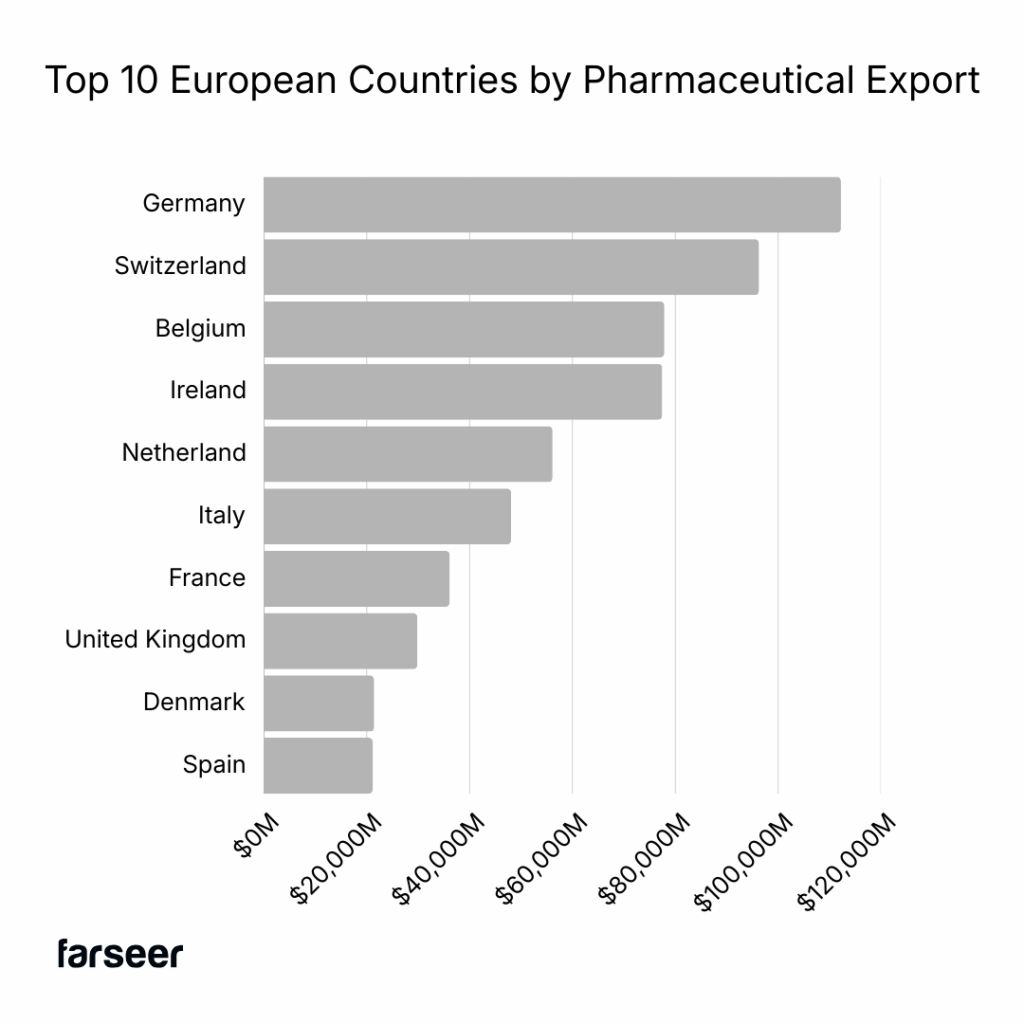

With a population topping 450 million and healthcare expenditure exceeding €1.7 trillion annually (10% of GDP), the EU is the world’s second-largest pharmaceutical market. This represents an enormous market opportunity but comes with significant operational complexity involving convoluted systems and bureaucratic snarls that can require elaborate financial calisthenics to achieve business results.

Behind potentially glossy revenue projections lies the sobering reality that most manufacturers only realize 40-60% of their list prices. Actual numbers vary widely by product and are cloaked in layers of taxes, claw-backs and mandatory rebates that can take years to determine.

Understanding the true cost of market access in Europe is critical to protecting margins, forecasting revenue, and managing cash flows. Making strategic pricing decisions on launch sequencing, pricing architecture, and resource allocation across 27 distinct regulatory environments requires sophisticated financial modelling and scenario analysis.

