Why is what-if analysis important? Planning based on a single forecast is like driving with blinders on. It tells you where you might end up, but only if everything goes as expected. In reality, prices fluctuate, supply chains get disrupted, and demand shifts sooner than you can say financial planning.

That’s why smart finance teams combine what-if analysis with scenario planning – building flexible, multi-path strategies that prepare them for more than one future.

So instead of hoping for the best, finance teams at complex, multi-entity companies use What-If scenarios to test how different variables (like raw material costs, FX rates, or wage increases) will affect cash flow, EBITDA, and your spending plans.

In this article, we’ll break down how to build and use What-If analysis to plan smarter, especially when you’re managing millions in revenue and multiple subsidiaries, with a life of their own.

What-If Analysis: The Basics

What-If analysis involves creating multiple versions based on possible changes in key drivers – those are core business variables that have the biggest impact on financial outcomes, like demand drops, supplier price increases, or FX rate changes.

With What-If analysis you’re not trying to predict the future perfectly. You’re preparing for a range of outcomes so that you can respond fast when things change.

Let’s say you’re managing financial planning in a manufacturing company where the profit is tight and materials are a huge cost. A 7% increase in raw material prices can wipe out your EBITDA targets. With What-If analysis, you simulate that increase and immediately see the impact on margin, working capital, and cash runway.

So how is this different from traditional forecasting?

Traditional forecasts often rely on historical data and assume business-as-usual. They’re built once per quarter or even once per year. But What-If analysis is dynamic. It’s interactive, multi-scenario, and based on factors that truly drive your business. It lets you ask: What if sales drop 10% in Q3? What if we delay our CAPEX project by one quarter? What if we cut temporary labor by 20%?

Traditional forecasting gives you one plan. What-If analysis gives you options.

Practical Applications for What-if Analysis In FP&A

As mentioned, What-If analysis comes in really handy to finance teams working in dynamic, high-volume environments. Here’s how it looks in practice:

How pricing changes affect your profit margins

In pharma distribution, prices usually depend on the region and local rules or rebates. Now imagine your biggest customer in Southeast Europe asks for a 5% discount on all products, what would that do to your margins?

With What-If analysis, you can quickly see how that discount would affect your margins, by country, product, or sales channel, before making any promises. It shows you which deals still make sense, and which ones would hurt your profit too much.

Handling volume changes in manufacturing

Food and beverage companies often see demand go up and down with the seasons. If sales suddenly jump in Q4, it might mean paying for overtime, rushing deliveries, or buying more raw materials than planned.

If you use What-If analysis, you can test what happens if production goes up by, let’s say, 15%, and see how it affects your costs, cash needs, and profit. That way, finance and operations can stay in sync and avoid last-minute chaos.

Managing FX impact in cross-border business

Automotive and industrial suppliers in Central and Eastern Europe often buy parts in euros but sell in local currencies like RSD or HUF. Even a small shift, like 3–5%, in the exchange rate can make a big difference to your profit. What-If analysis enables you to test different FX rates and see right away how your financials would be affected. This helps you plan your cash flow better and decide if you need to protect yourself from currency fluctuations.

How to Build What-If Scenarios That Actually Help

Not all scenarios are useful. If you’re just applying a flat 10% change across the board, you’re not doing What-If analysis, you’re guessing. To get real value, scenarios need to reflect how your business actually works.

Tie scenarios to real business drivers

Focus on the factors that truly impact your business when creating scenarios. Instead of simply modeling a general increase in revenue, break it down into the actual elements that affect it, such as the number of units sold, the average price per unit, discount rates, and return ratios.

When planning costs, concentrate on the specific drivers like production volumes, energy prices, and labor costs per shift, rather than just modeling a simple increase in operating expenses (OPEX). This way, you’re working with more realistic and actionable inputs that better reflect your business’s performance.

Engage Sales, Operations, and Procurement in the process

Finance alone can’t create accurate What-If scenarios. If procurement is aware that a major supplier contract is about to be renegotiated, or if sales anticipates a slowdown in a specific region, that information must be included in your scenarios – especially when you’re also managing broader S&OP planning across departments.

Read What-if Analysis in Sales Planning [How-to + Spreadsheet Template Download]

Use Best-Case, Base-Case, and Worst-Case logic

Break down your scenarios into three types: best-case, base-case, and worst-case. This approach helps management clearly see the possible outcomes.

For example, in your base-case scenario, you might assume a 3% annual wage increase. In the worst-case scenario, you could plan for a 7% increase because of inflation. When you map out all three possibilities, optimistic, expected, and pessimistic, you can make important decisions early. These can include anything, from freezing hiring, adjusting prices, to delaying capital expenditures (CAPEX) before any pressure starts to build. This way, you’ll be better prepared for whatever situation arises.

