CFOs know the pain: long planning cycles, Excel errors, and forecasts that are outdated before the board even sees them. Markets move fast, but finance often moves slow.

According to PwC, 74% of CFOs are changing their capital spending strategies in response to economic uncertainty – a clear signal that rigid annual budgeting isn’t enough. Finance leaders need flexible capital planning to adapt, while still relying on capital budgeting to evaluate project-level returns.

In this blog, we’ll cut through the noise and show what sets capital planning apart from capital budgeting, where most teams struggle, and how modern FP&A platforms bring the two together in one workflow.

Read more: Strategic Financial Planning That Actually Drives Results

Capital Planning vs. Capital Budgeting: Key Differences

Let’s make this simple. Capital planning vs capital budgeting is not a matter of choosing one over the other – they serve different purposes but work best together.

Capital planning is the big picture. It’s about setting long-term priorities – which areas of the business deserve investment and how resources will be allocated over the next 5–10 years. The goal is to make sure every big move supports the company’s overall strategy. Think of it as the roadmap.

Capital budgeting, on the other hand, is project-level. It’s where finance evaluates a specific investment: should we build the new plant, upgrade the system, or buy the equipment? That’s where metrics like ROI, NPV, and IRR come in. Think of it as the due diligence before you write the check.

Both are essential. Planning without budgeting is just wishful thinking. Budgeting without planning means you might pick profitable projects that don’t actually move the business forward.

Read more: Best Capital Budgeting Software: Tools That Go Beyond Approvals

Key differences in plain language:

Time horizon: Planning looks years ahead; budgeting looks at the next project.

- Scope: Planning = portfolio and strategy; budgeting = individual investments.

- Output: Planning sets the priorities; budgeting decides which projects get funded.

- Tools: Planning relies on scenarios and resource allocation; budgeting leans on ROI, NPV, and IRR.

For CFOs, the trick isn’t choosing one over the other. It’s making sure capital planning and capital budgeting work together – and that’s where most teams hit a wall when they’re stuck in Excel silos.

Read more. 5 Strategies for Smarter Corporate Financial Planning

Common Challenges

On paper, capital planning vs capital budgeting sound straightforward. In reality, most finance teams are stuck fighting the same problems every cycle. Plans take too long, forecasts lose relevance, and strategy often gets lost somewhere between PowerPoint decks and Excel sheets.

Here are the most common challenges finance leaders point to – and why they matter:

Forecasts go stale

By the time leadership sees the numbers, market conditions have already shifted. This makes capital allocation reactive instead of proactive.

Spreadsheet inconsistency

Each department runs its own file, consolidation takes days, and no one trusts which version is correct. Decisions stall because nobody is sure which numbers to believe.

Manual workflows

Endless copy-pasting, formatting, and formula checking turn budgeting into a slow, error-prone process. Teams spend more time preparing numbers than analyzing them.

No scenario planning

Most organizations work with a single plan. When prices, FX rates, or demand changes, the entire model collapses – and finance scrambles to rebuild from scratch.

Disconnected processes

Capital planning often lives in PowerPoints while budgeting lives in spreadsheets. Without a single connected process, projects that look profitable on paper might not support long-term goals.

These challenges are common, but not inevitable. In the next section we’ll look at how modern FP&A teams are solving them in practice.

Read more: 6 Budgeting Challenges (+ Fixes) Finance Teams Experience Today

Modern FP&A Approach

In many companies, capital planning and capital budgeting run on separate tracks. Strategy gets presented in slides, while the numbers live in spreadsheets. Finance spends weeks trying to reconcile the two, and by the time plans reach leadership, they’re already outdated.

