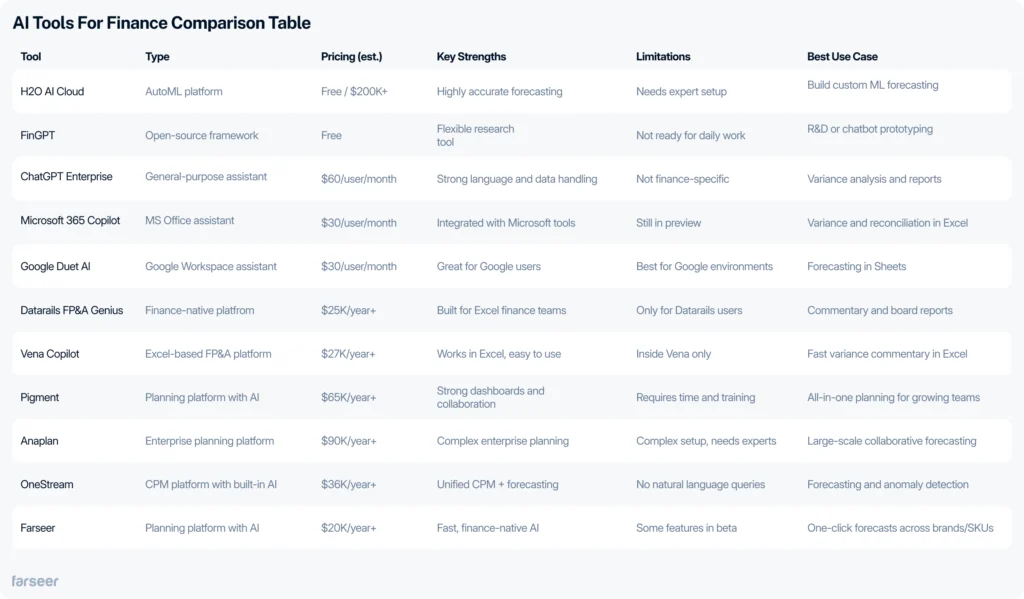

Every week, a new tool shows up claiming to be the best AI for finance. Often, they’re built fast, aimed at individual users, and disappear just as quickly. The truth is, the market’s flooded, and for finance teams in larger companies, that’s not helpful. Instead, it’s distracting.

After all, you can’t experiment with random tools when you’re dealing with sensitive financial data, structured workflows, and tight reporting cycles. You need something that works with your existing processes, fits into your security standards, and actually helps get work done faster, without introducing risk.

Read: Finance Automation in 2026: Tools, Use Cases, and Real-World Strategy

This guide keeps things practical.

We’ve selected 11 tools that are already in use by finance teams, not just in theory, but inside real FP&A environments. These tools help with forecasting, variance analysis, planning, and reporting, and they scale.

To make things easier, we grouped them by how they fit into your stack: open-source, affordable copilots, finance-native platforms, and full enterprise solutions.

Build-Your-Own AI: Open and Flexible Tools for Finance

Some finance teams don’t want off-the-shelf tools. They want control. That means building their own solutions using open platforms. These tools give you the flexibility to train models, connect them to your data, and decide exactly how they work. But they also take time and technical skill.

They don’t come with dashboards or ready-made workflows. You need a data team or someone in finance systems who knows how to work with machine learning. That makes them a better fit for larger companies with resources to support them.

In this section, we’ll cover one open platform that’s already used in production and briefly mention another that’s still experimental.

H2O AI Cloud

Type: AutoML platform with open-source and enterprise options

Pricing: Free (open-source) or around $200K/year (enterprise version)

What it is

H2O AI Cloud is a platform for teams that want to build their own forecasting models. It includes automated machine learning tools, supports on-prem or cloud deployment, and works well if you have data science or finance systems support. It’s not a finance product, but you can use it to automate parts of your forecasting and variance analysis.

Key AI Features for FP&A

- AutoML for time series forecasting

- Scenario modeling by adjusting input drivers

- Anomaly detection to flag outliers

- Model explanations with clear outputs and documentation

Practical FP&A Use Case

A finance team loads actuals into H2O, trains a forecast model, and tests a scenario where revenue drops 10%. The model shows the expected impact and explains what’s driving it. If results change during the quarter, anomaly detection highlights the issue for review.

