2026 is written by experts who’ve lived through spreadsheet chaos, and are now building the next generation of connected planning.

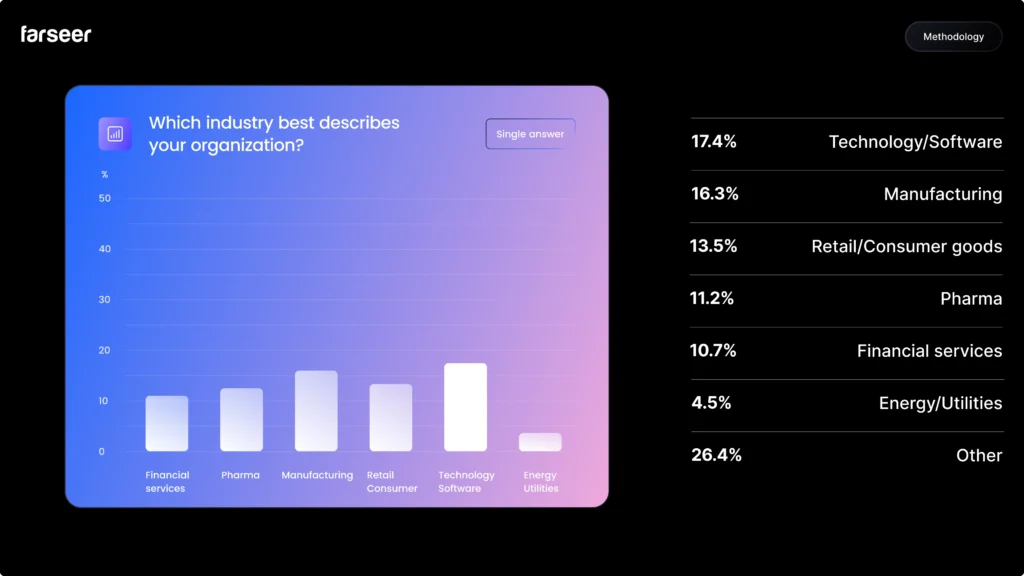

- When it comes to industries, 18% of participants work in technology/software, 16% in manufacturing, 14% in retail/consumer goods, 11% in pharma, 11% financial services and the rest of 30% are from industries like energy, utilities, and others.

Strategic Focus - Where Finance Is Headed

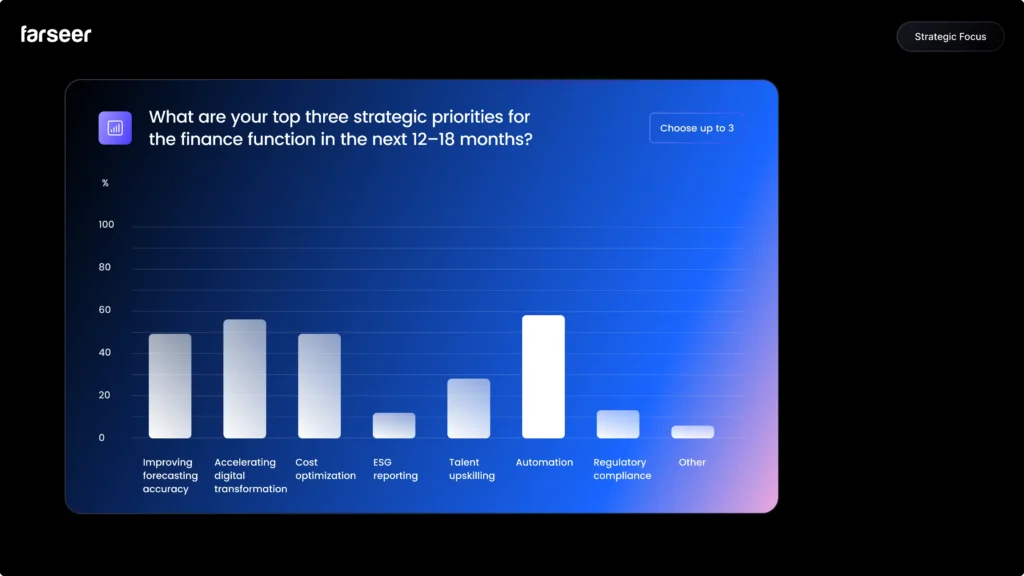

What are your top three strategic priorities for the finance function in the next 12–18 months?