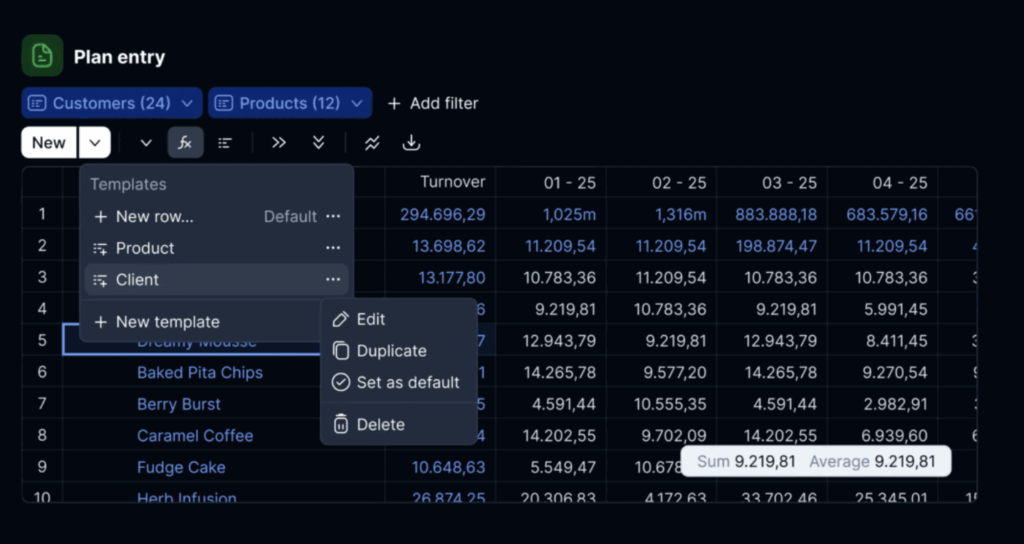

A better approach is to run budget planning and forecasting, reporting, and analysis as one connected process. That’s where modern FP&A platforms like Farseer help – giving finance a way to move faster, reduce errors, and keep strategy tied directly to execution.

Read more: Why Finance Teams Are Moving to Continuous Budgeting

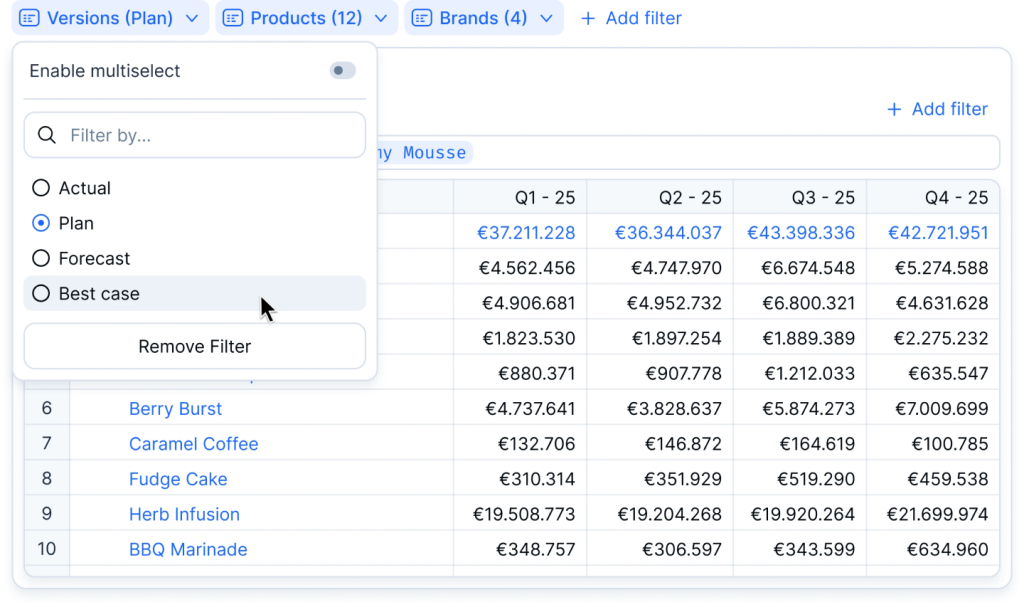

Scenario planning

Relying on a single plan is risky. Markets move fast – prices shift, currencies swing, demand changes. Instead of rebuilding models from scratch, finance teams in Farseer create best, base, and worst-case scenarios side by side and see the impact flow through three statements (P&L, Balance Sheet, Cash Flow).

This makes it easier for leadership to weigh trade-offs and choose the right path with confidence. For example, Hrvatski Telekom cut their forecasting cycle from 10 days to just 2 by working this way.

Live forecasts

Nobody wants to present numbers they already know are outdated. Farseer keeps forecasts live by updating as assumptions and data change. Teams can react quickly to new information and explain not just what changed, but why. That shifts boardroom conversations toward forward-looking decisions, instead of defending old numbers.