The VAT Foundation: Where Complexity Begins

All pharmaceutical sales are initially subject to the EU VAT Directive. Different VAT rates apply across EU member states, ranging from 17% in Luxembourg to 27% in Hungary.

Member countries are then given broad discretion to set individual VAT rates, with many applying reduced rates to pharmaceuticals and a few using a zero rate to certain types of medicines. This creates a labyrinth of per-country pharmaceutical-specific requirements, in which businesses must establish a baseline list price for market launch. For example, Germany applies a 7% reduced rate to pharmaceuticals, France applies an ultra-reduced 2.1% rate to reimbursed prescription medicines and 10% for non-reimbursed, Spain applies a 4% rate to all pharmaceuticals, while Italy applies a 10% rate. In contrast, Malta does not apply a rate on prescription or over-the-counter drugs, and Sweden and the UK both charge 0% VAT on prescription medicine, but 25% and 20% respectively on OTC medicine.

Why do all the VAT nuances by country matter to a manufacturer? VAT is ultimately charged through the distribution channel. This creates working capital demands on the business that must fund the tax during the collection cycle (typically 30-90 days), even though it’s ultimately reverse-charged through the distribution chain. Adding to the calculation complexity.

External Reference Pricing: The Domino Effect

External Reference Pricing (ERP), is a price-regulation tool widely used by European Union (EU) Member States to help control the cost of medicines. The core premise is simple and is used by a majority of EU member states. A country sets the maximum reimbursement prices based on prices observed in a “basket” of reference countries.

Each country determines a list of countries (the “basket”) whose prices will be used as a benchmark. The size of this basket varies widely across EU states (from a few countries to over 30). Each country uses different formulas to determine the price negotiated. Common methods include:

- Simple average: An average of the prices from all countries in the reference basket.

- Average (or median) of lowest prices: An average is taken from a smaller subset of the lowest prices in the reference basket.

- Lowest price: The lowest price found among all the reference countries is used directly.

- Weighted average: A weighted average price that accounts for factors like GDP per capita, exchange rates, and population size.

- Country of origin: The price from the country of origin, with the price not allowed to be greater than the price granted by the origin country’s authorities.

The primary goal is cost containment for public healthcare budgets, ensuring that a country does not pay substantially more for a drug than its peers, and is primarily applied to publicly reimbursed, often patented, medicines. Sounds straightforward until you realize that each country is referencing the others. This creates a circular spiral in which a price reduction in one market can cascade across multiple countries.

This is referred to as a “reference price spiral” and has profound strategic implications for pharmaceutical manufacturers and patients. For a business seeking to maximize profit and shareholder returns, the reference price spiral creates a launch sequencing dilemma that should be modelled across multiple scenarios, assumptions, and risk factors. To maximize the global net price of the new drug, a business must manage the price “contamination” caused by ERP.

Launch Sequencing Strategy

The key strategic challenge is determining the optimal order (sequence) in which to launch the drug across different countries. A company cannot afford to launch a drug first in a key reference country for larger, more profitable markets and accept a very low initial price, because that low price would become a permanent low anchor that drags down prices across the entire reference network. A business should model the effects of entering high-price markets first to minimize the ERP spiral impact.

Businesses need to financially model the advantages of a product launch strategy that targets countries offering the highest initial price and the most pricing freedom. This means prioritizing markets that allow value-based pricing and are excluded from the External Reference Pricing (ERP) systems of other major countries (i.e., they are not used as pricing reference points), such as the US (where high initial prices are historically common, despite shifting dynamics). Conversely, it should delay or avoid product launches in low-priced markets. For example, those countries that are frequently used as reference countries by other large markets, and those that are known to aggressively negotiate or set prices based on the lowest possible reference price.

Unfortunately, this creates a moral dilemma. Launch sequencing that optimizes total return may also unfairly delay product launches in lower-income or more price-sensitive EU countries. At the extreme, patients in certain countries may never gain access to new, innovative medicines because their governments’ ERP process makes them too “risky” to launch within an optimized global pricing strategy.

The Automatic Revenue Haircut – Mandatory Rebates and Clawbacks

Mandatory rebates and clawbacks are one of the most powerful and often contentious tools EU governments use for cost containment and come in three forms:

- Fixed Statutory Discount: A set, mandatory percentage discount applied to the manufacturer’s sales price for a specific category of drugs (e.g., all generics, all patented drugs, or all drugs dispensed via the public system). The company pays this percentage regardless of volume.