Efficiency, intelligence, and control define the year ahead.

- Finance leaders in 2026 are focused on building smarter, more connected operations. Automation (58%) and digital transformation (56%) top the agenda, marking a shift from manual reporting to integrated, real-time planning. Alongside this, priorities like forecast accuracy (50%) and cost optimization (51%) reflect a market focused on resilience, predicting better, spending smarter, and reacting faster.

- Nearly a third of participants emphasize talent upskilling (29%), recognizing that technology alone isn’t enough without data-savvy people to drive it. Meanwhile, ESG reporting (11%) and regulatory compliance (13%) remain secondary as teams focus on modernizing their foundations before expanding into new frameworks. In short, finance is moving from efficiency toward intelligence, connecting data, people, and automation to plan with precision and speed.

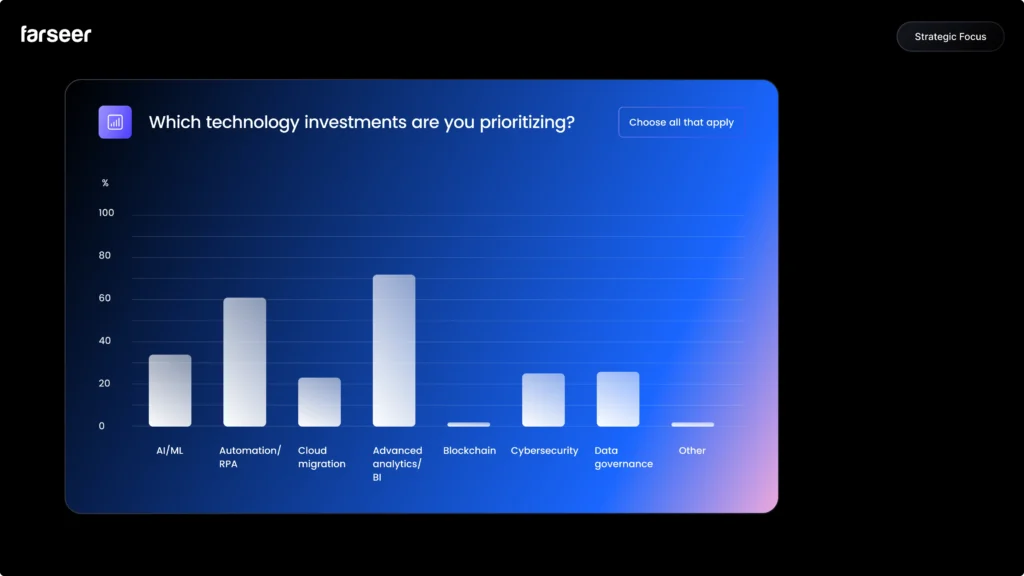

Which technology investments are you prioritizing?

Finance leaders double down on automation, analytics, and AI to build a smarter, more connected finance ecosystem.

- Finance teams in 2026 are investing where it matters most – in advanced analytics (72%), automation/RPA (61%), and AI/ML (33%), to turn data into decisions and speed into strategy. These priorities show that CFOs are focused on building an intelligent finance stack that combines automation for efficiency, analytics for visibility, and AI for predictive power.

- Supporting investments in data governance (27%), cloud migration (24%), and cybersecurity (26%) underline the shift toward scalable, secure, and connected systems. Rather than chasing hype, finance is making pragmatic moves, strengthening its digital core to achieve faster, smarter, and more reliable planning.