Strengths

- Accurate forecasts

- Scales across teams

- Built-in explainability

Limitations

- Needs expert setup and training

- Not connected to Excel or finance tools

- Enterprise version is expensive

Also worth mentioning

Some companies are testing FinGPT, an open-source framework for building finance-focused AI tools. It’s not something you can use out of the box. You need a data team to train the model and connect it to your own data. Most teams use it for research or to test ideas like finance chatbots or automated commentary. It’s not a fit for daily FP&A work, but it may be useful in internal R&D projects.

Best AI for Finance if You’re Not Ready for Full Enterprise Tools

These tools weren’t built just for finance, but they’ve quickly become useful to finance teams. You can use them to write commentary, clean up spreadsheets, generate formulas, or summarize reports. They don’t require a full rollout or major setup, and most teams can start using them right away.

They’re a good fit for companies still working in Excel or Google Sheets that want to reduce manual work without buying a full planning system.

In this section, we’ll cover three general-purpose tools that offer strong value for finance use.

ChatGPT Enterprise (OpenAI)

Type: General-purpose AI assistant

Pricing: Around $60/user/month, (150+ user minimum)

What it is

ChatGPT Enterprise is the business version of OpenAI’s GPT-4 assistant. It’s built for large teams and includes enterprise-grade security, admin controls, and a 32k token context window for handling large documents or complex prompts. It doesn’t train on your data and supports uploads like Excel, CSV, and PDF. While it’s not made for finance, teams use it for commentary, analysis, and automation across FP&A workflows.

Key AI Features for FP&A

- Advanced Data Analysis: uploads CSVs, performs calculations, builds charts

- Natural language Q&A over structured data

- Excel formula writing and data cleaning

- Python support for more advanced use cases

- Long-context answers for board decks or multi-tab workbook

Practical FP&A Use Case

A finance analyst uploads a CSV of actuals and budget. ChatGPT calculates variances by business unit, explains key drivers, and drafts a full commentary for the monthly report.

Strengths

- Works across text, numbers, and code

- Built-in data privacy and admin controls

- Handles large and complex inputs

Limitations

- Not built for finance workflows

- Doesn’t know your data unless uploaded or integrated

- Needs fact-checking to avoid errors in logic or math

Microsoft 365 Copilot (with Copilot for Finance)

Type: General-purpose AI assistant with finance-focused features

Pricing: $30/user/month for Microsoft 365 Copilot. Copilot for Finance is still in preview

What it is

Microsoft 365 Copilot brings GPT-4 into Excel, Outlook, Word, PowerPoint, and Teams. It works across the tools finance teams already use and connects to company data through Microsoft Graph. The finance version, called Copilot for Finance, helps with tasks like variance analysis, reconciliation, and reporting. It’s still in preview, but already useful.

Key AI Features for FP&A

- Ask Excel why a number changed and get an instant explanation

- Reconcile numbers between spreadsheets and source systems

- Draft emails to budget owners with live data

- Build PowerPoint slides directly from Excel

- Built-in prompts for common finance tasks

Practical FP&A Use Case

A planner asks why actual spend is over budget. Copilot reads the Excel file, finds the issue, and writes a short explanation that can go into a report or email.

Strengths

- Works inside Microsoft tools your team already uses

- Built for real finance workflows

- Follows company security settings

Limitations

- Still in preview, not all features are available

- Best for teams already working in Microsoft 365

- Needs review, like any other AI tool

Google Duet AI (Workspace)

Type: General-purpose AI assistant for Google Workspace

Pricing: Around $30/user/month (Workspace add-on)

What it is

Google Duet AI works inside Google Sheets, Docs, Slides, and Gmail. It helps finance teams write formulas, build presentations, summarize reports, and draft emails. It runs on Google’s PaLM 2 model and fits best in companies already using Google Workspace. For more technical teams, Duet also supports SQL generation in BigQuery for deeper analysis.

Key AI Features for FP&A

- Writes and explains formulas in Sheets

- Summarizes Docs and long reports

- Answers questions like “What’s the revenue trend?” in Sheets

- Drafts presentations from spreadsheet data

- Generates SQL queries for BigQuery

- Translates reports for global teams

Practical FP&A Use Case

A controller uses Sheets to forecast next quarter’s revenue. Duet writes the formula, explains the logic, and adds a chart. The results are dropped into Slides for a leadership update.