Consistent data

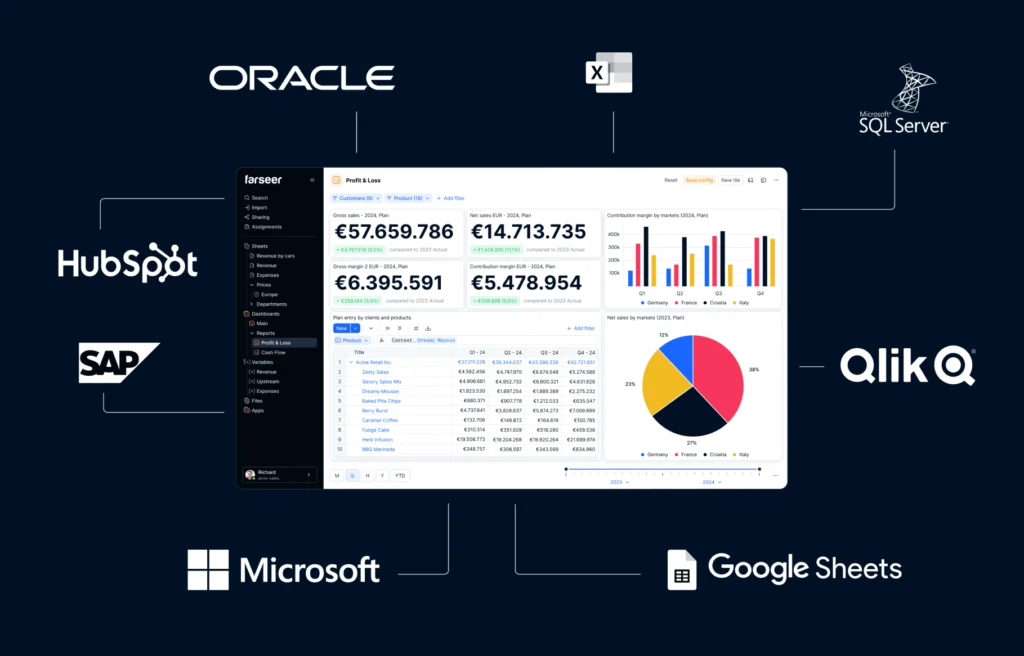

Departments working in separate spreadsheets inevitably end up with conflicting figures. In Farseer, data flows directly from ERP, CRM, and BI systems into live dashboards. Actuals and plans stay aligned, removing the need for manual reconciliations. This also builds trust across departments, since everyone is working with the same up-to-date information.

Finance in control

In many legacy systems, finance depends on IT or external consultants to update drivers or add scenarios. With Farseer’s no-code modeling approach, finance teams can make adjustments themselves. That independence speeds up decision-making and reduces costs. Altium, for example, reduced reporting time by 30% and shortened planning cycles by 25% once they gained that flexibility.

When planning and budgeting run together instead of apart, finance teams spend less time fixing spreadsheets and more time shaping decisions. The result is fewer surprises, faster reactions, and a clearer link between strategy and execution.

How EOS Matrix Cut Planning Steps by 50%

When planning and budgeting live in spreadsheets, even strong finance teams end up buried in mechanics instead of insights.

That was the reality at EOS Matrix Croatia, the country’s leading receivables management company. Their controlling team had to consolidate fragmented Excel files across multiple entities, perform endless manual checks, and race against deadlines each cycle. Reports got delivered, but only after long hours and with constant risk of error.

With Farseer, that changed.

- 50% fewer planning steps – cutting cycle times in half

- Automated P&L reports – no more manual builds

- More time for analysis – controllers could finally focus on insights, not spreadsheets

Key takeaways on capital planning vs capital budgeting:

- Capital planning and capital budgeting are not the same. Planning sets the long-term roadmap; budgeting decides which projects actually get funded.

- Both are critical. Without planning, budgeting is just chasing ROI. Without budgeting, planning is wishful thinking.

- Excel silos and manual workflows slow finance down. Forecasts go stale, numbers don’t align, and strategy gets lost in the process.

- Modern FP&A brings planning and budgeting together. With Farseer, teams get live forecasts, side-by-side scenarios, and one version of the truth.

- Real results are already proven. Hrvatski Telekom cut forecasting from 10 to 2 days, Altium shortened planning cycles by 25%, and EOS Matrix cut planning steps in half.