AI & Technology Adoption - How Digital Finance Is Evolving

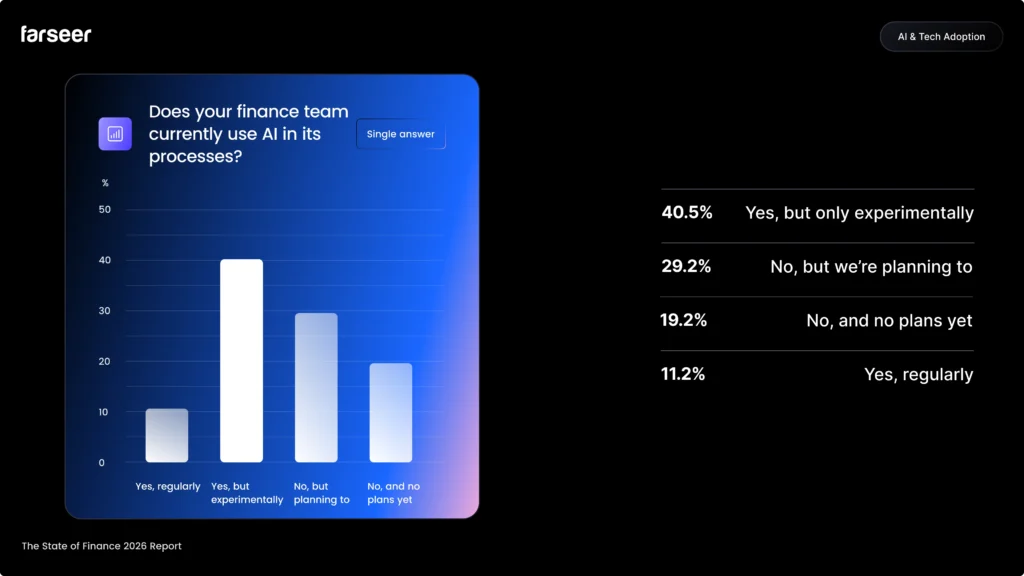

Does your finance team currently use AI in its processes?

Most finance teams are testing AI – few use it daily, but nearly all see its potential.

- Most finance teams are still in the early stages of adopting AI.

- According to the survey, 40% use AI experimentally, 29% plan to adopt it soon, 11% already use it regularly, and 19% have no plans yet.

- This means nearly 70% are either testing or preparing to integrate AI, signaling strong curiosity but cautious implementation.

Finance leaders see clear potential in predictive analytics and automation but want control and explainability before scaling usage, positioning AI as an assistant to finance, not a replacement.

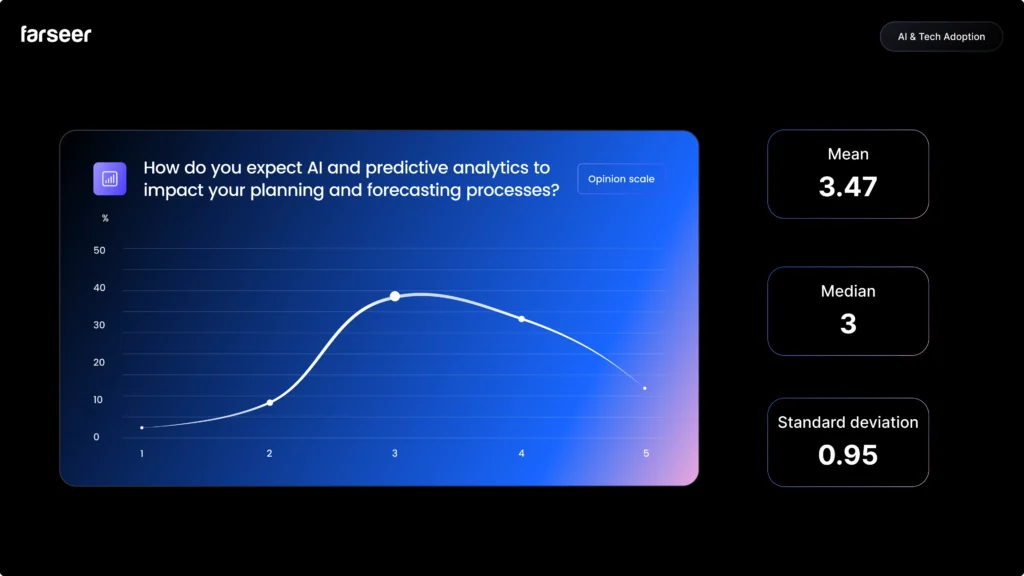

How do you expect AI and predictive analytics to impact your planning and forecasting processes?

Finance leaders see AI as a game-changer for accuracy, speed, and scenario agility in forecasting.