- Clawback (Volume/Budget-Driven): A company must “pay back” money to the government if the country’s total pharmaceutical expenditure (or the company’s own sales) exceeds a pre-defined budget cap or spending threshold. The percentage often fluctuates and can be very high.

- Managed Entry Agreements (MEAs) / Confidential Rebates: These are negotiated, product-specific contracts, but often the rebate amount is mandatory once the agreement is triggered (e.g., a volume threshold is met). The net price resulting from the rebate is typically confidential.

Fixed Statutory Discounts

Before customer negotiated or volume-based discounts, most EU countries imposed statutory mandatory rebates. These are non-negotiable, legally mandated discounts that manufacturers must provide to various stakeholders in the pharmaceutical supply chain, such as the public health system.

In addition to pure pricing considerations that would be modelled within a global launch sequencing strategy, several other business-process considerations should be considered, including revenue recognition and cash flow timing.

From an accounting perspective, statutory rebates must be treated as contra-revenue accrued at the time of sale. Unlike discretionary commercial discounts, there’s no judgment involved. The business has a legal obligation to make payment at the point of sale. The revenue recognition system must automatically reduce gross sales by these percentages, and the accounts payable system must track the accumulating liability even before invoices are received from payers. This can create significant accrued liabilities that need to be tracked at the detailed product level for an extended period and reported on publicly facing financial reports.

Cash flow timing must also be considered. Wholesalers are invoiced at the gross price (before statutory rebate) with cash collected 30-60 days later. 90-180 days after the original sale, the business will receive an invoice from the statutory authority demanding the rebate payment. These timing delays require the use of a cash flow that has either direct or implied cost of funds ramifications within a capital budgeting context.

Volume-Based Clawbacks: When Success Becomes Expensive

Clawbacks are agreements that trigger rebates or refunds when sales volumes or revenues exceed predetermined thresholds negotiated during pricing approval and generally follow one of two models:

- Fixed percentage above a certain sales threshold. For example, sales up to €10 million are paid at full price; sales from €10-20 million trigger a 15% rebate; sales above €20 million trigger a 25% rebate.

- Cap-based on a predetermined sales budget. A government sets an annual, fixed budget for pharmaceutical spending. If actual spending exceeds this budget, the industry is required to repay the difference (the “excess expenditure”).

Cap-based clawbacks can be set at different levels within the supply chain, for example, at both the hospital and the retail pharmacy level. Clawbacks are most often calculated 12-18 months after the sales occurred, creating significant financial statement uncertainty.

Volume-based clawbacks require sophisticated, multi-iteration scenario analysis for confident financial forecasting. Under IFRS 15 (Revenue from Contracts with Customers), these arrangements constitute variable consideration that must be estimated at the point of sale. A business must estimate the probability of a cap being exceeded and reduce revenue accordingly. This can create significant volatility within financial statements as estimates based on new information and changing legislative priorities are taken into account.

The balance sheet and cash flow impact is equally significant requiring a business to carry an accrued rebates liability which represents its best estimate of future clawback obligations. For manufacturers with European revenues coming from markets with aggressive clawback mechanisms, such as Greece, the UK, or Italy, this liability can represent a significant portion of annual revenues, requiring quarterly re-estimation and potential adjustment.

Read The Compliance Iceberg: Your Financial Models May Be Missing Billions in Risk

Managed Entry Agreements: Sophisticated Risk-Sharing or Revenue Erosion?

Managed Entry Agreements (MEAs) are arrangements, also called Patient Access Schemes or risk-sharing agreements, that come in two broad categories with very different financial implications.

- Financial-based MEAs – reduce the effective price without requiring outcomes data collection and typically have price-volume agreements with discounts applied when cumulative sales exceed negotiated volume thresholds. The manufacturer pays up to a maximum amount with additional units provided free. This allows discounts across a manufacturer’s entire product portfolio in exchange for formulary access

- Outcomes-based MEAs – link payment to real-world clinical performance. The manufacturer only pays if the patient demonstrates clinical response. Ongoing payment requires meeting response criteria at defined checkpoints, with manufacturer refunding if population-level outcomes targets aren’t met.

