Does financial planning feel harder than it used to?

Well, one thing is sure – the job didn’t get simpler.

Also, the business didn’t slow down. And the spreadsheet definitely didn’t get smarter. What changed is the gap between how fast decisions need to happen and how slow most planning processes still are.

So finance teams are adjusting.

Read more: Strategic Financial Planning That Actually Drives Results

According to Farseer’s research on the State of Finance in 2025/26 over 50% of finance experts rely on hybrid scenario planning, blending top-down strategy with operational reality.

The best practices below reflect that reality. They’re practical, proven, and built for a world that keeps moving.

Best Practice #1: Define Clear, Measurable Financial Goals

Every effective financial plan starts the same way: with goals you can actually point to.

Not “grow responsibly.” Not “improve efficiency.” Real targets. With numbers and with a finish line.

Because if the goal is fuzzy, everything that follows gets fuzzy too:

- debates turn into religion (“I feel like we’re doing fine”)

- priorities multiply like rabbits

- forecasts become polished storytelling instead of decision-making

So what does “clear” look like in practice?

Strong financial goals do three things well: they tie directly to business strategy, define success in measurable terms, and get tracked often enough to steer, not just explain results.

Research on goal setting shows that in around 90% of studies, specific and measurable goals lead to better performance than vague “do your best” objectives. When teams know exactly what they’re aiming for, decisions get faster and more consistent.

Best Practice #2: Use Accurate, Connected Data

Let’s call it what it is: most planning problems aren’t planning problems. They’re data problems.

When numbers live in five systems and twelve spreadsheets, planning turns into detective work. Teams argue about whose version is right. Time gets wasted reconciling instead of deciding. And by the time everyone agrees on the numbers, the moment has passed.

Good financial planning needs a few basics done right:

- one source of truth

- financial and operational data that actually talk to each other

- inputs that update when the business does, not a week later.

This is exactly the gap Farseer is built to close.

Familiar with copying data into models and hoping nothing breaks? Farseer to the rescue.

It connects directly to your source systems and keeps everything in sync. Change a driver, like headcount, volume, pricing, and forecasts, scenarios, and plans move with it.

Best Practice #3: Plan for Multiple Scenarios

The future has a habit of ignoring your forecast.

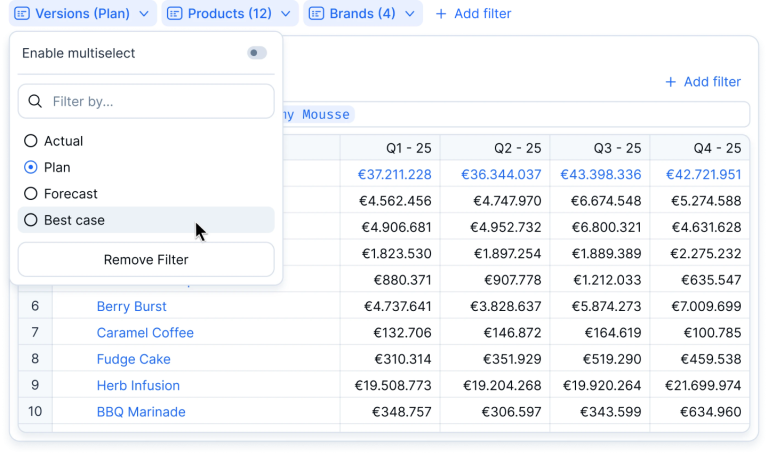

That’s why you do scenario planning, right? It’s a way to pressure-test decisions before reality does it for you. When you model best-case, worst-case, and “most likely” scenarios, you can easily see the risks, challenge assumptions, and understand the trade-offs behind every big decision.

With Farseer, scenarios are built directly on top of the same connected data, so teams can spin up alternatives quickly and compare outcomes without breaking the core plan. Change a few drivers, run the numbers, and see what actually happens.

The payoff is speed and confidence. Instead of reacting when something changes, finance teams already know the options, and what each one costs.

Best Practice #4: Keep Financial Plans Flexible

Static annual plans don’t age well. Sometimes they don’t even make it to Q2.

Once a plan is locked, reality gets to work breaking it – prices change, hiring slips, demand moves, priorities shift. And suddenly the plan everyone signed off on is something you’re explaining, not using.

That’s why rolling forecasts and continuous planning are gaining ground. But here’s the catch: only 12% of finance teams currently use rolling forecasts, according to Farseer’s State of Finance 2026 research. Most still plan monthly or quarterly, even as the pace of change keeps getting faster.

Flexible planning isn’t about changing direction every week. It’s about updating assumptions when they break, adjusting plans while decisions still matter, and keeping forecasts relevant throughout the year.

Read Capital Planning vs Capital Budgeting: The Practical Differences

Best Practice #5: Align Financial Planning Across the Organization

Financial planning falls apart fast when everyone is working from different numbers.

Finance has one view. Operations has another. Leadership has a third – usually pulled from a slide five versions old.

Alignment fixes that. When finance, operations, and leadership plan off the same assumptions, things move faster. With fewer debates about inputs, clearer trade-offs and better decisions.

The need for this is clear in the data. Research shows that 22% of finance teams say cross-department collaboration is one of their biggest FP&A challenges – second only to data quality. It’s not a modeling problem. It’s a visibility problem.

When teams share access to plans, forecasts, and scenarios, finance stops acting as the scorekeeper and starts acting as a partner. That’s when planning shifts from reporting what happened to shaping what happens next.

Best Practice #6: Use Technology That Supports Better Decisions

Traditional planning tools weren’t built for today’s complexity. They were built for stability and that’s not the world finance operates in anymore.

Spreadsheets, bilt-on models, and rigid systems slow teams down just when speed matters most. Forecasts take too long. Scenarios feel expensive. Collaboration turns into version control.

Modern financial planning platforms change that by automating data integration, shortening forecasting cycles, making scenario modeling easier, and giving teams a shared view of the plan. The goal isn’t more technology – it’s better decisions, made faster, with less friction.

When planning tools support how finance actually works, teams spend less time maintaining models and more time thinking ahead.

Putting financial planning best practices into action with Farseer

Farseer is built to support the way modern finance teams plan – connected, flexible, and forward-looking.

With Farseer, organizations can:

- Connect financial and operational data into a single planning environment

- Model scenarios quickly and confidently, without duplicating models

- Continuously adapt plans as assumptions change

- Focus on forward-looking decisions, not past explanations

It’s financial planning designed for uncertainty, without unnecessary complexity. Finance teams stay in control, even when the future refuses to behave.

Key Takeaways

Strong financial planning:

- Starts with clear goals

- Relies on accurate, connected data

- Prepares for multiple outcomes

- Remains flexible as conditions change

- Aligns teams around a shared view of the business

Financial planning will never predict the future perfectly. That’s not the job.

The job is making better decisions, faster, with more confidence, no matter what the future throws at you.

That’s exactly what Farseer is built for.

See how Farseer helps finance teams turn uncertainty into clarity, connect plans across the business, and make better decisions, before pressure hits.