- Finance leaders expect AI and predictive analytics to have a strong, positive impact on planning and forecasting.

- Most respondents rated the impact between 4 and 5 on a 5-point scale, showing optimism that AI will significantly improve forecast accuracy, speed, and scenario modeling.

- Few expect little or no impact, suggesting that the finance function broadly views AI as transformative, not experimental, once data quality and trust barriers are addressed.

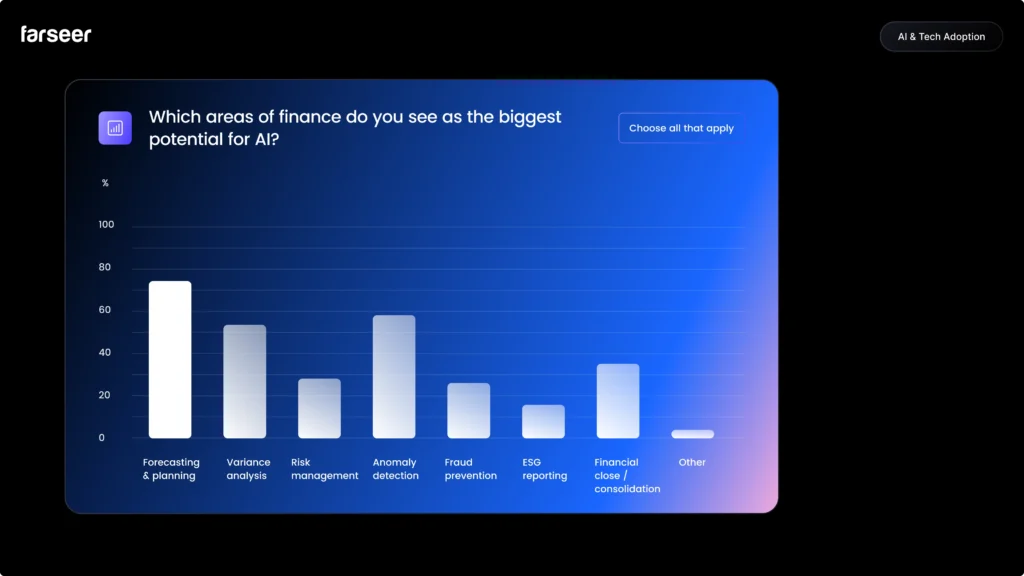

Which areas of finance do you see as the biggest potential for AI?

AI’s greatest promise lies in forecasting, analysis, and automation — the core engines of financial performance.

- Finance leaders see the biggest potential for AI in forecasting and planning (75%), followed by anomaly detection (57%), variance analysis (52%), and financial close/consolidation (37%).

- Smaller shares identified risk management (29%), fraud prevention (26%), and ESG reporting (16%) as key areas.

Overall, the focus is clear – most finance teams view AI as a way to enhance forecasting precision, automate analysis, and uncover insights faster, with compliance-related applications still secondary.

Read The Compliance Iceberg: Your Financial Models May Be Missing Billions in Risk