The use of MEAs varies significantly among countries and can significantly increase accounting complexity. IFRS 15 requires a business to estimate the probability of meeting outcome criteria and record revenue accordingly, net, not gross price. For example, if there’s a 30% probability that patients won’t respond, then revenue must be reduced by 30% at the time of sale. Financial scenario modelling can include:

- Clinical outcome probability modeling: Based on clinical trial data, real-world evidence, and patient population characteristics.

- Multi-year revenue reconciliation: As actual outcomes data emerges (often 1-3 years post-treatment), a true-up between estimated vs. actual revenue must be made.

- Complex accounts receivable/payable positions: A business may owe refunds for patients treated years earlier while still collecting payment for recently treated patients.

Cash flow impact may extend over multiple years and reflect similar modelling complexity to clawbacks. A product that is shipped, invoiced and revenue recognized in one year may require a 20-30% refund after 2-3 years. This creates balance sheet uncertainty and requires maintaining substantial reserves that tie up working capital.

Hospital Procurements: Where Margins Go to Die

While patient-paid or pharmacy pricing receives the most attention, hospital procurement systems can create very aggressive pricing pressure in European markets. Public hospitals and hospital networks conduct competitive solicitations for pharmaceutical supply contracts with a single winner taking 100% of the volume. Bidding can become hypercompetitive because there’s no second place.

Manufacturers often submit bids at 40-60% below retail pharmacy prices to secure the volume.

The financial implications of this procurement process cascade through a business.

- Upon award, the price becomes a public benchmark that influences pricing negotiations in other segments. Retail payers and other countries’ reference pricing authorities see the results and may question why their price is higher.

- Hospital contracts typically run 1-3 years, locking in pricing despite potential cost inflation, currency fluctuations, or supply chain disruptions.

- Customer concentration risk. If a manufacturer wins multiple major regional solicitations that represent a large percentage of total revenue for a product over many years but then loses a renewal upon re-bid that could represent a significant hit to its top line revenue.

- Complexity of inventory and manufacturing planning. Winners must maintain supply for 100% of committed volume or face penalties, while losers may face unexpected excess inventory.

Strategic Imperatives: Plan to Profit

The real migraine isn’t any one single scheme, it is how they interact in a sequential cascade effect that compounds revenue erosion. Navigating this landscape demands strategic thinking about pricing architecture, launch sequencing, and financial planning. To win in this highly regulated, complex environment, businesses need to:

- Develop a tiered European pricing strategy that sequences product launches to minimize ERP price erosion. Businesses should look to launch first in high-price, low-ERP-impact markets and delay launches in low-price markets that many countries reference.