Strengths

- Fast for spreadsheet, document, and email tasks

- Built for teams already in Google Workspace

- Good support for global teams and languages

Limitations

- Not tuned for finance workflows

- No native ERP or BI integrations

- Less useful in Microsoft-based environments

Best AI for Finance Tools Built Around FP&A Workflows

These tools add AI into everyday FP&A work like variance analysis, forecasting, and report writing. They’re built for finance teams and follow the structure and logic of real planning processes. Everyday we see some new ai trends.

Most connect straight to Excel or your planning model. You don’t have to prompt them like a chatbot. They already know what a forecast looks like and how to explain changes in the numbers.

They’re a strong fit if your team wants to speed up existing workflows.

Read: Top 10 Finance Automation Software for Enterprise FP&A in 2026

Datarails FP&A Genius

Type: Finance-native AI assistant built into FP&A software

Pricing: Starts around $25,000 per year. Custom pricing based on users and features

What it is

Datarails is a planning and reporting platform designed for Excel-based finance teams. It pulls data from your spreadsheets and systems into a single model, so everything stays aligned. FP&A Genius is its built-in AI assistant. It lets you ask questions about your data in plain English and get instant answers, reports, or commentary.

Key AI Features for FP&A

- Answers questions like “Why did margin drop in Q2?”

- Writes report commentary with source data

- Explains variances across time or departments

- Generates board-ready PDFs with visuals

- Pulls real numbers from your model, not guesses

Practical FP&A Use Case

A controller asks why gross margin dropped last month. FP&A Genius checks the actuals, finds the drop in product margins, and explains the cause with text and charts. The user turns it into a PDF and sends it to the CFO.

Strengths

- Built for finance, not adapted to it

- Answers come from your real data

- Easy to use inside Excel

Limitations

- Only available to Datarails customers

- Needs good data quality to be effective

- Some edge cases still need human review

Vena Copilot

Type: FP&A AI assistant built into an Excel-based platform

Pricing: Starts around $27,000 per year. Custom pricing based on users and features

What it is

Vena is a planning and reporting platform that keeps your spreadsheets but connects them into one structured model. Vena Copilot is its AI assistant. It helps with variance analysis, forecast updates, and commentary, all inside Excel.

Key AI Features for FP&A

- Writes variance explanations in plain English

- Drafts report commentary using real data

- Helps update forecasts and scenarios

- Works directly in Excel templates

- Learns your model structure over time

Practical FP&A Use Case

A planner updates actuals in the monthly report. Copilot flags a drop in revenue, writes a quick explanation, and updates the commentary section. The planner tweaks next quarter’s forecast, and Copilot shows how it affects margins.

Strengths

- Works in Excel, no need to learn a new tool

- Focused on finance workflows

- Speaks the language of FP&A

Limitations

- Only available inside Vena

- Needs clean data to work well

- Some features are still being refined

Pigment

Type: Finance planning platform with built-in AI

Pricing: Starts around $65,000 per year. Custom pricing based on users, data, and features

What it is

Pigment helps finance and ops teams build forecasts, budgets, and headcount plans in one place. It’s a flexible alternative to legacy planning tools, with strong dashboards and real collaboration features. Pigment AI lets you ask questions in plain language, find trends, and speed up your reporting.

Key AI Features for FP&A

- Ask “Why did expenses go up?” and get a clear answer

- Write variance explanations and board summaries

- Spot unusual patterns in your numbers

- Build scenarios faster with AI input

- Create charts and commentary with a single prompt

Practical FP&A Use Case

The finance team sees a jump in Q3 costs. Instead of digging through data, they ask Pigment AI. It finds the spike in marketing spend and explains the impact. That text goes straight into the monthly report.

Strengths

- Easy to model finance, HR, and sales plans in one place

- Visual, clean dashboards

- Smart AI tools that work on top of your actual data

Limitations

- Needs time and training to use well

- Works best when used across the whole company

- Higher cost and setup means it fits larger teams best

Read 6 Pigment Competitors to Pay Attention to in 2026 (+Pricing)

Best AI for Finance in Enterprise Planning Platforms

These are the biggest tools in the market. They’re built for companies with complex models, large teams, and planning that cuts across departments. Many are already used for budgeting, forecasting, and scenario planning.

Now they include AI to help with commentary, variance analysis, and faster model updates.

They’re a good fit for multi-entity companies that already have strong planning processes and want to improve speed and accuracy.