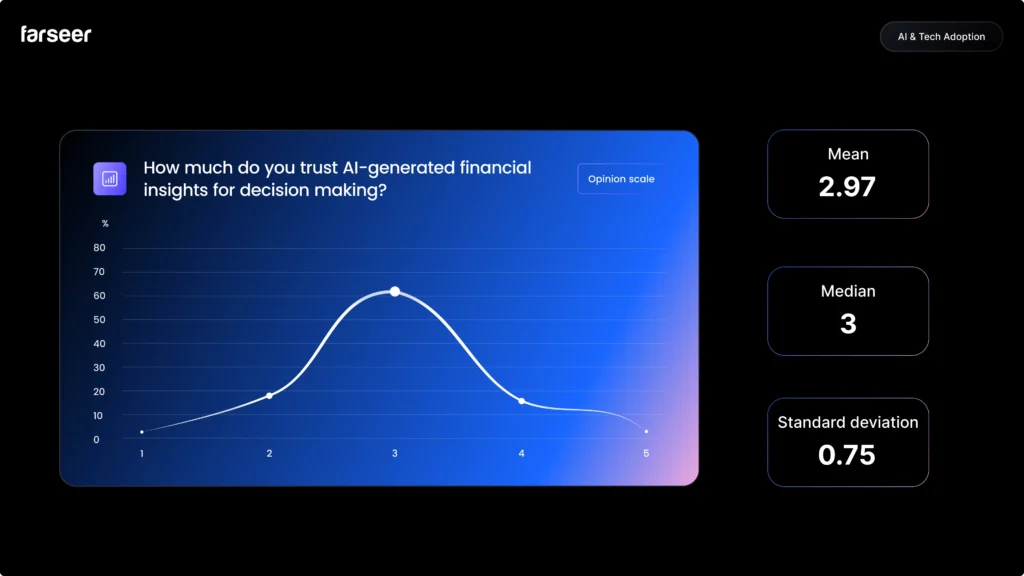

How much do you trust AI-generated financial insights for decision-making?

Finance leaders are cautiously optimistic: they trust AI insights, but only when they’re transparent and explainable.

- Finance professionals show moderate but growing trust in AI-generated insights, with an average rating of 3.0 out of 5.

- Most respondents fall in the “neutral to somewhat trusting” range, indicating cautious optimism – they see value in AI but want transparency and validation before relying on it fully.

In short, finance teams are open to AI-assisted decision-making, as long as it remains explainable, auditable, and under their control.

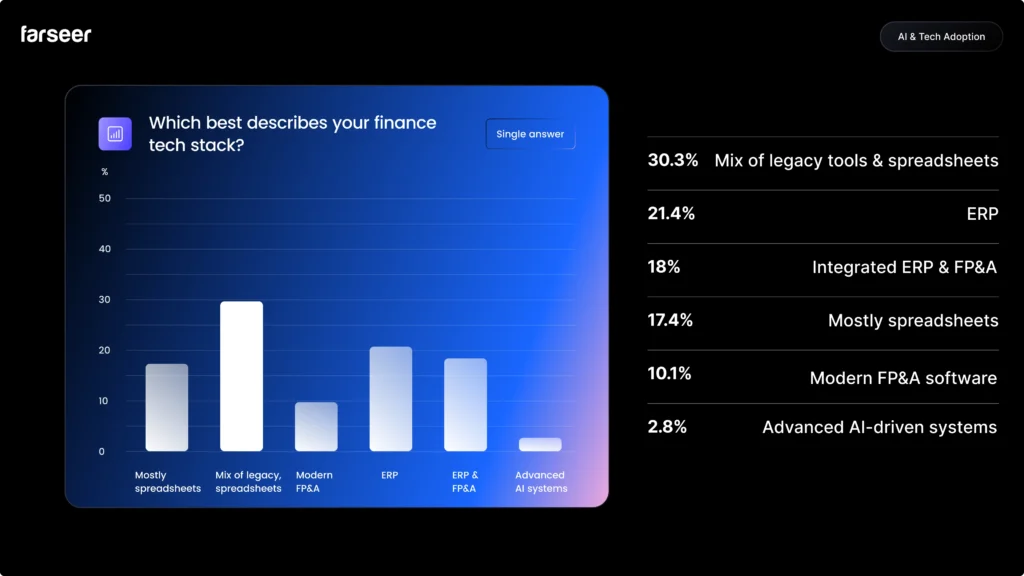

Which best describes your finance tech stack?

The results show that most finance teams still rely heavily on traditional tools.

- A majority describe their setup as a mix of legacy systems and spreadsheets (30%), 20% operate mostly in ERPs, while another 17% operate exclusively in spreadsheets

- Only 10% use modern FP&A software and 18% have integrated ERP and FP&A systems, with just 3% reporting advanced, AI-driven platforms.

This points to a clear maturity gap: finance functions are aware of digital transformation but remain constrained by fragmented, manual processes. Spreadsheets still dominate day-to-day planning, limiting agility, collaboration, and data consistency. The few who’ve adopted integrated or AI-powered stacks stand out as early movers, showing where the industry is heading: toward connected, automated, and insight-driven planning environments.

