Vertical financial analysis is a key part of financial statement analysis that helps you understand how your company performs. In this blog, we’ll explain what it is exactly, how it compares to other types of analyses and how top companies use it to improve budgeting, forecasting, and decision-making. Read on to learn everything about vertical financial statement analysis.

Related: A Complete Guide to Financial Statement Analysis for Strategy Makers

What is Vertical Financial Analysis?

Vertical financial analysis is a financial statement analysis method where each line item in a statement is displayed as a percentage of a base figure. On an income statement, most often it’s the percentage of total revenue, and on a balance sheet, percentage of total assets or total liabilities and equity. The name “vertical” comes from comparing the financial structure by moving vertically down the statement.

Vertical analysis can also be used for cash flow statements, but it’s rare since cash flow focuses on timing and liquidity, not cost structure.

It simplifies financial data by converting absolute numbers into percentages, making it easier to spot inefficiencies, track trends, and assess performance over time. Vertical analysis is particularly valuable in industries where cost control is key (manufacturing, distribution, and FMCG). When costs are expressed as a percentage of revenue or assets, it’s easier to understand how individual cost components impact overall profitability.

How Vertical Analysis Works

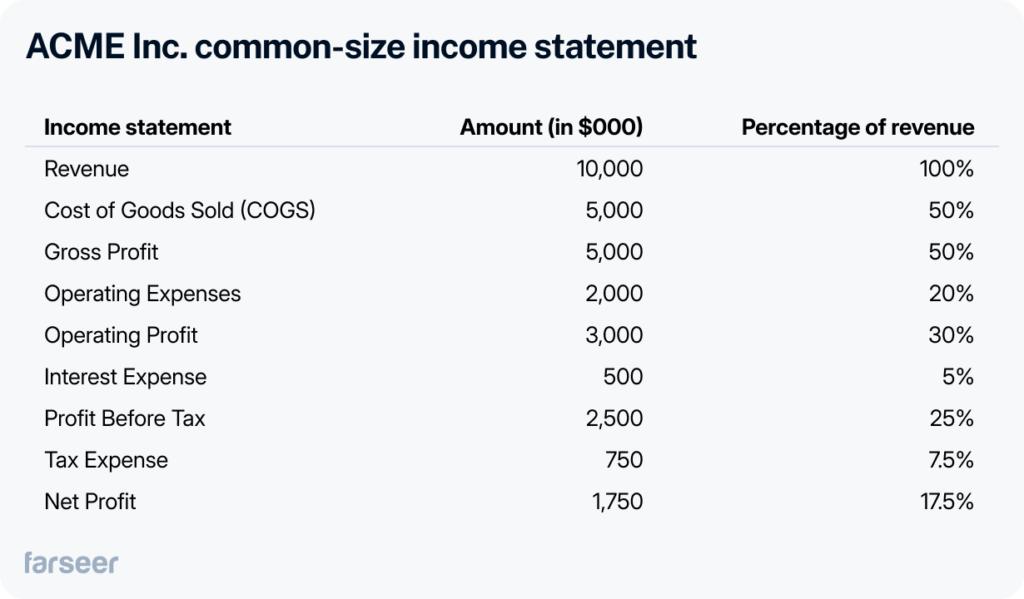

To show how this works in practice, let’s use an imaginary company with real analysis problems – ACME Inc.

On the income statement, ACME shows costs and revenues as a percentage of total revenue. If their quarterly revenue is $10 million and COGS is $5 million, that means COGS makes up 50% of their revenue. The situation is similar with the operating expenses which are at $2 million, so they represent 20% of total revenue. This gives ACME’s finance team a clear picture of how much revenue goes to production and overhead, helping them quickly spot areas for improvement.