Read: The Future of AI in Finance: Use Cases to Watch by 2030

Anaplan

Type: Enterprise planning platform with integrated AI

Pricing: Starts around $90,000 per year. Custom pricing based on users, data, and features

What it is

Anaplan is a well-known planning platform for large companies. It helps finance, sales, HR, and operations teams plan together in one system. Its AI engine, PlanIQ, adds forecasting, anomaly detection, and scenario modeling on top of the core planning tools.

Key AI Features for FP&A

- Forecasts built with time series models

- Predictive inputs for driver-based models

- Smart updates to scenarios when data shifts

- Alerts when numbers look off or trends change

Practical FP&A Use Case

A global finance team runs a new forecast and sees a drop in revenue in Europe. PlanIQ spots the change, updates the forecast, and flags marketing as the likely cause. The team checks the numbers and adjusts spend.

Strengths

- Handles complex plans across teams and regions

- Reliable platform with strong security

- Adds predictive power to existing models

Limitations

- Takes a lot of time and money to set up

- Works best with dedicated internal experts

- AI tools need good data to be useful

Read Anaplan Competitors – The 6 Best Alternatives for Enterprise FP&A

OneStream

Type: Corporate performance management platform with built-in AI

Pricing: Starts around $36,000 per year. Custom pricing based on users, applications, and features

What it is

OneStream combines planning, reporting, and consolidation in one platform. It includes built-in AI tools you can use to forecast, spot anomalies, or run scenarios without leaving your finance environment. The AI works directly on your data, so results are ready to use in your reports.

Key AI Features for FP&A

- Forecasting with built-in ML models

- Anomaly detection across actuals and close

- Scenario analysis for faster planning

- AI apps like cash forecasting in its marketplace

Practical FP&A Use Case

A finance team runs an AI model to predict next quarter’s operating expenses. The platform compares multiple approaches, picks the most accurate, and writes the forecast back into the plan. It also flags outliers in actuals for review before month-end close.

Strengths

- Covers the full FP&A cycle in one place

- AI works on top of your real planning and actuals

- Strong security and audit controls

Limitations

- Needs support from finance systems or admins

- Best for large teams with complex planning

- No natural language interface for now

Farseer

Type: Finance planning platform with built-in AI

Pricing: Starts at $20,000 per year. Final price depends on features, users, and data

What it is

Farseer is a planning platform that helps finance teams move faster. It handles budgets, forecasts, cash flow, and CapEx in one model. No spreadsheets. No version mess. Actuals sync from your ERP and other relevant sources, and everything updates in real time.

AI takes care of repetitive tasks. It builds forecasts, flags outliers, and alerts you when something important shifts. Farseer is a good fit for teams that want to keep planning in their hands, without needing IT.

Key AI Features for FP&A

- Auto-selects from several ML methods to generate forecasts

- Runs dynamic scenarios without manual setup

- One-click forecast across brands or cost centers

- Flags when a key driver changes

- Spots anomalies in actuals.

- Drafts commentary and explanations (beta)

Practical FP&A Use Case

A finance team needs to create an annual forecast for dozens of brands and thousands of SKUs. Farseer builds the full forecast in one click. The team then tweaks the numbers where they have better insight, like known changes in pricing or demand.

Strengths

- Custom-built database specialized for financial planning and modeling

- Quick to roll out, easy to scale

- Full control stays with the finance team; no IT involvement is needed.

Limitations

- Some AI features are still in beta

- Works best when the full team uses it

Curious how Farseer could fit into your planning process?

We’ll walk you through how teams use it to speed up forecasts, cut manual work, and stay in control, all without leaving finance. No IT setup, no long onboarding, just clear models and practical AI.

Key Takeaways

- Most AI tools aren’t built for finance. While many look flashy, but don’t match the way finance teams actually work.

- That’s why, it’s important to choose tools that match your process. Sure, general-purpose copilots can help with small tasks, but they don’t replace a structured model or workflow.

- Ideally, AI should make your day easier. The best tools take care of real work like explaining variances, building forecasts, or drafting reports.

- Meanwhile, your stack makes a difference. Some tools run inside Excel or Google Sheets, while others require a full platform. So, pick what fits your setup.

- Ultimately, enterprise teams need more than speed. Tools like Farseer help teams move faster yet without losing control. They work on real data, at scale, and help you focus on decisions, not manual cleanup.