FP&A Process & Performance – How Finance Operates Today

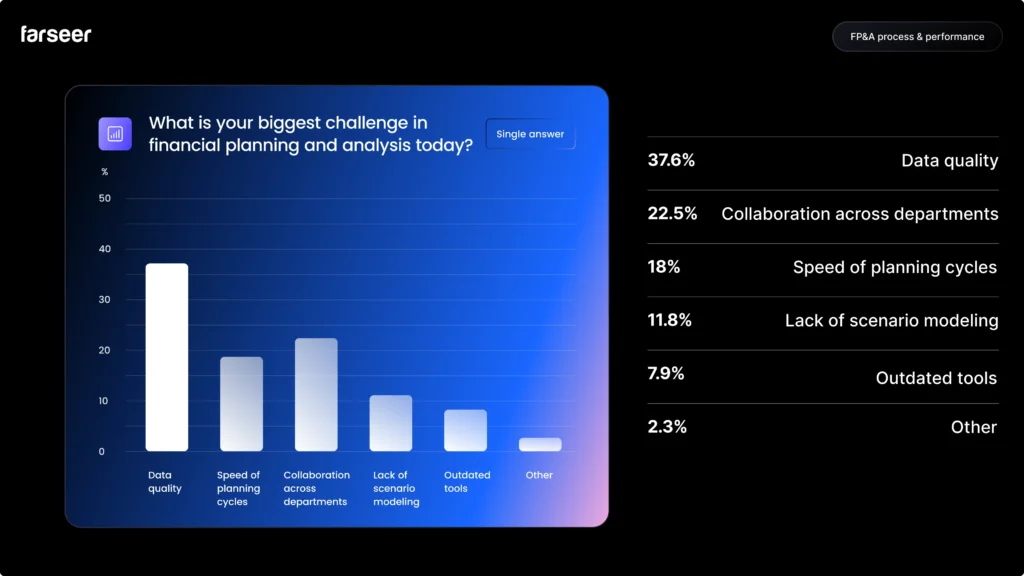

What is your biggest challenge in financial planning and analysis today?

Data quality and disconnected processes remain finance’s biggest roadblocks to faster, smarter planning.

- Finance teams report that their biggest challenges in FP&A are data quality (38%), cross-department collaboration (22%), and slow planning cycles (18%), followed by limited scenario modeling (12%) and outdated tools (8%).

The findings show that finance’s main pain point isn’t analysis itself, but the manual, fragmented processes behind it: unreliable data, disconnected systems, and delayed inputs.

In short, teams want to spend less time fixing data and more time using it to drive decisions.

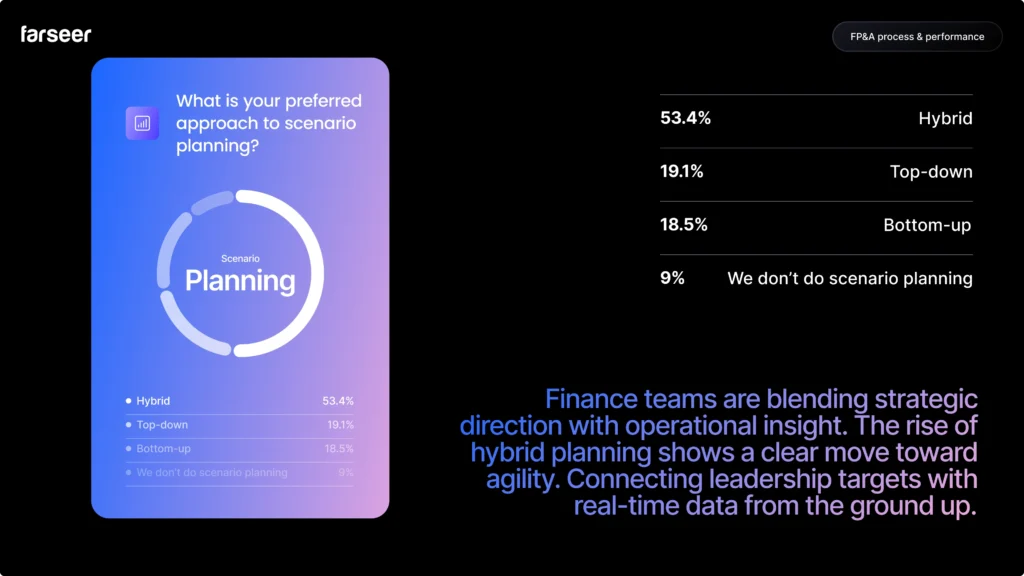

What is your preferred approach to scenario planning?