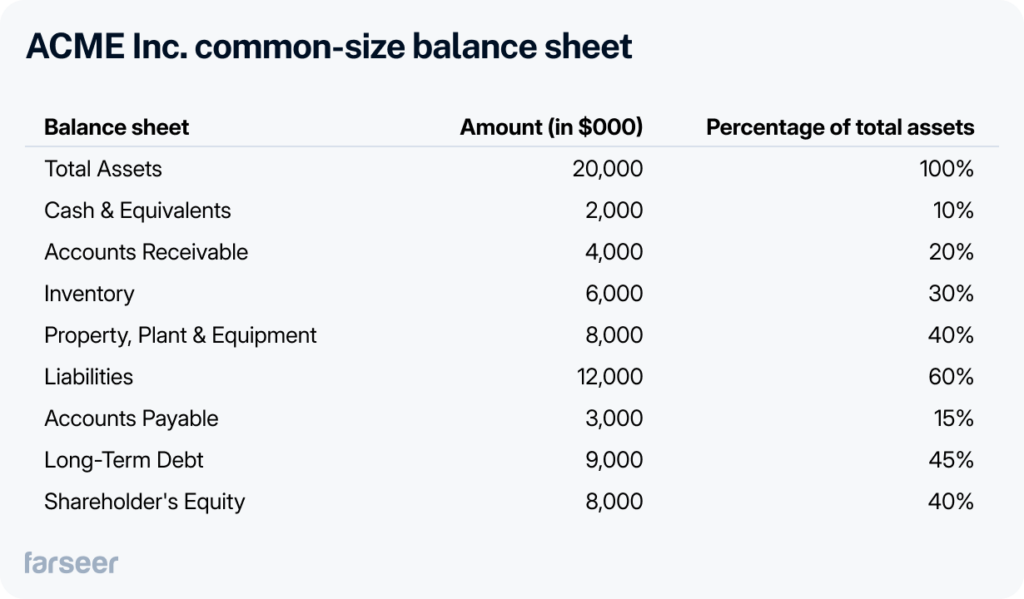

On the balance sheet, vertical analysis shows each item as a percentage of total assets. With total assets of $20 million and inventory valued at $6 million, inventory makes up 30% of ACME’s assets. This helps the finance team see how much of their resources are tied up in inventory compared to other assets like cash or receivables. It gives them useful insights into how their assets are allocated.

By converting each line item into a percentage of a key figure, ACME can standardize their financial data, making it easier to compare performance over time or with competitors. Vertical financial analysis becomes a handy tool for tracking and improving their overall performance.

Common Size Financial Statements in Vertical Analysis

A common-size financial statement is simply a result of vertical financial analysis, with line items expressed as percentages of the base figure. This format standardizes financial data, making it easier to compare performance across periods or with competitors.

For example, by converting ACME Inc.’s income statement into a common-size format, the finance team can quickly see that COGS makes up 50% of total revenue, and operating expenses represent 20%.

Similarly, on the balance sheet, inventory, for example, accounts for 30% of total assets:

This format allows the company to spot trends, compare with industry benchmarks, and make better financial decisions.

Horizontal Financial Analysis vs. Vertical Financial Analysis

Vertical financial analysis goes hand in hand with horizontal financial analysis, and they have to be used together, but they serve different purposes.

Vertical analysis focuses on a single period, expressing each line item in percentages of total revenue or assets. It helps companies assess cost structures and compare performance within that period.

Horizontal analysis looks at changes over time. It tracks trends like revenue growth, expense fluctuations, or profit margins. It’s very useful for identifying long-term patterns or seasonal variations.

When to Use Vertical and Horizontal Analysis?

Use vertical analysis to make sense of the cost and revenue breakdown for a single period, or to benchmark against competitors.

Use horizontal analysis to track trends over time and evaluate growth in revenues, expenses, and profits.

Used together, both methods can tell you a lot about a company’s cost structure and performance trends. You should use them together with financial ratios and other metrics for a complete picture of financial health, though.

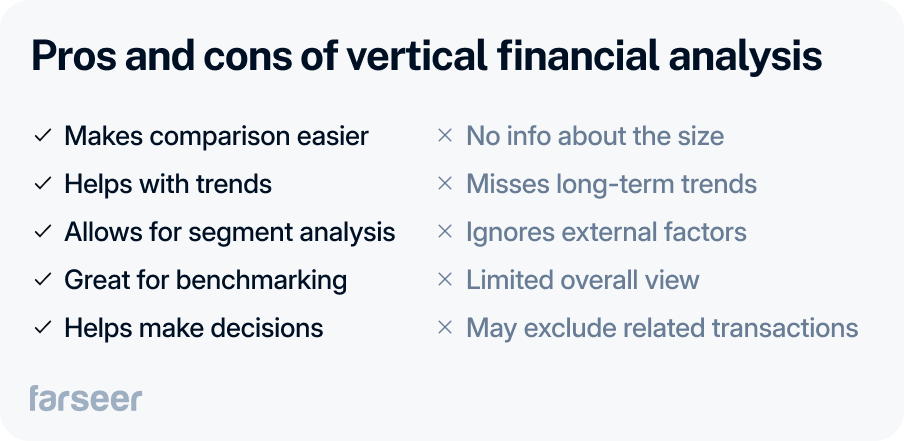

Pros and Cons of Vertical Analysis

Vertical financial analysis is a great tool, but it has its pros and cons.