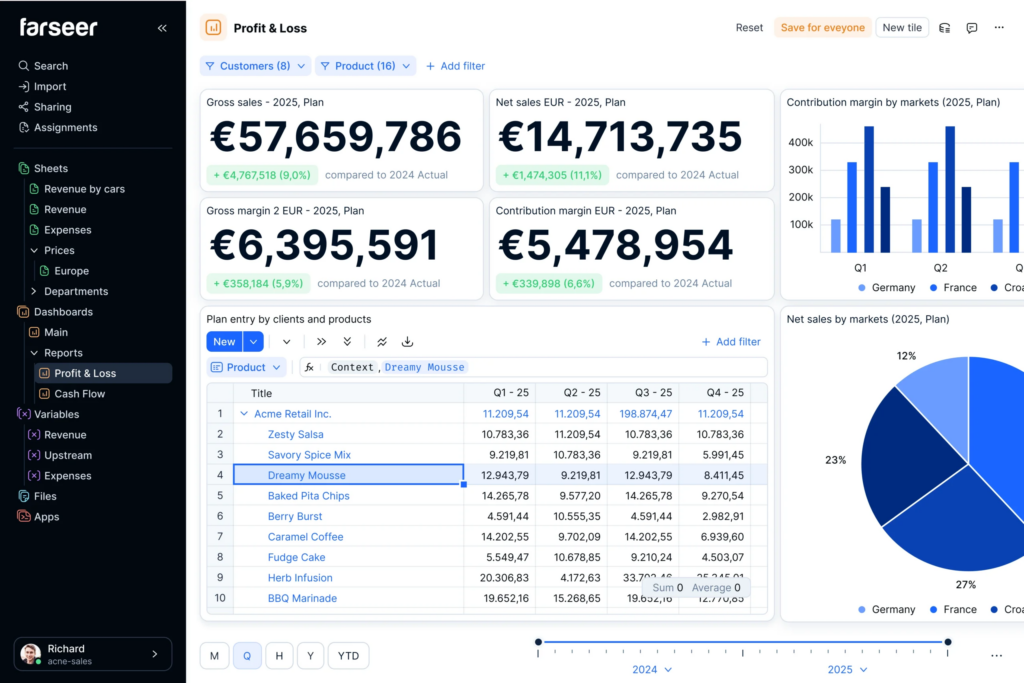

- Build sophisticated gross-to-net revenue models with scenario analysis for different volume outcomes, clawback trigger points, and MEA reconciliation probabilities. Recruit and retain a high-performing FP&A team with pharmaceutical-specific expertise supported by a robust FP&A planning tool like Farseer.

- Establish written accrual policies for rebates and clawbacks. Given the 12–24-month lag in calculating certain financial impacts, applying statistical modelling, including regression and Monte Carlo techniques, may yield the greatest success.

- Model working capital requirements at the country-level, including P&L and cash flow forecasts. The combination of slow-payer systems and large rebate reserves means a cash conversion cycle in Europe will be 30-60 days longer than in other major markets.

- Invest in market access infrastructure early. Each major EU country demands dedicated pricing and reimbursement expertise, health economics and outcomes research capabilities, and sustained payer relationship management. The investment in personnel, analytical systems, and advisory support is material but essential to optimizing price realization and preventing value erosion.

- Treat MEA negotiations as financial contracts, not just market access tools. Involve finance and accounting teams early to model the P&L and balance sheet implications before committing to outcomes-based arrangements that create multi-year uncertainty.

Change On The Horizon

The EU is modernising its pharmaceutical legislation through the “Pharma Package,” which will replace regulations that are over 20 years old. The proposal is currently in trilogue negotiations, which began in mid-2025 and involve the European Council, Parliament, and Commission. A final agreement is expected in early 2026, followed by an 18-36 month transition period before the new rules take effect. The impact on EU pharmaceutical pricing is far-ranging, including:

- Changes to market protections that link the duration of market protection to the timeliness and breadth of a product’s launch across the EU. With a potential reduction in base market protection, there could be increased pressure to secure an extension requiring an earlier and widespread launch across the EU than initially contemplated.

- New rules that will require changes in supply chains that limit the ability of EU wholesalers to procure pharmaceutical products from non-EU Wholesale Distribution Authorization (WDA) holders. This change may force companies to restructure their financial and supply chains to align with EU-based entities, potentially increasing operational costs and affecting transfer pricing models.

- While the Health Technology Assessment Regulation (HTAR) was adopted earlier, its key provisions on Joint Clinical Assessments (JCAs) will become mandatory in early 2026. Instead of performing individual clinical assessments for each country, a single Joint Clinical Assessment will be conducted at the EU level. While pricing and reimbursement remain national competencies, the JCA report will be used by all national Health Technology Assessment (HTA) bodies.

Conclusion: Managing the Complexity

The European Union’s 27 pharmaceutical markets present manufacturers with unparalleled complexity. The cascade of VAT variations, external reference pricing effects, mandatory rebates, volume-based clawbacks, outcomes-based risk-sharing, and hospital procurement dynamics can reduce net price realization to 40-60% of list prices.

For pharmaceutical CFOs and financial executives, it’s a comprehensive financial management challenge that affects revenue recognition, working capital, cash flow timing, balance sheet reserves, and strategic decision-making about launch sequencing and resource allocation.

Success requires building EU-specific expertise, investing in sophisticated technical and human financial modeling capabilities, establishing consistent accrual policies, and maintaining realistic expectations about product and net revenue realization.

The migraine is real. But with proper planning, robust systems, and clear-eyed assessment of the mechanisms at play, pharmaceutical manufacturers can navigate this complexity and still achieve attractive returns in the world’s second-largest pharmaceutical market. The key is entering with eyes wide open to the realities behind the list prices and building a financial plan accordingly.

Ken Fick is a CPA, and MBA with over 25 years of finance experience providing leading-edge solutions designed to improve forecasting, budgeting, planning, and decision-making to companies from $3 million to over $50 billion in revenue. He is a freelance writer that focuses on producing engaging content on all things business, accounting, finance and investment related. You can view a sampling of his published work at FPAexperts.com.