Hybrid scenario planning takes the lead – blending strategic direction with on-the-ground insight for greater agility.

- Most finance teams favor a hybrid approach to scenario planning (53%), combining top-down strategic guidance with bottom-up operational inputs.

- About 19% rely mainly on top-down planning, another 19% on bottom-up, while 9% admit they don’t do formal scenario planning at all.

This shows that finance leaders increasingly value collaborative, connected modeling, where local insights feed into corporate strategy, a key step toward agile, real-time planning.

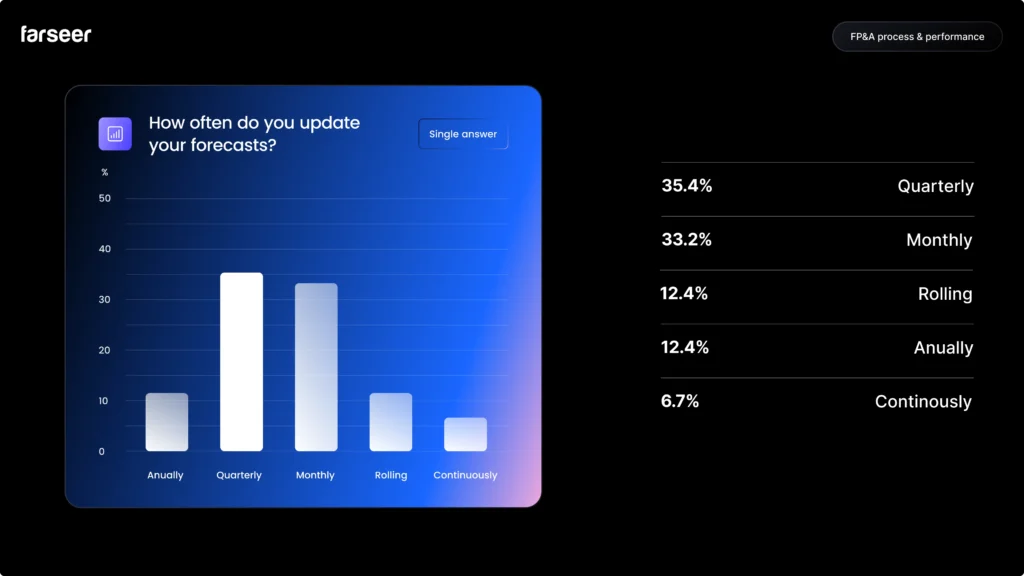

How often do you update your forecasts?

Quarterly and monthly cycles still dominate, but rolling and continuous forecasting are on the rise.

- Most finance teams still update their forecasts on a quarterly (36%) or monthly (33%) basis, while only 12% use rolling forecasts and another 12% plan annually. A small group (7%) operate continuously, updating forecasts in real time.

The data reveals that while many teams aspire to agility, most remain tied to traditional planning cycles – signaling both the opportunity and the need for more automated, connected forecasting processes.

