Farseer has raised $7.2 million in Series A funding led by Aymo Ventures, with participation from SQ Capital and Apertu Capital. The round funds the next phase of the product and scales what we built in the region into a global platform for enterprise finance teams ready to move beyond spreadsheet glue.

Why this matters

Spreadsheets still sit between systems, teams, and definitions. That layer works until it becomes the reason finance cannot move fast. Budgeting, reforecasting, and board packs turn into stitching exports, maintaining mapping tables, and chasing “final final” files.

The spreadsheet is still the operating system of corporate finance

Actuals live in ERP. Plans live in Excel. Reporting lives across BI dashboards, exports, and copied workbooks. The moment you need one view across entities, departments, scenarios, and time, you patch the stack with spreadsheets.

The outcomes are consistent. Cycles slow down. Versions multiply. Logic hides. Scenario analysis stays shallow because it is slow to run and slow to align. Finance spends more time preparing numbers than using them.

The problem is infrastructure, not features

Templates, dashboards, and integrations help, but they do not fix the bottleneck. Finance needs a governed, fast, model driven system that connects data, definitions, and workflows in one place.

Spreadsheets are not infrastructure. They do not give consistent definitions at scale, predictable governance, reliable traceability, or performance under enterprise load.

What we are building

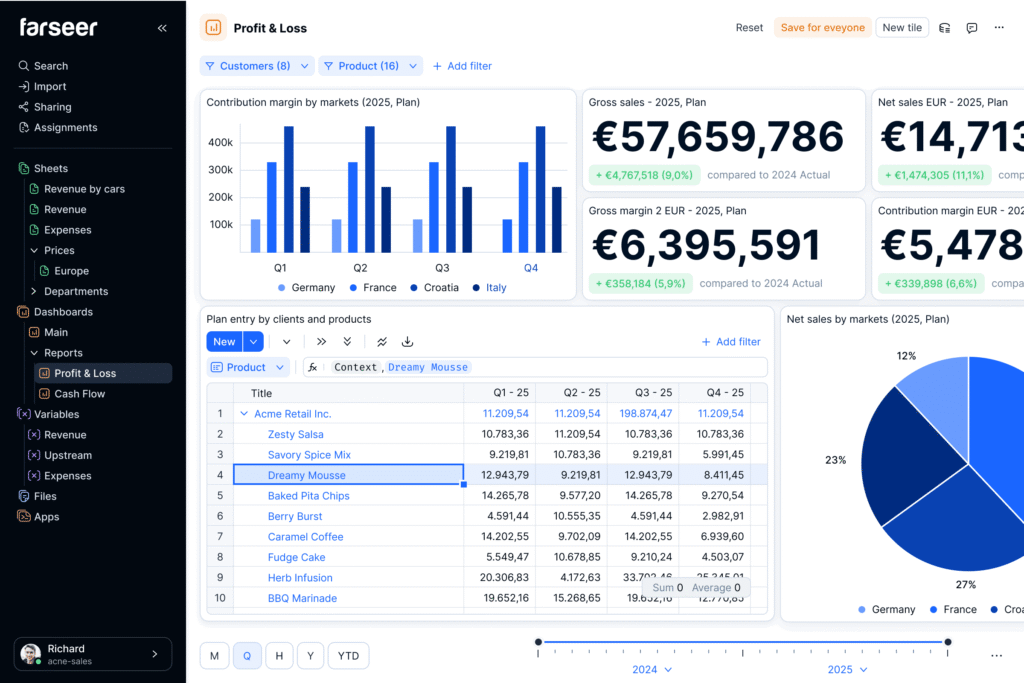

Farseer replaces spreadsheet glue with one system built for corporate finance. Plans and actuals live in one place. Calculations are defined once and trusted everywhere. When something changes, the model updates instantly and the change is traceable.

Under the hood, we built our own calculation engine, Rama, because speed and correctness are non negotiables in finance. At the core is Rama DB, an analytical database designed for interactivity and large, multidimensional financial models in real time.

One set of definitions for planning, reporting, and AI

Most finance stacks stitch together a warehouse, BI, FP&A tools, and spreadsheets. That creates duplicated logic and drifting definitions.

We are building one platform where planning, reporting, and analytics run on the same definitions. That is how meetings move from debating numbers to making decisions.

AI only works in finance when it runs inside governance. That is why we embed AI into workflows on governed data and a real model. It can explain what changed, support variance commentary, and simulate scenarios on the same engine and definitions. This also sets up future agents inside finance workflows, with context and guardrails.

From the region to Western Europe and the United States

In Croatia, customers include JGL, Hrvatski Telekom, Violeta, and CIOS, plus many others. Overall, we have more than 60 customers. We are growing in Western Europe and have closed our first customers in the United States.

Enterprise environments are unforgiving. If the platform is slow, fragile, or hard to explain, trust disappears fast. The real proof is what happens after go live. When teams see value, scope expands. More models get added. More teams adopt the same operating system.

What this Series A enables

We are accelerating product development, deepening the engine, and investing heavily in AI across the platform, while keeping governance, traceability, and explainability non negotiables.

The ambition is clear. Make Farseer the standard infrastructure for corporate finance. Finance should not run on spreadsheets. It should run on a real operating system.