Pros

- Makes comparison easier: It’s simple to compare financial line items across periods or with competitors.

- Helps with trends: It helps spot growth or cost patterns, like tracking if operating expenses rise in line with revenue.

- Allows for segment analysis: It compares different business segments’ performance and helps find the most profitable product lines.

- Great for benchmarking: Companies of all sizes can be easily benchmarked, using common-size percentages to compare performance regardless of revenue differences.

- Helps make decisions: Managers can set clear cost and profit goals using percentages, like capping operating expenses at a set percentage of revenue.

Cons

- No info about the size: Percentages don’t show the actual size of line items. 50% COGS doesn’t mean a lot by itself when compared to a competitor with much larger revenue.

- Misses long-term trends: Looking only at a single period can miss seasonal cost changes or long-term shifts in raw material prices, for example.

- Ignores external factors: It doesn’t account for inflation, currency fluctuations, or economic conditions.

- Limited overall view: It focuses on specific line items rather than the company’s overall financial health.

- May exclude related transactions: It can overlook transactions between related entities, like subsidiaries, which leads to an incomplete picture.

How to Use Vertical Financial Analysis in Practice

Automate Vertical Analysis with FP&A Tools

Once you have the financial statements compiled, it’s easy to make comparisons. However, the data collection and organization are the hard parts. For this, many companies use FP&A software. It automatically collects data and helps generate common-size financial statements. This way, analysts don’t have to do this manually, and can perform vertical and horizontal analysis easily.

Example: Siemens uses FP&A software for their financial analyses. It helps them track costs, and allocate resources better, especially for managing operational costs and supply chain disruptions.

Use Vertical Analysis for Budgeting and Forecasting

Vertical analysis helps make more accurate budgets by showing how costs scale with revenue. It provides a clear picture and helps set realistic expense targets.

Heineken tracks costs as a percentage of revenue. When they noticed marketing costs had grown from 15% of revenue, they adjusted their budget to match future revenue.

Include Vertical Analysis in Regular Financial Reviews

Including vertical analysis in regular monthly or quarterly reviews will make it easier to track cost trends over time. This way, you’ll be able to find weak spots early and take action.

Example: In 2022, Unilever used vertical analysis to spot growing costs. It showed that COGS increased as a percentage of revenue. They caught this early, adjusted prices and cut costs, and kept their margins in check.

Make Right Metrics a Priority

Vertical analysis turns key financial ratios (gross margin, operating margin, etc.) into clear insights when they are shown as a percentage of revenue. This is also a great way for analysts to quickly find costs that are misaligned, so they can adapt their strategy.

Example: Companies like Coca Cola use vertical analysis in their reporting, and track KPIs like gross and operating margin as a percentage of revenue.

Compare with Competitors

Vertical analysis also makes it easier to compare your company’s performance with your competitors, and clearly shows if you’re spending too much, or underperforming. Comparison with the competition is a very common use case for vertical financial analysis.

Example: Walmart and Target use vertical analysis to compare their costs such as SG&A and profit margins against each other. It’s a great way to benchmark and figure out where your company stands against the competition.

Combine Vertical Analysis With Scenario Planning

Vertical analysis gets even more useful when combined with scenario planning. It allows you to investigate how cost changes or fluctuations in revenue affect the key metrics you track, and to adapt your strategy.

Example: Companies like Ford use vertical analysis combined with scenario planning to see what happens with their margins when prices of raw materials such as steel grow. This helps to negotiate better prices and keep the profitability in check.

Conclusion

Vertical financial analysis is a valuable tool to break down financial statements and gain a better view of how your company performs.

When you understand how each cost or revenue item contributes to overall results, you can find trends, make better budgets, and stay competitive.

It’s a simple way to refine forecasts, compare yourself to competitors, and maintain control over your company’s financial health.