text here

External Environment – What Pressures Finance Faces

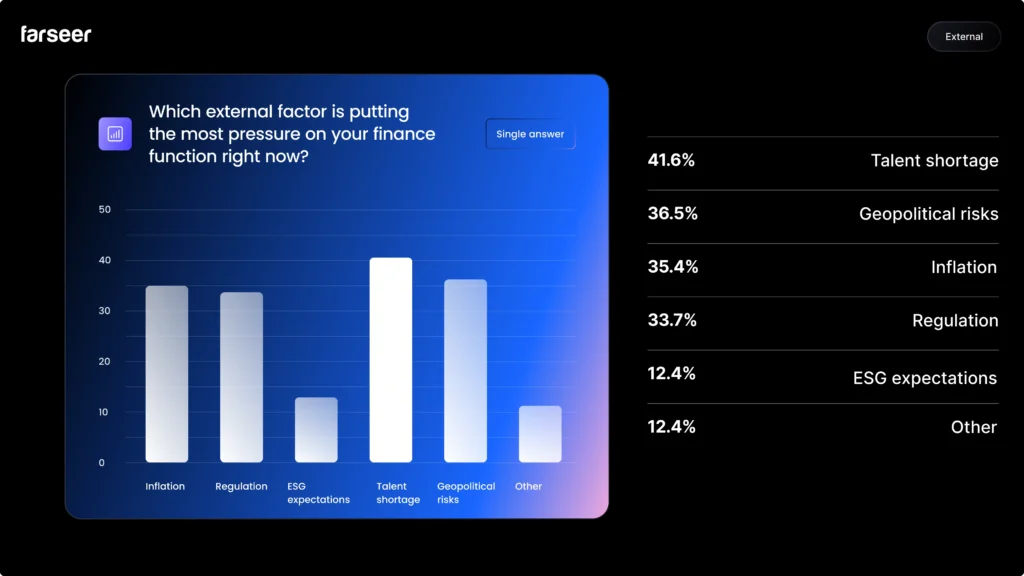

Which external factor is putting the most pressure on your finance function right now?

Inflation, regulation, and talent shortages top the list of external pressures reshaping finance priorities.

- Finance teams cite talent shortages (41%), geopolitical risks (37%) and inflation (36%) as the top external pressures, followed by geopolitical risks (36%), and ESG expectations (12%). Other answers which encompass 7% include market dynamics, new management, material price change, competition, change in consumer habits, FX movement, etc.

These results show that finance leaders are navigating a volatile environment where rising costs, tighter compliance demands, and workforce challenges strain both budgets and planning agility.

In response, many are prioritizing cost control, scenario modeling, and automation to stay resilient amid constant uncertainty.

If We Look at the Company Size…

Finance transformation looks very different depending on company size.

- Smaller teams (under 200 employees) still live mostly in spreadsheets, focusing on cost control and forecast accuracy, while mid-sized firms are in the modernization phase, layering automation and analytics over legacy tools.

- As organizations scale, complexity accelerates transformation: large and enterprise companies are investing heavily in integration, governance, and AI adoption, enabling more rolling forecasts, hybrid scenario planning, and cross-department collaboration.

- AI maturity rises steadily with size – from 42% adoption in small firms to nearly 80% in enterprises, along with growing trust and explainability requirements.

- Yet even at the top end, challenges persist: data quality and collaboration remain universal bottlenecks, only amplified by scale.

The trendline is unmistakable:

The bigger the organization, the more finance moves from manual control to connected intelligence.

The Big Picture

The data paints a clear picture of a finance function in transition: experienced leaders, modern ambitions, and legacy tools.

The majority of respondents are seasoned professionals (70% with 10+ years of experience) working in mid-to-large enterprises, and their priorities reflect both ambition and pragmatism. Automation (58%), digital transformation (56%), forecasting accuracy (50%), and cost optimization (51%) dominate the agenda, showing that finance is focused on efficiency and control in a volatile market.

At the same time, 72% are investing in advanced analytics and 61% in automation/RPA, signaling a clear shift toward connected, intelligent systems. Yet most teams still rely on spreadsheets or mixed legacy stacks (72%), and only a small fraction use integrated or AI-driven platforms — proof that transformation is underway, but uneven.

AI adoption reflects this gap: 70% are testing or planning to use AI, but trust remains moderate (3/5), and most see the biggest potential in forecasting, analysis, and anomaly detection — practical, high-impact areas rather than experimental ones. Meanwhile, data quality continues to be the top FP&A challenge (38%), highlighting why finance leaders are focusing on foundational improvements before scaling automation and AI.

Externally, inflation, regulation, and talent shortages are driving urgency, pushing teams toward rolling forecasting (12%), hybrid scenario planning (53%), and greater agility overall.

In short, finance leaders know where they’re heading — toward connected data, automated workflows, and predictive insight — but the journey is still in progress. The opportunity lies in closing the gap between ambition and execution. The finance function of tomorrow will belong to those who can combine control with speed, automation with trust, and strategy with real-time visibility.