Tools That Make What-If Planning Work

Spreadsheets are a good starting point, but they can’t keep up as your business grows.

Many mid-sized companies still use Excel for What-If analysis, and it works, until something goes wrong. A broken link, outdated data, or missed assumption can mess up the whole model. Plus, when multiple departments and planners are involved, keeping everything consistent across versions becomes really hard.

If you’re comparing options and want to see which planning tools actually support robust scenario modeling, check out this breakdown of 7 scenario modeling software tools that actually work. It covers both enterprise platforms and Excel-friendly tools like Vena and Jedox – plus a few insights on which type fits which team best.

Here’s where platforms like Farseer change the game:

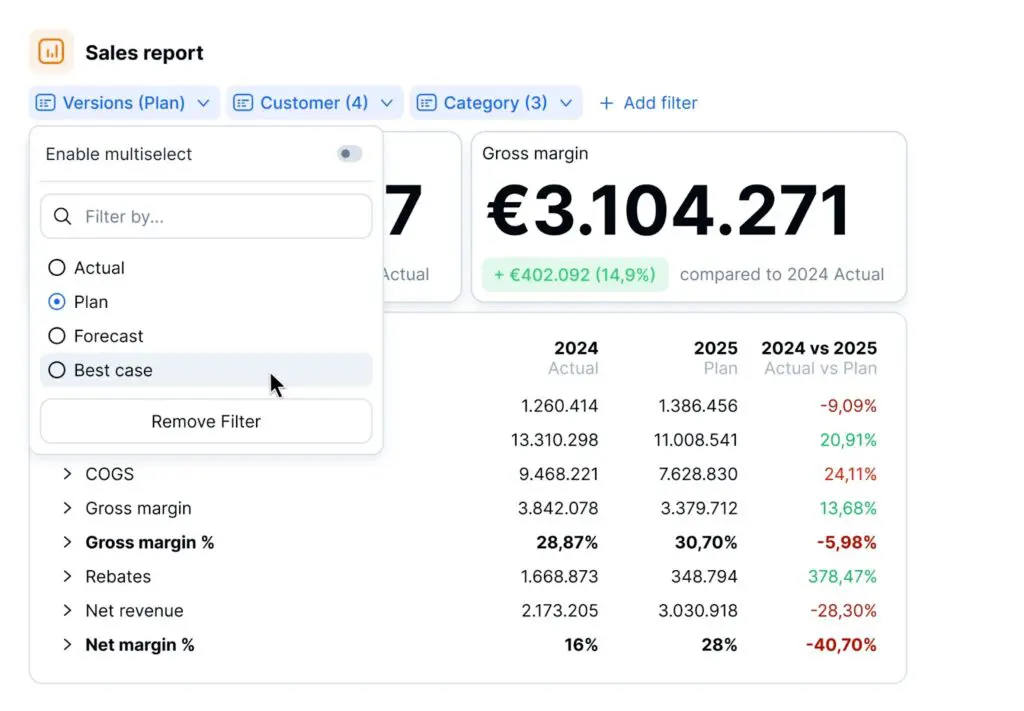

Quick scenario switching

Instead of creating separate files for each scenario, platforms like Farseer let you switch between scenarios in just a few seconds.

Want to see how a 5% sales drop and a delayed CAPEX rollout will affect your Q3 outlook? No need to rebuild everything, just adjust the key factors and compare the results in real time.

Driver-based modeling

Stop manually entering numbers. With Farseer, you use real business factors, like how many units are sold, production volumes, prices, and costs. This way, your scenarios are based on actual data, which makes them more accurate and better matched to how your business really works. It’s a much more reliable way to plan because it reflects the true drivers of your operations.

The best part? When there’s a sudden change like an FX rate increase or something similar, you don’t need to update manually 50+ spreadsheets – just update the currency driver, and the whole model recalculates.

Centralized data access

What-If analysis only works if everyone uses the same numbers. Farseer brings together data from finance, operations, procurement, and HR into one place. This avoids version issues and allows teams to test assumptions together, without wasting time searching for files or updating them.

Conclusion

In businesses with multiple entities, fluctuating costs, and tight margins, relying on one forecast is risky. Smart companies test real business scenarios instead of using simple assumptions – and often combine what-if analysis with sensitivity analysis to understand how individual assumptions move the bigger picture.

When you use driver-based models, collaborate across teams, and choose the right tools, you can shift easily from reactive to proactive decision-making. The real value comes not just in making the plan, but in being ready to adjust when needed.

If your current tools are slowing you down, consider changing your approach to scenario planning. Companies using Farseer have reduced planning time, improved forecast accuracy, and made better decisions by simulating, not guessing.